You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

W1TTY - anyone using it?

- Thread starter tomdublin

- Start date

Brendan Burgess

Founder

- Messages

- 52,183

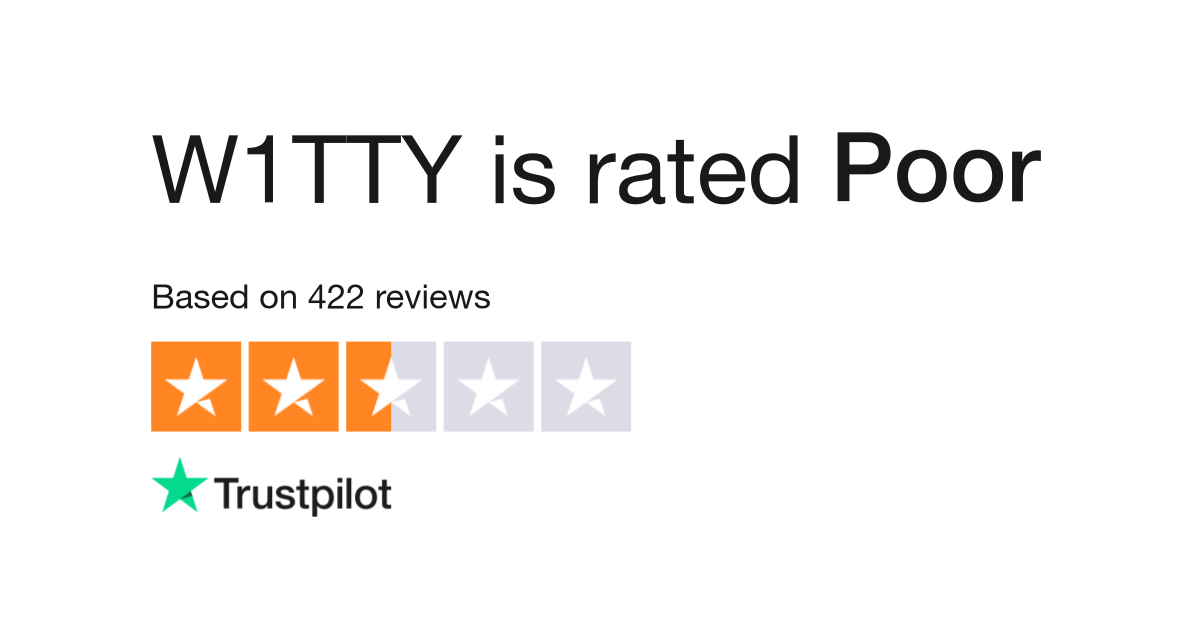

Mixed feedback on Trustpilot

ie.trustpilot.com

ie.trustpilot.com

Seems to offer 1% cash back not 3% - which is only available on some deals.

And charges if you top up more than €100?

But give it a shot and let us know how you get on.

Brendan

W1TTY is rated "Average" with 3.7 / 5 on Trustpilot

Do you agree with W1TTY's TrustScore? Voice your opinion today and hear what 280 customers have already said.

Seems to offer 1% cash back not 3% - which is only available on some deals.

And charges if you top up more than €100?

But give it a shot and let us know how you get on.

Brendan

It says 3% here subject to a maximum of €120 p.m. but there are so many other terms and conditions it seems too complicated for me anyway...

legal.w1tty.com

legal.w1tty.com

3% Cashback

These Terms and Conditions of the “3% Cashback” Program set out terms and conditions for the customers of WITTY GLOBAL UAB who are eligible for special benefits hereunder.

Only if you top up by debit card, SEPA transfers are free. Hence I was wondering if SEPA transfers are instant. Otherwise you would need to leave money in the account but that might be a bit risky given the lack of deposit insurance.And charges if you top up more than €100?

I have used W1TTY for the last 9 months. It's great for cashback.

SEPA transfers from PTSB take about a day. Don't think W1TTY support SEPA Instant.

Cashback is 3% on EU/EEA purchases in EUR both online and in-stores. Max 120 EUR per month. Cashback after 45 days - you click claim in the app.

High top up fees over 100 EUR per month.

I would guess that their business model is to use the cashback as a way to entice new customers to sign up. I would guess that the offer will end at some stage but they keep rolling it month after month.

FCA regulated.

No deposit protection. No investor protection scheme. Probably wise not to keep a large sum with them but you can just do transfers of 100 or 200 EUR at a go or something like that.

No referral scheme.

No interest paid.

SEPA transfers from PTSB take about a day. Don't think W1TTY support SEPA Instant.

Cashback is 3% on EU/EEA purchases in EUR both online and in-stores. Max 120 EUR per month. Cashback after 45 days - you click claim in the app.

High top up fees over 100 EUR per month.

