I see peter Brown on news talk this morning interested in emerging market bonds, he says that its still high risk but probably at the end of the cycle, you get 10 percent yield and now the likelihood that emerging market currencies will appreciate again versus the dollar, of course the high yield was wiped out by the depreciating emerging market currencies up to this point however he thinks we are near the turning point. He also said that the trade tariffs imposed by trump was a damp squid effect on the market. All this against a background of getting nothing for holding German bonds.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Longest Bull Market in History

- Thread starter Sarenco

- Start date

- Status

- Not open for further replies.

galway_blow_in

Registered User

- Messages

- 2,102

I see peter Brown on news talk this morning interested in emerging market bonds, he says that its still high risk but probably at the end of the cycle, you get 10 percent yield and now the likelihood that emerging market currencies will appreciate again versus the dollar, of course the high yield was wiped out by the depreciating emerging market currencies up to this point however he thinks we are near the turning point. He also said that the trade tariffs imposed by trump was a damp squid effect on the market. All this against a background of getting nothing for holding German bonds.

Are those sovereign or corporate bonds or a mix of both he was referring to ?

But where are the up and coming innovations that point to future successes (which have already been priced into valuations)? I'm not seeing it.

Brilliant.

That is why stock picking is only for the wise.

If you could see them they would be priced in.

idle chatter imho

not really he actually does put his money where his mouth is. Also the thread is about "the longest bull market in history", however emerging markets and their bonds are clearly not in a bull market. You could also say that german bonds are in a bull market as the market has bid up their price so much that you now get 0% for investing in a german bond.

It was very clear from the OP that this thread related to the S&P500.

If you want to speculate on the future direction of EM bonds (or any other asset class for that matter) that's obviously fair enough. But it has nothing to do with the subject matter of this thread.

If you want to speculate on the future direction of EM bonds (or any other asset class for that matter) that's obviously fair enough. But it has nothing to do with the subject matter of this thread.

galway_blow_in

Registered User

- Messages

- 2,102

just looking at the euro stoxx 600 chart on the marketwatch website , price today is below where it was nearly twenty years ago in march 2000.

what is the point of owning a european broad based equity fund ?

what is the point of owning a european broad based equity fund ?

Every dog has its day.what is the point of owning a european broad based equity fund ?

European stocks outperformed US stocks over the 20-year period to the end of 2007. I've no idea which will outperform over the next 20 years so I hold both European and US equities. It's basic diversification.

Last edited:

galway_blow_in

Registered User

- Messages

- 2,102

Every dog has its day.

European stocks outperformed US stocks over the 20-year period to the end of 2007. I've no idea which will outperform over the next 20 years so I hold both European and US equities. It's basic diversification.

So from 1987 to 2007,European equities outperformed the u.s market ?

Must see can I find a chart.

But the tech stocks in 2001 were largely joke companies built on nothing.

Companies like Amazon hardly have feet of clay.

Gordon Gekko

Registered User

- Messages

- 7,919

What is your point?

In 2000, joke companies traded on crazy valuations.

Today, companies like Amazon are actually doing amazing things.

In 2000, joke companies traded on crazy valuations.

Today, companies like Amazon are actually doing amazing things.

