Galway Joe

Registered User

- Messages

- 7

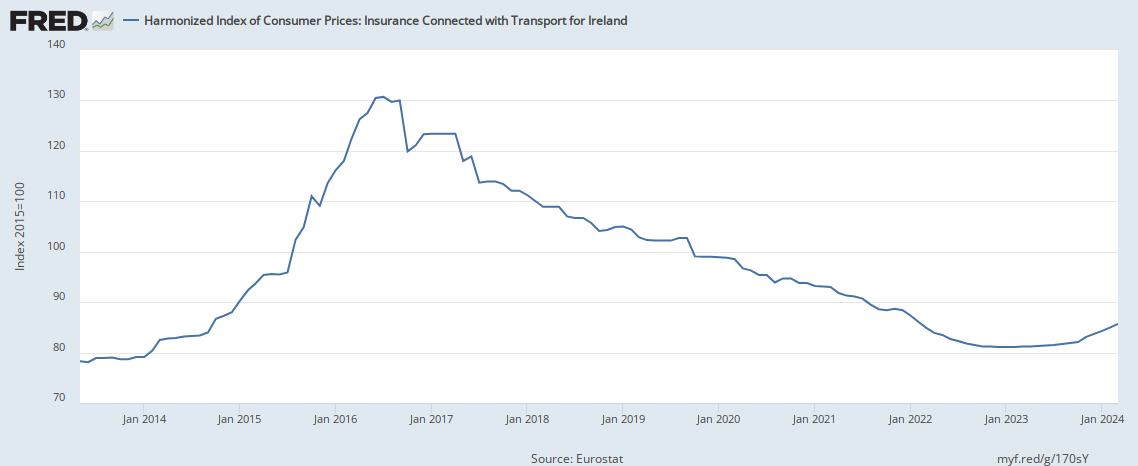

Hi Folks - not sure if I have the right section for this or not! I just got a renewal quote in from my insurer which has increased by 20% since last year. I was under the impression that with the agreement with Government and insurance companies regarding reduced payouts in the case of accidents that the savings would be passed on to the motorist. Thankfully I have had no accidents in my 43 years of driving. - Any comments most welcome.