I'd think that for RPZ measures to be considered effective they would have to have some degree of impact on taming the increase. There isn't even a blip on that rise corresponding to the introduction of the measures.Very little either way!

These statistics are based on advertised (market) rents, usually new to market.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Very low rent in Rent Pressure Zone

- Thread starter CapitalK

- Start date

NoRegretsCoyote

Registered User

- Messages

- 5,766

They are very effective at taming the increase in rents for people who already have leases.they would have to have some degree of impact on taming the increase.

They are ineffective for new tenants - in fact probably increase market rents even further as more landlords leave the market.

That's just it, the success or otherwise of a measure should be judged on overall impact.They are very effective at taming the increase in rents for people who already have leases.

They are ineffective for new tenants - in fact probably increase market rents even further as more landlords leave the market.

PebbleBeach2020

Registered User

- Messages

- 635

they are a political decision only and haven't worked by and large anywhere.

The opposition object to housing developments for a variety of reasons, they proclaim what they would do to landlords interests if they were in power. This all makes a bad situation worse. Landlords start selling up immediately in the fear of this happening. And it makes the current situation worse. As the current situation gets worse, the opposition get more popular. And the vicious cycle continues

The opposition object to housing developments for a variety of reasons, they proclaim what they would do to landlords interests if they were in power. This all makes a bad situation worse. Landlords start selling up immediately in the fear of this happening. And it makes the current situation worse. As the current situation gets worse, the opposition get more popular. And the vicious cycle continues

I'm in a similar situation. Kept the rent the same for the last five years for good tenants, thought we'd bump it up based on the previous regime of 4% increments, even if was to a limit But we can't charge anything approaching market rates now under the newest rules.

Bear in mind that if you get in a new tenant, even if they're a good one, and you want to sell in the next 3 - 5 years for any reason then the tenant may not be able to find anywhere else and therefore might refuse to go. And that's in the best case where they genuinely tried to move but the market is still so difficult that they're stuck. Until there's more supply, it's difficult for tenants to move on.

I feel like if there was more anti-landlord legislation on the way or you had need of the place, you can give notice but you may still not get it back. Just one of the reasons why I'm selling now that the former tenants decided to move.

Bear in mind that if you get in a new tenant, even if they're a good one, and you want to sell in the next 3 - 5 years for any reason then the tenant may not be able to find anywhere else and therefore might refuse to go. And that's in the best case where they genuinely tried to move but the market is still so difficult that they're stuck. Until there's more supply, it's difficult for tenants to move on.

I feel like if there was more anti-landlord legislation on the way or you had need of the place, you can give notice but you may still not get it back. Just one of the reasons why I'm selling now that the former tenants decided to move.

I ended up with two properties in RPZ's and both were well below market rate. I sold one in 2020 and made a capital loss from what I paid originally. I am just after going sale agreed on he sale of my second rental and I can offset the gain against the loss because I sold them in the correct order.

I decided I didn't need the hassle anymore and the taxation was ridiculous. So I upgraded my PPR and hope to clear the mortgage and have a few quid in the bank in the not too distant future. I'll be glad to get rid of tax returns, management fees, insurance policies, etc.

I decided I didn't need the hassle anymore and the taxation was ridiculous. So I upgraded my PPR and hope to clear the mortgage and have a few quid in the bank in the not too distant future. I'll be glad to get rid of tax returns, management fees, insurance policies, etc.

The government and it's agencies have managed to make a total mess of the rental market tbh. The issue is & was always supply. These measures are populist, ineffective, movable goal post panic inducing moves that probably don't serve either tenants well or landlords in the medium term

As for the the OP's issue, I would decorate the property , add something to it and re rent it at market rates. Then I'd seriously consider selling up.

As for the the OP's issue, I would decorate the property , add something to it and re rent it at market rates. Then I'd seriously consider selling up.

Probably not.I can't imagine this would be a runner for the OP; I'm also not convinced, if challenged, that it would pass the rent controls element.

Not in Swords - there is an army of would be owner occupiers happy to snap up the property to live in and are not concerned about the fact that its been rented.Dont forget that low locked rent will probably effecte the sale price of your property too.

"Market rates" incidentally are pretty vague in Swords - unless you are in one of the 4 or 5 town centre apartment developments which have very clear rents: the outer edges of the town there's literally a 600 euro +/- differential on similar properties.The government and it's agencies have managed to make a total mess of the rental market tbh. The issue is & was always supply. These measures are populist, ineffective, movable goal post panic inducing moves that probably don't serve either tenants well or landlords in the medium term

As for the the OP's issue, I would decorate the property , add something to it and re rent it at market rates. Then I'd seriously consider selling up.

