00 44 300 200 3500. As per comments above, there is no need to phone them unless it is to clarify if your CF38 form has been received. If it has, then the rest of the process runs by itself and they will get back to you at some point. They won't tell you over the phone whether you will be class 2 or 3, nor will they give you a HRMC payment reference number.Thanks so much for this information. Do you have the number handy that you got through on?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UK State pension - Am I class 2 or Class 3

- Thread starter DannyBoyD

- Start date

yes agree totally. However it is critical to know if your paperwork has been received successfully before the deadline, or do they acknowledge this back to you in some way, even though it will be many weeks before they look at it in depth?Maybe this is one for another thread, but it's socially optimal if everyone doesn't call them so much as it leaves them less resources to process the requests!

Once the request has been received before the July deadline they will have to honour it. I've been saying this on several threads for a long time and nothing anyone has heard on the phone has contradicted it.

NoRegretsCoyote

Registered User

- Messages

- 5,766

1) keep a scan of what you send themHowever it is critical to know if your paperwork has been received successfully

2) have it sent by recorded delivery

That way there can never be dispute.

yep I did both of those things. €9.70 for recorded delivery, but well worth it. Posted on 16th March. Not showing as being delivered yet. Are you a good bit further through the process than me?1) keep a scan of what you send them

2) have it sent by recorded delivery

That way there can never be dispute.

Last edited:

Hi there

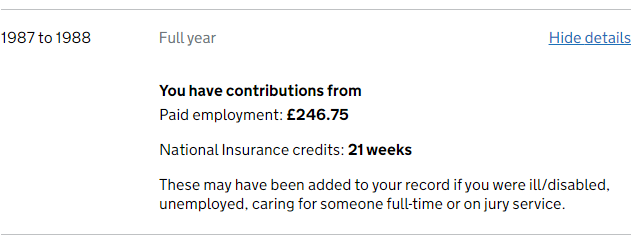

Thanks so much for all the great tips and knowledge - it's greatly appreciated and makes it all so much easier to navigate. I have a question, apologies if it has come up before but I haven't come across it. My husband is being told on his forecast which we managed to access online that he has 6 years of full contributions - which he was surprised about as he thought he only worked over there for about 4/5 years max and with some gaps for study and travel in between. Also, the breakdown is a bit confusing, it doesn't show 6 years of contributions - 3 years are marked as full years yet when you look at the detail - it shows this:

Is 21 weeks considered a full year's contribution?

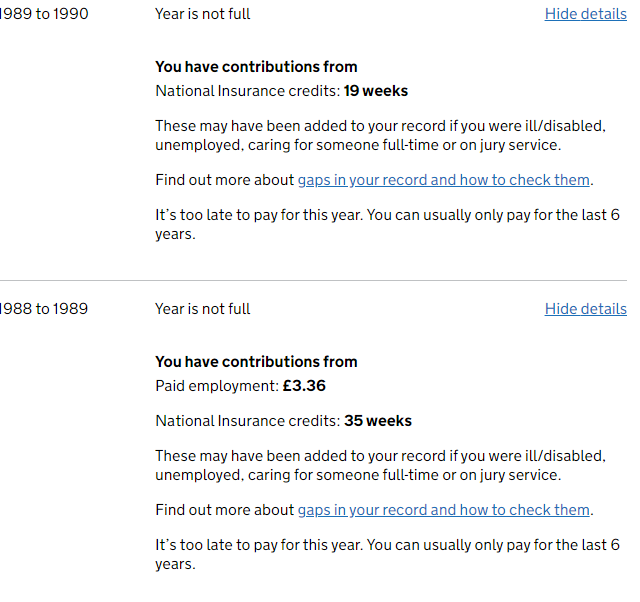

Then these two years are marked "Year is not Full"

Don't understand why these two are showing not full with same or more NI credits.

Also, if he is not sure of date he left to go back to Ireland and work, could that be a sticking point?

Thanks again for any advice.

Rose

Thanks so much for all the great tips and knowledge - it's greatly appreciated and makes it all so much easier to navigate. I have a question, apologies if it has come up before but I haven't come across it. My husband is being told on his forecast which we managed to access online that he has 6 years of full contributions - which he was surprised about as he thought he only worked over there for about 4/5 years max and with some gaps for study and travel in between. Also, the breakdown is a bit confusing, it doesn't show 6 years of contributions - 3 years are marked as full years yet when you look at the detail - it shows this:

Is 21 weeks considered a full year's contribution?

Then these two years are marked "Year is not Full"

Don't understand why these two are showing not full with same or more NI credits.

Also, if he is not sure of date he left to go back to Ireland and work, could that be a sticking point?

Thanks again for any advice.

Rose

yep I did both of those things. €9.70 for recorded delivery, but well worth it. Posted on 16th March. Not showing as being delivered yet.

