You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

KBC KBC told brokers" all fixed rate loans will roll onto trackers on expiry"

- Thread starter PadKiss

- Start date

- Status

- Not open for further replies.

Padraic is doing great work on this and the Central Bank is also working hard on the issue.

I'm as frustrated as everyone else, but at the same time I'm more than confident that the final outcome will be in our favour and I have just accepted that it will take time and that kbc will use every trick in the book to avoid their obligations.

I simply can't see how any pressure group can do anything more than is being done at present.

I'm as frustrated as everyone else, but at the same time I'm more than confident that the final outcome will be in our favour and I have just accepted that it will take time and that kbc will use every trick in the book to avoid their obligations.

I simply can't see how any pressure group can do anything more than is being done at present.

Hi all, Firstly I want to acknowledge the frustration you all feel with what is occurring here. This matter has taken far too long to get addressed correctly. I am pleased to finally let you know that I will be writing here in the coming days as well as contacting all who have contacted me through my office in regards to the public meeting I am arranging.

I want to assure each of you that there is a major piece of work that has been ongoing in my office since 2010 relating to KBC, who have whether they like it or not major questions to answer. It covers wide aspects of how their customers have been treated to date. I will outline the current position and the groupings that exist within the KBC problem, and there are many, each with a different set of reasons why their account should be restored to the correct tracker rate.

I understand the annoyance at the length of time it has taken me to come back on my previous promise of a public meeting but I felt it would only be worthwhile holding a meeting if I have made progress in putting together the 'jigsaw' of the cases and the evidence. It is now time for that meeting and for everyone to "get on the bus" and that will be the purpose for the meeting, to get as many of the affected customers of KBC grouped together whose accounts have cases in my view.

I am waiting on confirmation of the venue but I will give at least a weeks notice for the meeting. I hope the room will be full in order to send a clear message to KBC, we are not going away and KBC must address the matters regarding Tracker Mortgages correctly. I will of course expand on this in greater detail at the meeting.

You will hear again from me by Tuesday with a formal notice of the meeting confirming a date, time and location and I hope it will suit most to attend or at the least send a representation. Political and media interested will also be invited to show the large numbers that have grave concerns how this bank has dealt with each of your issues. I look forward to seeing you all at the meeting when I will expand in greater detail on the merits of the case. Be in touch soon Padraic

I want to assure each of you that there is a major piece of work that has been ongoing in my office since 2010 relating to KBC, who have whether they like it or not major questions to answer. It covers wide aspects of how their customers have been treated to date. I will outline the current position and the groupings that exist within the KBC problem, and there are many, each with a different set of reasons why their account should be restored to the correct tracker rate.

I understand the annoyance at the length of time it has taken me to come back on my previous promise of a public meeting but I felt it would only be worthwhile holding a meeting if I have made progress in putting together the 'jigsaw' of the cases and the evidence. It is now time for that meeting and for everyone to "get on the bus" and that will be the purpose for the meeting, to get as many of the affected customers of KBC grouped together whose accounts have cases in my view.

I am waiting on confirmation of the venue but I will give at least a weeks notice for the meeting. I hope the room will be full in order to send a clear message to KBC, we are not going away and KBC must address the matters regarding Tracker Mortgages correctly. I will of course expand on this in greater detail at the meeting.

You will hear again from me by Tuesday with a formal notice of the meeting confirming a date, time and location and I hope it will suit most to attend or at the least send a representation. Political and media interested will also be invited to show the large numbers that have grave concerns how this bank has dealt with each of your issues. I look forward to seeing you all at the meeting when I will expand in greater detail on the merits of the case. Be in touch soon Padraic

Am I the only one wondering why Padraic Kissane is ploughing a lone furrow on this issue.. his work is fantastic and very commendable however this is a national scandal as far as I'm concerned . It's up there with some of the worst, and I'm not hearing enough noise from the powers that be and influential political figures who can make a difference .. some dip in and out but there needs to be a sustained campaign to hold these banks to account... they are laughing at the central bank and regulators as far as I can see

moneymakeover

Registered User

- Messages

- 961

I don't understand why no legal action has been taken against the banks.

That presumably would speed things up.

It seems the legal system in this country works in favour of the big institutions to the detriment of the little man.