If I were the OP I'd look at the financial impact of selling up as its locally still an in demand market. There's a good few LLs in similar scenarios and doing so right now. It is frustrating, but until some change is made (and given the political environment its only likely to get worse) you might be as well off putting it on the market and cutting your losses. Obviously it would depend on your own situation, if you owe anything and the difference between you much you'd claw back now. I am the lucky tenant in a similar scenario and I worked out that at the price my LL was willing to sell to me at, it would take them 14 years to get the same in rent (I couldn't buy in the end due to a legal issue).

Agreed - but nobody will dare change this right now, because it would start to impact a group of tenants who quietly have benefited from the system for a long time.That's just it, the success or otherwise of a measure should be judged on overall impact.

Absolutely. Evidence plays little or no role in much of government policy, those who shout loudest prevail.Agreed - but nobody will dare change this right now, because it would start to impact a group of tenants who quietly have benefited from the system for a long time.

BigPineapple

Registered User

- Messages

- 133

Looking at Citizen Information site, it seems to suggest that you can get 2% per year as cumulative.

I can't say I'm familiar with renting laws, it might give you some hope.

https://www.citizensinformation.ie/en/housing/renting_a_home/rent_increases.html

I can't say I'm familiar with renting laws, it might give you some hope.

Since, 11 December 2021, annual rent increases in RPZs are capped in line with the rate of general inflation or 2% a year, whichever is lower. So, if your landlord reviews the rent every 12 months and the rate of general inflation is 1.5%, then your rent can only be increased by a maximum of 1.5%. However, if the rate of general inflation is higher than 2%, for example, 3%, the rent can only be increased by a maximum of 2%.

It is a bit more complicated if your landlord has not reviewed the rent for a number of years, as the 2% cap applies every year. So, for example, if you moved into rented accommodation in December 2016 and the rent hasn’t changed since then, the general inflation rate would apply when calculating the rent increase. This is because the inflation rate between December 2016 and December 2021 was 6.6%, which is lower than the 10% that would apply under the 2% per year condition (2% per year for 5 years = 10%). The RTB’s Rent Pressure Zone calculator applies both of these conditions and calculates the allowable rent increase for you.

https://www.citizensinformation.ie/en/housing/renting_a_home/rent_increases.html

Sconeandjam

Registered User

- Messages

- 352

Doing the same here. Selling in the right order so loss can be carried to the next property. The fear of SF getting in and telling you you cannot sell unless the tenant stays or they say to those on HAP that they will only pay half the rate or tax the small landlord more. All I see at the moment is money being handed out like smarties before SF gets in and there is nothing in the pot to fix up the mess.I ended up with two properties in RPZ's and both were well below market rate. I sold one in 2020 and made a capital loss from what I paid originally. I am just after going sale agreed on he sale of my second rental and I can offset the gain against the loss because I sold them in the correct order.

I decided I didn't need the hassle anymore and the taxation was ridiculous. So I upgraded my PPR and hope to clear the mortgage and have a few quid in the bank in the not too distant future. I'll be glad to get rid of tax returns, management fees, insurance policies, etc.

Sconeandjam

Registered User

- Messages

- 352

This is correct. Before you could increase by 4% but that was changed last year. Obrien brought this in very quickly.Looking at Citizen Information site, it seems to suggest that you can get 2% per year as cumulative.

I can't say I'm familiar with renting laws, it might give you some hope.

https://www.citizensinformation.ie/en/housing/renting_a_home/rent_increases.html

OP there is a formula on the RTB website and you have to give 90days notice of the increase.

You have to inform RTB of changes in rent and if your tenant has left. You have to give a copy of the notice to leave to RTB a month after the leave date. Make sure you dot your eyes and dot your tee's.

Be very careful with your plans. In order to bring up to market rent you either take it off the market for 2 years and then let. Do short term letting in the mean time. If you chance increasing the rent and the current tenant finds our (previous tenant arrives at the door) you will have to pay back the difference and could be given a fine.

If your tenants are coming to the end of a 4 or 6year cycle you can I think can still give notice that you will not be renewing the lease for a further part 4.

citizens information

"Preventing a further Part 4 tenancy

If your landlord wants to stop a further Part 4 tenancy from coming into existence, they can serve a notice during the original Part 4 tenancy, with the notice period expiring on or after the end of the tenancy. A notice served in this way should provide a reason for termination. The reason does not need to be one of the valid grounds for terminating a Part 4 tenancy."

You have a template on RTB site but make sure you tell your tenant you are not renewing the tenancy and give them the notice period. I was told to fill the forms in before the end of the cycle and the give the 220days or what ever days notice they are due in notice.