On your first point, many of us have found that some of our final school years, prior to college/university were credited as Full Years, even if we didn't work or make any contribution, so those might be the reason he sees more Full years than expected. So his 3 full working years are complimented with these three 'free' years whilst still in education. Thats probably where the 6 years come from.Hi there

Thanks so much for all the great tips and knowledge - it's greatly appreciated and makes it all so much easier to navigate. I have a question, apologies if it has come up before but I haven't come across it. My husband is being told on his forecast which we managed to access online that he has 6 years of full contributions - which he was surprised about as he thought he only worked over there for about 4/5 years max and with some gaps for study and travel in between. Also, the breakdown is a bit confusing, it doesn't show 6 years of contributions - 3 years are marked as full years yet when you look at the detail - it shows this:

View attachment 7368

Is 21 weeks considered a full year's contribution?

Then these two years are marked "Year is not Full"

View attachment 7369

Don't understand why these two are showing not full with same or more NI credits.

Also, if he is not sure of date he left to go back to Ireland and work, could that be a sticking point?

Thanks again for any advice.

Rose

I don't know if two half years can be made to count as one "Full Year". Maybe others on here might know. Certainly in my case I have some "not full" years on my record and they don't seem to count for anything. Maybe if you have some "not full" years on your record, and they fall within the period which you pay to top them up, then maybe they can come into play in that situation and if so, it will take a lesser top-up amount for those years, in order to turn them into "full years"

I am in the process of dealing with this myself and my record has 3 years more than I thought it would. Similarly for my wife. On the basis that you are doing better than you thought you would, the fact that there is nothing you can do about the years that far back shown in your post and if you have sketchy information' you are probably best to leave it as it is and concentrate on back paying for those years that are available (i.e. the last 16 years).Hi there

Thanks so much for all the great tips and knowledge - it's greatly appreciated and makes it all so much easier to navigate. I have a question, apologies if it has come up before but I haven't come across it. My husband is being told on his forecast which we managed to access online that he has 6 years of full contributions - which he was surprised about as he thought he only worked over there for about 4/5 years max and with some gaps for study and travel in between. Also, the breakdown is a bit confusing, it doesn't show 6 years of contributions - 3 years are marked as full years yet when you look at the detail - it shows this:

View attachment 7368

Is 21 weeks considered a full year's contribution?

Then these two years are marked "Year is not Full"

View attachment 7369

Don't understand why these two are showing not full with same or more NI credits.

Also, if he is not sure of date he left to go back to Ireland and work, could that be a sticking point?

Thanks again for any advice.

Rose

Hi, did you get any feedback on your question. This is very relevant for me and would be grateful if someone could shed some light on this situation.Is it possible to add explainer of who qualifies for class 2 vs class 3 contributions? Especially if someone had breaks in employment history, are there circumstances where you move between classes depending on your employment status in Ireland after leaving UK?

Would I have had to start work immediately when arriving back in ireland?? I arrived back in july 2015 became self employed in January 2016. My NI in UK was paid for 2015.

Folks - read the key post for a description of the Class 2 / Class 3 and the requirements.

Anyone posting on AAM is providing the best information they can from their own experience / understanding.

The Decision Makers are DWP in the UK; not us.

You should complete CF83, include a cover letter and any supporting documentation you consider relevant. Keep a copy and send by recorded delivery. It'll cost you less than a tenner.

Anyone posting on AAM is providing the best information they can from their own experience / understanding.

The Decision Makers are DWP in the UK; not us.

You should complete CF83, include a cover letter and any supporting documentation you consider relevant. Keep a copy and send by recorded delivery. It'll cost you less than a tenner.

Yes the decision makers are DWP in the UK, but those decisions will be based on criteria and facts. Not sure if people think paying voluntary contributions is a new thing, it has always been this way, just now they are allowing for more than 6 years back dated. So I was hoping that someone could confirm when the criteria states "living and working abroad"Folks - read the key post for a description of the Class 2 / Class 3 and the requirements.

Anyone posting on AAM is providing the best information they can from their own experience / understanding.

The Decision Makers are DWP in the UK; not us.

You should complete CF83, include a cover letter and any supporting documentation you consider relevant. Keep a copy and send by recorded delivery. It'll cost you less than a tenner.

-Did anybody that moved back to Ireland and took a few months to settle in, then got a job get accepted for class 2.

-What if working when you arrived back to Ireland but not now, did you get approved for class 2.

-What proof do they ask for when trying to prove you worked. Payslips?

-What would be acceptable for a self employed person.

It's all well and good to send the application, but it be good to know these things before sending it.

Thanks in advance.

NoRegretsCoyote

Registered User

- Messages

- 5,766

I’ve been reading these threads for anout three years.-Did anybody that moved back to Ireland and took a few months to settle in, then got a job get accepted for class 2.

-What if working when you arrived back to Ireland but not now, did you get approved for class 2.

-What proof do they ask for when trying to prove you worked. Payslips?

-What would be acceptable for a self employed person.

I’ve only come across one example of someone being asked to submit a CV to a caseworker in HMRC.