I recall hearing Ross Maguire was taking legal action against Aib

http://m.independent.ie/business/pe...ustomers-may-have-lost-trackers-31472656.html

But have not heard anything since

I read about a judge McNulty encouraging customers to take a tracker case to court.

https://www.google.ie/amp/amp.irish...ail-on-tracker-mortgage-decisions-437875.html

But still not heard of any actual cases.

It seems the entire situation is being carefully choreographed by the central bank and the banks.

With little regard for the customer.

That presumably would speed things up.

It seems the legal system in this country works in favour of the big institutions to the detriment of the little man.

I recall hearing Ross Maguire was taking legal action against Aib

http://m.independent.ie/business/pe...ustomers-may-have-lost-trackers-31472656.html

But have not heard anything since

I read about a judge McNulty encouraging customers to take a tracker case to court.

https://www.google.ie/amp/amp.irish...ail-on-tracker-mortgage-decisions-437875.html

But still not heard of any actual cases.

It seems the entire situation is being carefully choreographed by the central bank and the banks.

With little regard for the customer.

Lightening

Registered User

- Messages

- 308

Section 6 of the Theft and Fraud Offences Act 2001 provides that:

“A person who dishonestly, with the intention of making a gain for himself, or another, or of causing loss to another, by any deception induces another to do or refrain from doing an act, is guilty of an offence. “

A person found guilty of such an offence is liable to a fine or to imprisonment for up to five years.

“A person who dishonestly, with the intention of making a gain for himself, or another, or of causing loss to another, by any deception induces another to do or refrain from doing an act, is guilty of an offence. “

A person found guilty of such an offence is liable to a fine or to imprisonment for up to five years.

Lightening

Registered User

- Messages

- 308

Thanks Moneymakeover! Interesting comments from Judge McNulty above

thanks Padraic for your recent update look forward to hearing from you regarding the forthcoming meeting

thanks Padraic for your recent update look forward to hearing from you regarding the forthcoming meeting

Lightening

Registered User

- Messages

- 308

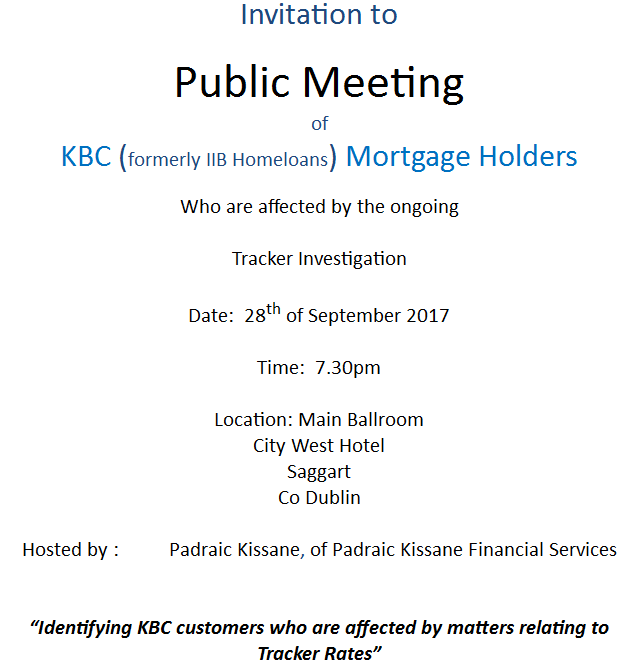

Padraic has just posted the details for the long awaited meeting next week 28/09 for KBC customers involved in the tracker scandal.

I will definitely be attending this meeting.

It is so important that people attend and show support. We need a united approach to tackle the indifference of this bank to our plight.

Please attend to register your concerns and send a clear message to KBC Bank of the numbers affected.

Forward this invite to anyone you know who has an issue (but may not have contacted us to date) with this bank and ask them to attend on the night or contact us at info@padraickissane.ie

Please RSVP to info@padraickissane.ie to confirm your attendance.

I will definitely be attending this meeting.

It is so important that people attend and show support. We need a united approach to tackle the indifference of this bank to our plight.

Please attend to register your concerns and send a clear message to KBC Bank of the numbers affected.

Forward this invite to anyone you know who has an issue (but may not have contacted us to date) with this bank and ask them to attend on the night or contact us at info@padraickissane.ie

Please RSVP to info@padraickissane.ie to confirm your attendance.

