Edit - this is an old thread - the new one can be found here: https://www.askaboutmoney.com/threads/the-single-public-service-pension-scheme.236839/

Last edited:

Thanks for this Ent. As someone who joined the PS in 2018 and will be 65 all too soon I am extremely interested. Are there advisers out there who are knowledgable about this.

Average weekly earnings in the public sector (excluding overtime) are up 13% 2008Q3 to 2021Q3. That's as long as the series goes back. Comparable private sector earnings increased 19%.It'd be interesting to know whether public sector workers wages have kept up (or surpassed inflation?) and whether these trends are likely to continue in the future.

The 2009 pension levy was not recorded as a "pay cut" by the CSO believe it or not!Interesting. I wonder how much of the disparity between public sector wage growth and CPI in the period can be attributed to public sector pay cuts in the aftermath of the 2008 crisis and deflation as a direct consequence of same?

That's true for the last six months but I doubt it in future.But as more members retire on SPSS into the future, having no max inflation cap could be extremely costly in the future.

I don't think so. Uprating for people under the old scheme is determined by the wages paid to people in equivalent grades who are currently working.So the SPSS is inflation linked. My wife has time under the old scheme as a nurse. Is the old scheme eligible for inflation increases too ?

This was true in the past but may not always be the case. The war in the Ukraine's showed how fragile global supply chains are and the impact this can have on inflation. Also, maybe as single scheme members become the majority in unions they'll negotiate better deals for single scheme members (e.g. via bonuses, which may not count as salary and may not lead to uprating for old scheme members!)That's true for the last six months but I doubt it in future.

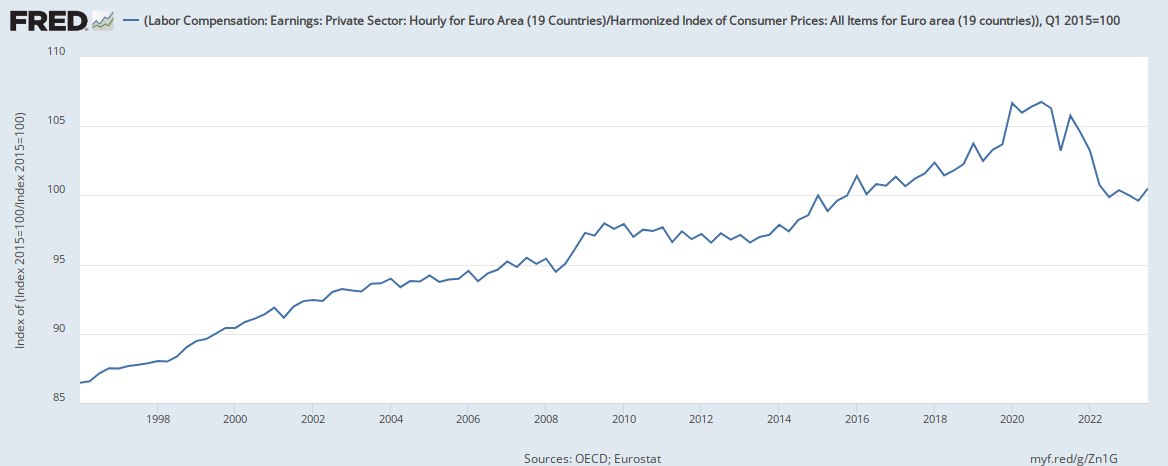

Over the long term public sector wages have increased above inflation. The de facto linkage of pre-SPSS pensions to wages means that in general pensioners will do better than SPSS pensions to inflation.

This is my take, yes. That pension will grow tax free for decades. If it's in a good fund it could grow at 8%.To summarise, if you join the public service and have an existing private pension, generally it seems the better option to maintain that private pension (with no further contributions) until close to retirement and then decide whether it is worthwhile purchasing Single Scheme benefits?

Are there any particular requirements if one wants to make AVCs while part of the single scheme? Can you use any AVC provider?

I simply do not believe that over the course of decades that public sector wages will increase at a rate below inflation.This was true in the past but may not always be the case.

You're right it's probably a safer bet and if I had the choice I'd probably choose the same. Inflation linking is very valuable though and who's to say how things will work out.If I had a choice at 65 between wage-linked and inflation-linked retirement income I would take the former.