In your shoes I would submit relevant facts to support a claim for Class 2 eligibility. You shouldnt lie, but there is probably no need for excessive detail either.

iamaspinner

Registered User

- Messages

- 275

Firstly big thanks to @DannyBoyD and all contributors.

What if you were studying+working p/t in UK (2+2 years, 1 Erasmus year in EU in between them), came to Ireland to continue studies+work p/t and then started working f/t (in Ireland)?

Do you think I'd even be entitled to pay back any contributions at all and if so which class?

I'm trying to get identity verified to check all this online, but first I need a phone with nfc!!

What if you were studying+working p/t in UK (2+2 years, 1 Erasmus year in EU in between them), came to Ireland to continue studies+work p/t and then started working f/t (in Ireland)?

Do you think I'd even be entitled to pay back any contributions at all and if so which class?

I'm trying to get identity verified to check all this online, but first I need a phone with nfc!!

iamaspinner

Registered User

- Messages

- 275

It turns out I have 3 years of full contributions and can make class 3 contributions from 2006. I am surprised to say the least: In my student years I made contributions ranging from £0 to £80.18!

I will have to re read this thread and the NI38 doc to see if I have a case to make for class 2.

I will have to re read this thread and the NI38 doc to see if I have a case to make for class 2.

From what I can see the system appears to default to class 3, so its worth asking for class 2.see if I have a case to make for class 2

The worst they can do is say no; and class 3 is still a good deal.

Allpartied

Registered User

- Messages

- 488

Just on the point about creditied years, which do not appear to be funded on the individual's insurance history, this document might help to explain .

Starting credits were given, automatically, to anyone who acquired a National Insurance number. The practice has been stopped, but if you were working in the UK before 2010, I think you get them and keep them.

This explanatory note explains that you did not need to be resident in the UK, to get the 3 years starting credits.

Starting Credits • Since April 1975, NI contributions have been credited to people for the tax year in which they reach age 16 and the following two tax years in order to protect their future basic State Pension entitlement and Bereavement Benefits for a spouse or civil partner (“Starting Credits”). The policy intention behind the credits was to ensure that young people staying on in education beyond the minimum school leaving age did not lose future benefit entitlement as a result. There is no requirement for the individual to be in the UK at the relevant age. This was primarily to ensure that young people being educated outside the UK were not penalised. • The DWP proposes introducing legislation before the end of the 2010/11 tax year, stopping new award.

Starting credits were given, automatically, to anyone who acquired a National Insurance number. The practice has been stopped, but if you were working in the UK before 2010, I think you get them and keep them.

This explanatory note explains that you did not need to be resident in the UK, to get the 3 years starting credits.

Starting Credits • Since April 1975, NI contributions have been credited to people for the tax year in which they reach age 16 and the following two tax years in order to protect their future basic State Pension entitlement and Bereavement Benefits for a spouse or civil partner (“Starting Credits”). The policy intention behind the credits was to ensure that young people staying on in education beyond the minimum school leaving age did not lose future benefit entitlement as a result. There is no requirement for the individual to be in the UK at the relevant age. This was primarily to ensure that young people being educated outside the UK were not penalised. • The DWP proposes introducing legislation before the end of the 2010/11 tax year, stopping new award.

doranalex1

New Member

- Messages

- 2

@DannyBoyD thanks for kickstarting this whole thing.

I am wondering if I am eligible for Class 2 contributions? I am an irish national who worked in London from 2010-2014.

On the National Insurance website it notes I have 'full year' contributions from 2010-2014.

In 2014 I left the UK and worked in USA until 2017. After that I returned to Ireland and have been in PAYE employment here ever since (albeit with around a 6-month gap in employment).

Am I eligible for Class 2 contributions? Or does my stint in the USA disqualify me? (I thought I read something like that but can't find it now).

Will they be looking for any kind of substantiation for where I went and worked after leaving the UK?

Thanks in advance for any help.

I am wondering if I am eligible for Class 2 contributions? I am an irish national who worked in London from 2010-2014.

On the National Insurance website it notes I have 'full year' contributions from 2010-2014.

In 2014 I left the UK and worked in USA until 2017. After that I returned to Ireland and have been in PAYE employment here ever since (albeit with around a 6-month gap in employment).

Am I eligible for Class 2 contributions? Or does my stint in the USA disqualify me? (I thought I read something like that but can't find it now).

Will they be looking for any kind of substantiation for where I went and worked after leaving the UK?

Thanks in advance for any help.

see post #56 and read all the earlier ones as wellAm I eligible for Class 2 contributions? Or does my stint in the USA disqualify me? (I thought I read something like that but can't find it now).

Will they be looking for any kind of substantiation for where I went and worked after leaving the UK?

This is already in the key post.You will need to complete the CF83 application form to be considered for either rate. I would suggest you enclose a covering letter providing exact dates

Post in thread 'UK State Pension - Make voluntary contributions to qualify for UK pension on top of Irish pension' https://www.askaboutmoney.com/threa...n-on-top-of-irish-pension.230581/post-1813832