Brendan Burgess

Founder

- Messages

- 52,115

Roma Burke and Tony Gilhawley have an excellent paper here on tax aspects of pension contributions. This paper is now available on the SAI website here.

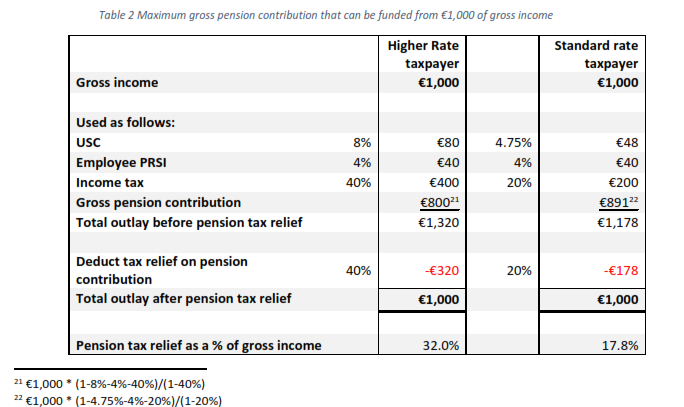

We loosely say that "higher earners get tax relief of 40% on pension contributions."

They see it differently

But does this show the full picture?

The Higher Rate taxpayer gets €800 of pension fund for his €1,000 contribution. The Standard Rate taxpayer gets €891.

OK, if they were not contributing to a pension, the HRT would get €480 net while the SRT would get €712 net.

So the HRT is getting €800 of a pension fund for €480 - a 66% top-up

The SRT is getting €891 for €712 - a 25% top-up.

Brendan

We loosely say that "higher earners get tax relief of 40% on pension contributions."

They see it differently

But does this show the full picture?

The Higher Rate taxpayer gets €800 of pension fund for his €1,000 contribution. The Standard Rate taxpayer gets €891.

OK, if they were not contributing to a pension, the HRT would get €480 net while the SRT would get €712 net.

So the HRT is getting €800 of a pension fund for €480 - a 66% top-up

The SRT is getting €891 for €712 - a 25% top-up.

Brendan