Hi Padraic, i am interested in attending but not sure if i have a case, i am awaiting my banking file but my situation is i was never on a tracker but my fixed period ended around the time of the flyer stating all FR mortgages will go onto the tracker, however i dont believe i was ever offered a tracker [im hoping my banking file will support this but im not sure what ito expect]. i have several letters offering FR which reading them now seem to have been applying pressure. I think coming along i would learn something and its very important, but its a little awkward for me currently. If anyone feels i might fall into the affected bracket i will make every effort to come along. thanks

Leighlinboy

Registered User

- Messages

- 139

Ill

Be there !

Be there !

I reckon you should come - at the very least you can get your questions answered. A forum is good, but has its limits.Hi Padraic, i am interested in attending but not sure if i have a case, i am awaiting my banking file but my situation is i was never on a tracker but my fixed period ended around the time of the flyer stating all FR mortgages will go onto the tracker, however i dont believe i was ever offered a tracker [im hoping my banking file will support this but im not sure what ito expect]. i have several letters offering FR which reading them now seem to have been applying pressure. I think coming along i would learn something and its very important, but its a little awkward for me currently. If anyone feels i might fall into the affected bracket i will make every effort to come along. thanks

If the answer is negative you can look at getting the best current rate possible. If people think you have a chance, then it's a sitting game.

Personally I don't think you have a case as there was no tracker in the first place - but others may think otherwise.

You've nothing to lose by attending though.

Lightening

Registered User

- Messages

- 308

It didn't have to start on the tracker!! Remember the flyer!! Prevailing variable rate wording etc!! Did your contract say you would move to the lenders prevailing rate at the end of the fixed rate? Some customers with other lenders started on a fixed also and they were put on the tracker.

Jonjesk Padraic has knowledge of all the contracts with KBC he has the best knowledge to advise you. Suggest you attend and talk to him.

Jonjesk Padraic has knowledge of all the contracts with KBC he has the best knowledge to advise you. Suggest you attend and talk to him.

Lightening

Registered User

- Messages

- 308

I am aware of people who fixed and had the wording "At the expiry of the fixed rate period the Lenders prevailing variable rate will apply". (the "variable as it was called" at the time was the tracker as we know KBC only did a variable (tracker) or fixed rate.

I am aware that KBC rolled these contracts to the tracker rate as late as 2010. (Fixed rate contracts that appear to have fixed for three years from 2007) Anyone that has this wording in their fixed rate contract is entitled to the tracker rate. This is further backed up by the famous flyer.

KBC has claimed that from July 2008 trackers were "off the table".

KBC are now trying to interprete the wording of the "Lenders prevailing variable rate" to suit themselves and cannot claim now that it was the Standard Variable Rate.

Jonjesk I suggest you ask immediately for a copy of your mortgage document from customer services and I expect it should come before Thursdays meeting.

I am quoting a recent post from Moneymaker where they quote the central bank statement

lenders must review the underlying loan documentation and customer files for the in-scope accounts to determine their specific contractual obligations, and also to determine if the documentation that each customer received had the potential to confuse or mislead the customer, both on a stand-alone basis and when read in conjunction with other communications – be they written or verbal – made to the individual customer.

I am aware that KBC rolled these contracts to the tracker rate as late as 2010. (Fixed rate contracts that appear to have fixed for three years from 2007) Anyone that has this wording in their fixed rate contract is entitled to the tracker rate. This is further backed up by the famous flyer.

KBC has claimed that from July 2008 trackers were "off the table".

KBC are now trying to interprete the wording of the "Lenders prevailing variable rate" to suit themselves and cannot claim now that it was the Standard Variable Rate.

Jonjesk I suggest you ask immediately for a copy of your mortgage document from customer services and I expect it should come before Thursdays meeting.

I am quoting a recent post from Moneymaker where they quote the central bank statement

lenders must review the underlying loan documentation and customer files for the in-scope accounts to determine their specific contractual obligations, and also to determine if the documentation that each customer received had the potential to confuse or mislead the customer, both on a stand-alone basis and when read in conjunction with other communications – be they written or verbal – made to the individual customer.

TheBarrall

Registered User

- Messages

- 9

i'm hoping this is the same from sept 2006 when I signed, as this is what mine says and I was at the time always under the impression it went back to the tracker once it finished, as we all know, it was not to be, I will not be able to make it Thursday, i'm hoping for a very good update though

- Status

- Not open for further replies.