I would guess that their business model is to use the cashback as a way to entice new customers to sign up. I would guess that the offer will end at some stage but they keep rolling it month after month.

FCA regulated.

No deposit protection. No investor protection scheme. Probably wise not to keep a large sum with them but you can just do transfers of 100 or 200 EUR at a go or something like that.

No referral scheme.

No interest paid.

Brendan Burgess

Founder

- Messages

- 52,183

Cashback is 3% on EU/EEA purchases in EUR both online and in-stores. Max 120 EUR per month.

Hi Lightning

Is that 3% of €4,000 = €120 cash back

or 3% of €120 = €3.60 cash back?

Brendan

Update: 3.1.2. The maximum amount of the Cashback to which the Client is entitled during a month is equal to 120 EUR.

@Brendan Burgess - 3% of €4,000 = €120 cash back. i.e. You get cashback on the first 4k that you spend per month but no cashback on any expenditure in excess of 4k.

Brendan Burgess

Founder

- Messages

- 52,183

High top up fees over 100 EUR per month.

I don't get this.

If I want to spend €4,000 a month

But don't want to risk having more than €200 in the account at any one time as there is no guarantee

Do I set up a S.O. in ptsb to send €200 every couple of days?

Brendan

@Brendan Burgess - Top up fees are high but bank transfers are free. You could set up a standing order or simply just do ad-hoc bank transfers whenever you wish/need. I do ad-hoc bank transfers.

OK but once customers have signed up what's the business model then? Even if they reduce cashback to 1% they will pay out 0.8% on every transaction since what they can charge retailers is capped EU-wide at 0.2%.I would guess that their business model is to use the cashback as a way to entice new customers to sign up

Last edited:

OK but once customers have signed up what's the business model then? Even if they reduce cashback to 1% they will pay out 0.8% on every transaction since what they can charge retailers is capped EU-wide at 0.2%.

Anyone's guess as to what if anything will replace the 3% cashback whenever the offers ends. But one can obviously cease using it if you choose at that stage.

Not a great start. Registered a couple of days ago, then was notified that my application has gone to "manual review" which would "need some clarification." A few days later I messaged their "Conscierge" to ask what clarification they need. After a few hours (not minutes as promised in the app) "Conscierge" replied that they would clarify and get back to me, but no clarification on the needed clarification so far. Catchy app design though!But give it a shot and let us know how you get on.

Last edited:

Did they ask you to upload a bank statement or utility bill as proof of address? They just got back to me asking for that.i signed up for this last night, was setup and verifiied in minutes, done a SEPA transfer to the account for €6 to pay the postage for the card.

Last edited:

i signed up for this last night, was setup and verifiied in minutes, done a SEPA transfer to the account for €6 to pay the postage for the card.

You obviously don't need a physical card, one can just use your phone for payments.

Last edited:

@Lightning I currently use my Revolut account for discretionary spending.

Each month I top-up my Revolut account using my AIB credit card (via Google Wallet) which I get 0.5% cashback on.

Would it be possible to then do a free bank transfer from my Revolut account to W1TTY in order to get a further 3% cashback?

This way I would effectively earn 3.5% cashback in total?

Each month I top-up my Revolut account using my AIB credit card (via Google Wallet) which I get 0.5% cashback on.

Would it be possible to then do a free bank transfer from my Revolut account to W1TTY in order to get a further 3% cashback?

This way I would effectively earn 3.5% cashback in total?

@PoundMan - Clever!! Interesting move to top up your Revolut account via your AIB credit card and then get 0.5% cashback. If that works, and then if you do a free bank transfer, you will then get a further 3% cashback on your expenditure provided it is EUR expenditure inside the EU and below the threshold.

I'm guessing it's probably only worth doing with my discretionary spending due to the lack of deposit protection. Does it cost anything to withdraw money out of a W1TTY account?@PoundMan - Clever!! Interesting move to top up your Revolut account via your AIB credit card and then get 0.5% cashback. If that works, and then if you do a free bank transfer, you will then get a further 3% cashback on your expenditure provided it is EUR expenditure inside the EU and below the threshold.

I'm guessing it's probably only worth doing with my discretionary spending due to the lack of deposit protection. Does it cost anything to withdraw money out of a W1TTY account?

SEPA withdrawals are free

I think I might give it a try, not totally sure if it will be worth it though as quite a lot of my discretionary expenses are through UK & US subscription services such as Amazon. At the moment I use my AIB cashback credit card for non-discretionary spending on things like fuel, health insurance, etc. I'd almost be tempted to try switching to W1TTY for all of my EU expenses but I have a feeling it might require a fair bit of complication and maintenance of various accounts in order to maximise the rewards. I'd also be worried about leaving too much money sitting in an unprotected account.