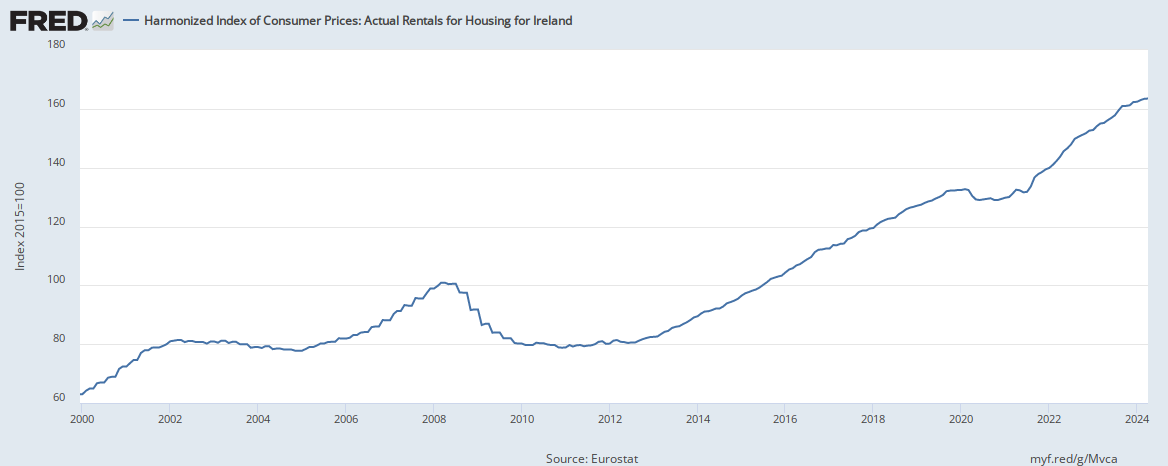

I've spent 25 years renting, and much as I get what you mean (I am one of luck ones who took out a lease in 2012 so rent heavily capped), if there wasn't small landlords, I would be living in my parents boxroom at nearly 50This graph tells you all you need to know about the outrageous rent increases.

Compared to salary development, we should sit about index=112 this year instead 140, and that's being generous already.

Poor landlords and their hardship of RPZ being imposed.

2008 to 2011 rents "only" dropped 20% in one of the worst ever economic downturns to ever occur in a developed economy. Since then they are up 75%.

20% would not bring the OP back to market levels.

Yes, but this isn't the inflation in the total actual rents charged in the rental market.

This just tracks the rents asked foron the properties that are offered for rent in that year. This will include a far higher proportion of new build and upgraded properties offered for rent (versus the whole rental stock) , and therefore will not reflect the overall increase (or decrease) in the overall market at all.

E.g. a particular rental property's rent has not gone up by 75% since 2011. It may have gone up by something like 50% , with the rest of the recorded increases in stats like yours attributable to asked for rents for newer, higher spec, better properties, offered for rent each year.

P.s. so at a guesstimate, a pre existing property's rent from 2011, has probably very closely tracked the increase in the salary index imho. And if you think about it, that makes common sense too.

So ,newer, better, higher rated (e.g. A) properties, etc will command a premium in the offered rental market each year.

P.p.s. now the government are deliberately forcing landlords to only put up their rents, a full 7% below inflation in 2022. That's just plain wrong imho.

Last edited:

PebbleBeach2020

Registered User

- Messages

- 635

for landlords with properties far below market rate, they must consider the option of leaving the property vacant for 2 years and then put the property back for rent at market rate.

a landlord with a property at say 1200 euro a month but market rate is 2000 euro a month will be tied into 2% annual increases at the most for the next few years at a minimum, possibly indefinitely. By leaving a property empty for 2 years, they forego €28,800 in rental income. It would take them three years approximately to make up the difference in income. Therefore, over 5 years, they would be in a far better position in terms of rental income as well as not having their property devalued potentially if they were to sell it, as a result of having rent far lower than market rent.

For someone intending to remain in the rental sector for the next 5 years at a minimum, someone who is 30+ % lower than market rent should seriously consider this as an option. This would have very serious consequences for current renters as well as the government.

The current treatment of landlords is very unfair. Landlords and tenants should both be part of the solution.

a landlord with a property at say 1200 euro a month but market rate is 2000 euro a month will be tied into 2% annual increases at the most for the next few years at a minimum, possibly indefinitely. By leaving a property empty for 2 years, they forego €28,800 in rental income. It would take them three years approximately to make up the difference in income. Therefore, over 5 years, they would be in a far better position in terms of rental income as well as not having their property devalued potentially if they were to sell it, as a result of having rent far lower than market rent.

For someone intending to remain in the rental sector for the next 5 years at a minimum, someone who is 30+ % lower than market rent should seriously consider this as an option. This would have very serious consequences for current renters as well as the government.

The current treatment of landlords is very unfair. Landlords and tenants should both be part of the solution.