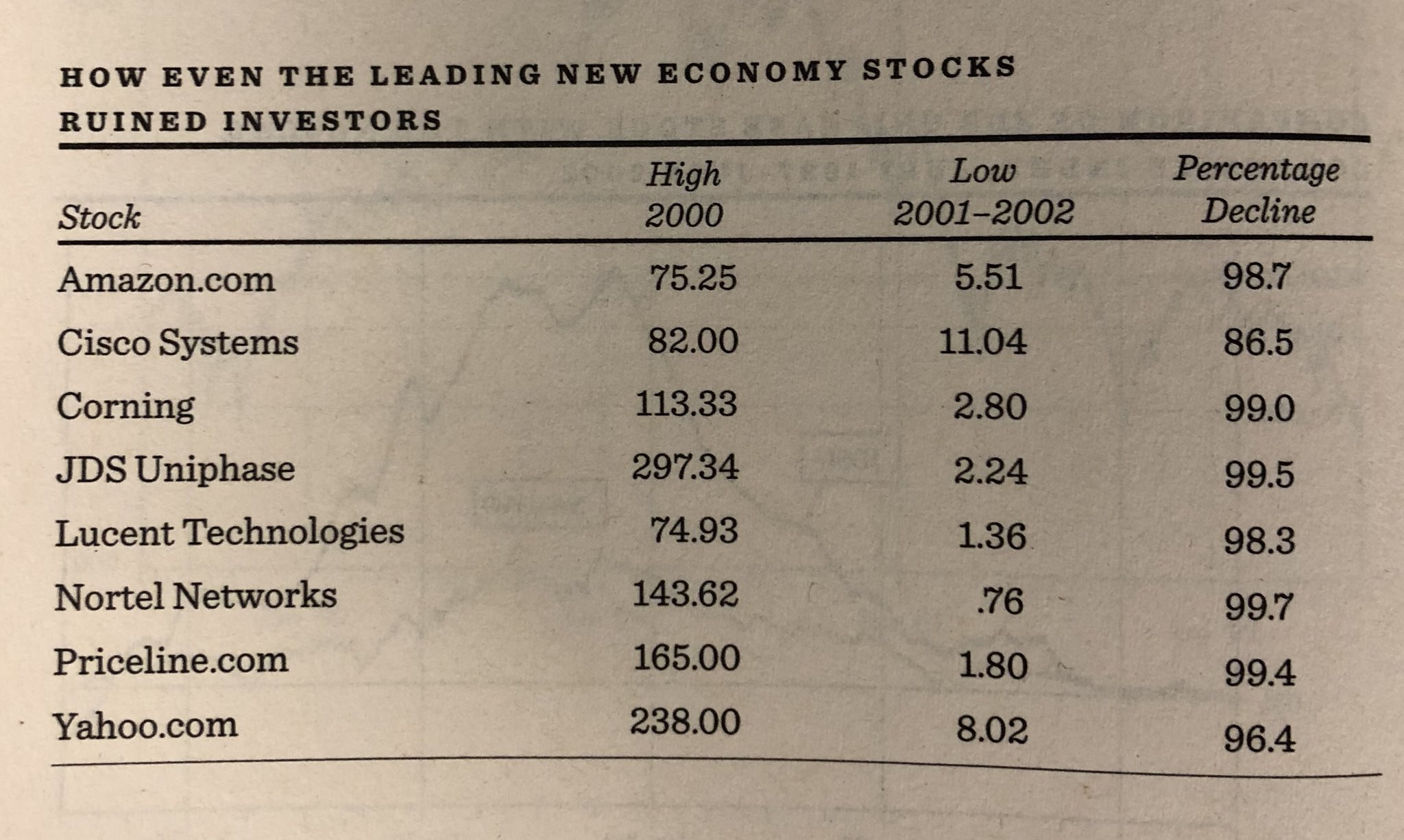

Amazon, Cisco, Nortel and Yahoo were serious players in 2000. Microsoft suffered a big decline also (not clawing its way back to its 1999 price until 2016.)

My point is that it isn't only joke companies, worth nothing and in the midst of being exposed as frauds, that can see their valuations cut in half or far worse.

My point is that it isn't only joke companies, worth nothing and in the midst of being exposed as frauds, that can see their valuations cut in half or far worse.

Amazon, Cisco, Nortel and Yahoo were serious players in 2000. Microsoft suffered a big decline also (not clawing its way back to its 1999 price until 2016.)

My point is that it isn't only joke companies, worth nothing and in the midst of being exposed as frauds, that can see their valuations cut in half or far worse.

Very good points, these companies were the architects of the internet and were not all joke companies, the funny thing was that 2012 was the perfect time to re invest in the likes of Microsoft, Cisco and Intel. They were punished too much by just being associated with the dot com crash even though they were still ground breaking technology companies that owned a huge number of patents that were needed in developing today's smart phones.

The same thing happened the oil companies in 2014, although not as extreme and the cycle has turned much faster. There was all this rubbish about "the end of oil" and we are burning more of it than ever before.

Very good points, these companies were the architects of the internet and were not all joke companies, the funny thing was that 2012 was the perfect time to re invest in the likes of Microsoft, Cisco and Intel.

Thanks joe. If the long-terms trends were just to these companies the prices would rise gradually over decades, with modest losses and re-gains, instead of spiking and crashing every ten years.

Gordon Gekko

Registered User

- Messages

- 7,919

Where did anyone say they were joke companies?

Throwing out a few names that grew into tech giants doesn’t disprove the idea that most of the dot.com bubble stuff was rubbish.

Throwing out a few names that grew into tech giants doesn’t disprove the idea that most of the dot.com bubble stuff was rubbish.

Yeah most of the dot-com stuff was rubbish. Beanie babies, pet-food, e-Toys etc.

But investors at the time couldn't distinguish between fool's gold and real gold, and worthwhile companies (what few there were) suffered price declines as severe as the junk. There was no careful sifting of the wheat from the chaff.

Richard Bernstein (former Merill strategist) said the other day that FAANGs have such strong fundamentals compared to dot-coms - in terms of cash flow and intrinsic value - that they won't suffer a crash. His arguments gave me serious pause but weren't enough to change my mind. I try to listen to all points of view though.

But investors at the time couldn't distinguish between fool's gold and real gold, and worthwhile companies (what few there were) suffered price declines as severe as the junk. There was no careful sifting of the wheat from the chaff.

Richard Bernstein (former Merill strategist) said the other day that FAANGs have such strong fundamentals compared to dot-coms - in terms of cash flow and intrinsic value - that they won't suffer a crash. His arguments gave me serious pause but weren't enough to change my mind. I try to listen to all points of view though.

Down about 5% in a few days, things happen really fast nowadays. I notice alot of beginners new to investing looking for advice. However no advice can prepare people from having to stomach these market sell offs on little real news. Its impossible to tell which piece of news the market will puke up over. I think we are near the end of the bull market in tech stocks, it has been an incredible run, I had offloaded most of my us technology by the beginning of this year so missed out on the last big upswing and I invested alot of it in european and emerging market etfs which were cheap and even cheaper now. Thats the really hard thing in investing in the short term you can be punished for doing the right thing (obviously its only right or wrong in hindsight and it may still be a mistake).

Gordon Gekko

Registered User

- Messages

- 7,919

What’s the average pullback over the course of a year, 13% or so?

People seem to be reacting more quickly to sensationalist media stuff.

People seem to be reacting more quickly to sensationalist media stuff.

What’s the average pullback over the course of a year, 13% or so?

People seem to be reacting more quickly to sensationalist media stuff.

what do you mean by average pullback of 13%?, i not really understand that statistic. I think people can react quickly because of electronic trading and cheap platforms, but it is more scary for the beginner and more likely he will sell up on such occasions than in the past, everyone has too much information at their finger tips.

Gordon Gekko

Registered User

- Messages

- 7,919

As I understand it, on average markets fall by circa 13/14% each year.

- Status

- Not open for further replies.