So, just to be very clear on this point. Our advice is certainly not typical of the broker community.

Personally I think the issue here stems from brokers (and tied agents in banks) having an over reliance on risk profile questionnaires to test a client's risk tolerance when what they should be testing is a more objective measure of capacity to bear losses. (the point about having AVCs and a DB pension - then yes, you objectively have more risk capacity)

When constructing investment portfolios, it is essential that we understand risk tolerance, AS WELL as capacity and risk required.

globalwealth.ie

I took great exception to the thread where a

100% Equity strategy was being touted as "something to consider". Its not a suitable investment strategy for an ARF for most people. That was my point. Just that

However, I consistently argue that, equally, a very conservative investment strategy (ESMA 2, 3 or even 4) is also wholly unsuitable for an ARF investment.

We estimate that the amount of investors cash held across these strategies is almost €10 Billion. Now we don't know the split between pre and post retirement but it really doesn't matter. Its not really suitable for pre-retirement savings to be in such conservative strategies and it clearly doesn't work for an ARF. So, broadly speaking nobody should have any money in any of these.

HM Treasury commissioned a review a while back now by Ron Sandler (

https://en.wikipedia.org/wiki/Sandler_Review) in which the phrase

"reckless conservatism" was coined to describe the investing decisions of a very large proportion of the UK investing public.

This is the original "bootstrap" analysis I did 10 years ago now and referenced in

our guide on this subject

Clearly, the all cash portfolio resulted in a lower inheritance for the investor’s heirs.

However, equally revealing is the fact that when we add in the stream of income payments, we see that the cash strategy also provided the lowest cumulative income payments for an investor themselves.

| 1 Strategic Portfolio Cautious (DMY) | |

| 2 Strategic Portfolio 20% Risk (DMY) | |

| 3 Strategic Portfolio 30% Risk (DMY) | |

| 4 Strategic Portfolio 40% Risk (DMY) | |

| 5 Strategic Portfolio Balanced (DMY) | |

| 6 German 3 Month Money Market Rate (Cash) (DMY) | |

| 7 MSCI World Index (gross div.) (Equity) (USD) | |

| 8 German REX Performance Index (Fixed Interest) | |

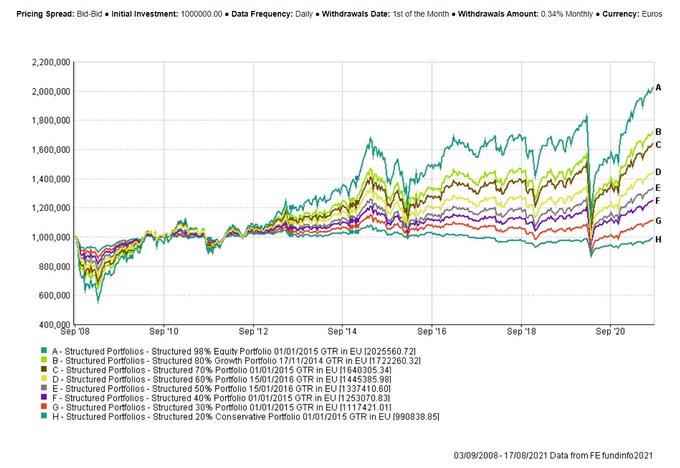

And here is the ex post performance of those strategies since our first Irish client invested back in Sept 2008 assuming a 4%pa withdrawal paid monthly on the 1st month

Investing in an ARF carries higher risk than annuity purchase as the fund remains invested and may fall as well as rise in value. This in turn may lead to the client receiving less income than they expect.

For some clients this is unacceptable. However, as we have seen, pursuing a deposit-based investment strategy within an ARF to avoid investment risk does not guarantee a better outcome and depending on how long the client lives, an Annuity may work out to be better value overall.

Some clients, in the face of a decline in the value of their ARF may subsequently elect to switch to an annuity part way through their retirement; some of these may discover that they would have been better off buying an annuity at outset.

Clearly, investing in an ARF is not without its risks. Furthermore, if part of the portfolio is held in cash to meet the needs of imputed distributions, the return from the non-cash part needs to be that much higher to meet the overall return objective. (cash drag)

If you need withdrawals from your ARF to maintain your required lifestyle and the withdrawal rate is close to the annuity rate that could currently be secured, you are only going to be able to maintain this income level if a higher level of investment risk is taken.

The decision to invest in an ARF is not a simple process and we believe that it is very important for clients to fully understand all the risks that they face.

Equally, it is essential to appreciate that if you pursue a cautious investment strategy (such as investing in a deposit account) with an ARF you will almost certainly fail to meet the critical yield requirement and might actually find out that you would have been better off with the purchase of an annuity (depending on how long you live).

This problem is much too complex to have a single solution for everyone. Relevant factors to consider include; the expected time horizon, the tolerance for risk, the desire for smooth consumption from year to year, and the desire to leave a bequest will each have an impact on the outcome.

While there is no single answer, there are several principles which apply uniformly:

• Investors are more likely to maintain living standards in retirement if they have low spending rates and reasonably large stock allocations within their portfolios. A long retirement coupled with a low stock allocation translates into a high probability of declining consumption.

• Insisting on a very high degree of “smoothing” of income from one year to the next (i.e. maintaining a relatively constant income) is a recipe for disaster. Imputed distributions are based on 4% or 5% of the remaining fund value and therefore does not subject the fund to this risk.

• For shorter time periods, higher spending rates may be justified. However, even over these shorter periods, higher spending rates increase the probability of declining consumption in the future.

• Expected bequests are higher for portfolios with high stock allocations, but so is the likelihood of leaving a small bequest. This is a classic risk/return trade-off.