Steven Barrett

Registered User

- Messages

- 5,500

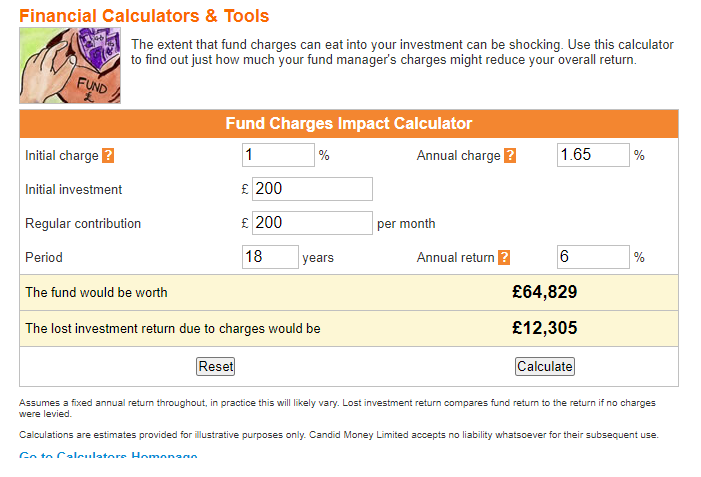

But he won't have built up any cash as it has all gone into the mortgage.I disagree. Over a 20 year horizon overpaying on the mortgage will give a better expected return than investing in an equity product with fees and taxes.

OP could get into the habit of overpaying mortage by the cost of college for a few years when kids in late teens, then stop the overpayments when kids are actually in college.

And while the expected return is greater, the actual return over the last 10 years has been less and you would have made more money by investing. Of course, there is no guarantee, that is the element of risk v return.

But my main argument is that there will be a need for liquid assets that overpaying a mortgage doesn't provide until decades later. That is why I advise a bit of A and a bit of B. I don't need you to agree with it. We just have a different opinion on this.

Steven

http://www.bluewaterfp.ie (www.bluewaterfp.ie)