Please tell me that this is NOT a verbatim quote from Raisin’s reply to you ????The information you saw on the Younited might be referring to any amount of money above 100,000 euro. The French Deposit Guarantee Scheme appears to be from 2022, so it might have been a change within the last year.

-

We are switching servers on Monday at 1 pm so Askaboutmoney will be unavailable for a few hours Click here for more information

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Those with deposits in Raisin, Lightyear - anything to report, issues, all good, etc?

- Thread starter BrokeBroker

- Start date

Yes and Yes, why do you ask?Just out of curiosity, do you have a deposit with YouNited or other partner bank on Raisin?

BrokeBroker

Registered User

- Messages

- 254

Please tell me that this is NOT a verbatim quote from Raisin’s reply to you ????

Did they faux pas?

BrokeBroker

Registered User

- Messages

- 254

Yes and Yes, why do you ask?

Just curious whether you were essentially, "putting your money where you assertions were", per se.

BrokeBroker

Registered User

- Messages

- 254

But the part on 0 euro having been lost, that's correct?Where are you quoting from?

It's factually incorrect. A common €100k was only introduced in 2010.

Deposit guarantee schemes

EU legislation protects deposits in case of bank failure.finance.ec.europa.eu

The amount, 100k etc., that's a fudge, not a concern.

Their contention that deposits are covered and the integrity of the DGS, this idea of harmonizing it across Europe, they're the questions I'm looking for unambiguous answers on.

While there were steps to harmonize schemes from 1994 they were different to what we have now.

It was only in the run up to the financial crisis that Ireland increased its limit to 100k before this you were covered for 90% of your deposits up to €20k.

Ireland raises state guarantee on Irish deposits

Ireland's finance minister Brian Lenihan said on Saturday the government had raised the state guarantee limit on Irish deposits to 100,000 euros (78,700 pounds) from 20,000 euros previously.www.reuters.com

BrokeBroker

Registered User

- Messages

- 254

That's the response Raisin sent you?!

YouNited Credit (one of the trading names of YouNited S.A.) do NOT offer deposits directly to the market. The product they offer directly to market, and mentioned on their website, is not a deposit, and is not covered by deposit guarantee.

They only offer deposits through intermediaries, such as Raisin.

YouNited has been one of Raisin's partners in Ireland since January 2020. Nothing changed their licence during 2022.

So, Raisin are a bunch of hacks/incompetents?

What should we conclude from their position on these questions?

Just to be clear, I never said they were hacks / incompetents. If you have an issue, you should report them to their regulator.So, Raisin are a bunch of hacks/incompetents?

What should we conclude from their position on these questions?

A customer service agent responded to your email without fully investigating the background. But the deposits are covered by the French deposit guarantee scheme which I think was the essence of your query - they should have stopped the reply there as that's the only part that is fact.

Last edited:

I'd be very surprised if there was a case anywhere in Europe of an eligible deposit not being fully paid out. Governments have spend billions ensuring that "€0" stays at 0. The last thing any governments wants is a widespread bank run which would be very like in the event people thought their few bob was at risk.But the part on 0 euro having been lost, that's correct?

