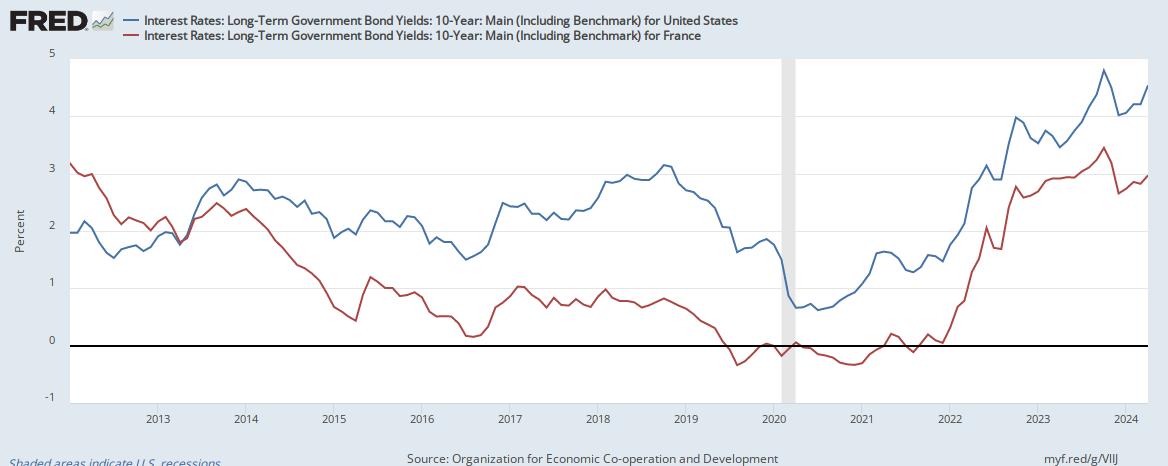

Based on C. Lagarde's replies at the press conference, I now think 4% is possible by June 2023.

I have two questions. One on “the significantly higher rates at a steady pace”. Does that mean we are going to see more 50-basis-point hikes in the future? And how many do you envision if you see significantly higher rates?

On QT, quantitative tightening, how do you decide which one do you reinvest and which not? Is there also a metric behind?

On the first one, I’m glad that you picked up the key messages that are really embedded in this monetary policy statement that I have just read for you. One of the key messages, in addition to the hike that we decided today, is the indication that not only will we raise interest rates further, which is something that we had said before, but we also say that today we judged that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive, to ensure a timely return of inflation to our 2% medium-term target. I’m reading straight from the monetary policy statement, first paragraph, because that is the one that that really includes the four key messages that we have. One of them is that we, at this point in time, expect and judge that we will have to raise interest rates significantly. Now, what does that mean? You have to read it together with the steady pace. It is pretty much obvious that, on the basis of the data that we have at the moment, significant rise at a steady pace means that we should expect to raise interest rates at a 50-basis-point pace for a period of time.

The second element that you have in this paragraph is the reference to a steady pace, so it’s significant, and it has to be a steady pace, which means that we have made progress over the course of the last few months, but we have more ground to cover. We have longer to go, and we are in for a long game.

Also, see below:

The European Central Bank will hike interest rates further in the euro zone to combat high inflation, ECB's Vice-President Luis de Guindos said today.

www.rte.ie