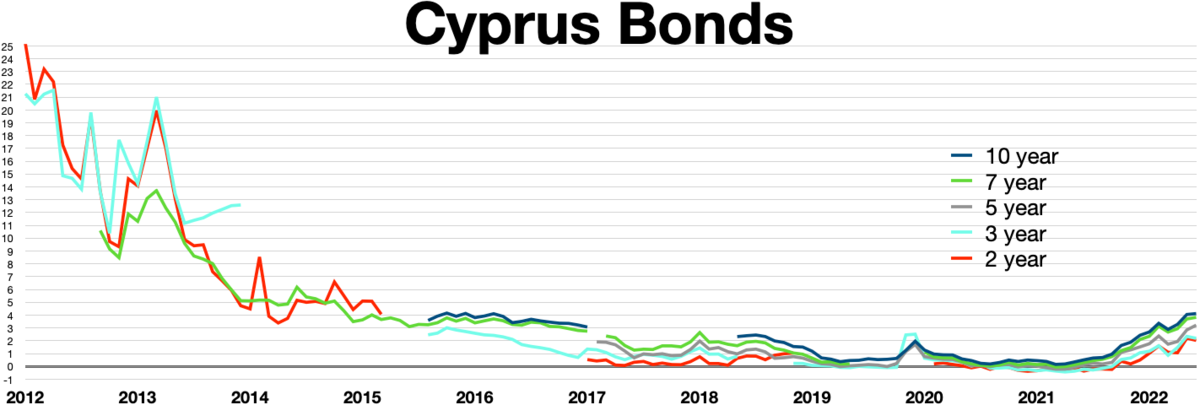

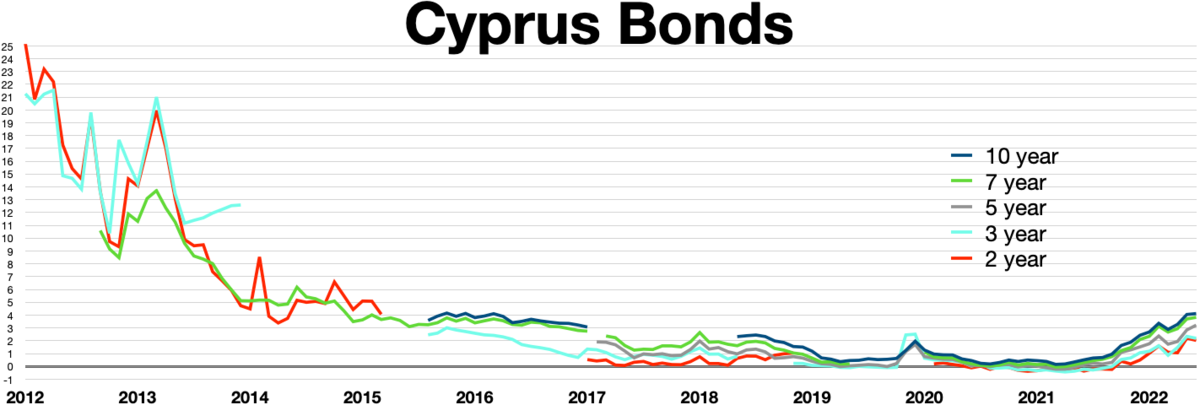

That's not to say high value depositors won't pay a price. It has happened in the past.

2012–2013 Cypriot financial crisis - Wikipedia

But raisins lack of understanding of the subject matter might be.The amount, 100k etc., that's a fudge, not a concern.

That would be the point of the 2014 directive in the link I posted. There is no ambiguity that eligible deposits held in an EU licenced bank are covered. The issue as I see it on the latter part of this thread is figuring out if the deposits are ultimately held with an EU bank or some other entity.Their contention that deposits are covered and the integrity of the DGS, this idea of harmonizing it across Europe, they're the questions I'm looking for unambiguous answers on.

Last edited:

BrokeBroker

Registered User

- Messages

- 254

I'd be very surprised if there was a case anywhere in Europe of an eligible deposit not being fully paid out. Governments have spend billions ensuring that "€0" stays at 0. The last thing any governments wants is a widespread bank run which would be very like in the event people thought their few bob was at risk.

That's not to say high value depositors won't pay a price. It has happened in the past.

2012–2013 Cypriot financial crisis - Wikipedia

en.m.wikipedia.org

Without knowing or looking at the specifics, "high value" would suggest, above the 100 k limit, presumably?

Could be...... but lots of depositors on this forum seem happy enough regardless?But raisins lack of understanding of the subject matter might be.

They don't seem to be losing sleep at least over this possibility the DGS assurance could be a red herring?

That would be the point of the 2014 directive in the link I posted. There is no ambiguity that eligible deposits held in an EU licenced bank are covered. The issue as I see it on the latter part of this thread is figuring out if the deposits are ultimately held with an EU bank or some other entity.

There's a suggestion here that some Raisin partner banks aren't what they claim and funds could, in the event of insolvency, be in jeopardy, despite claims from the brokerage to the contrary.

Given the links and French DGS pages listed on Raisin, assuming you have funds with YouNited, you clearly feel confident they are in fact as they claim and covered by the EU wide fail-safe?

BrokeBroker

Registered User

- Messages

- 254

Inquiry:

Can we eventually put this to bed?

YouNited is unquestionably covered by the fDGS in line with European directives, and your deposits are covered up to 100 large, and subject to all assurances in line with the European harmonized DGS?

@Freelance @skrooge ........thoughts?

Response from: contact@garantiedesdepots.frhttps://www.garantiedesdepots.fr/si...eoBanques_Fintech_GarantieFGDR_2022_03_02.pdf

As per this link, the institution YouNited is listed under the title "Not covered by the French DGS".

Dear Sir ,

This is a mistake , Younited Credit is membership of the FGDR . The modification of our website is underway .

Best Regards,

Can we eventually put this to bed?

YouNited is unquestionably covered by the fDGS in line with European directives, and your deposits are covered up to 100 large, and subject to all assurances in line with the European harmonized DGS?

@Freelance @skrooge ........thoughts?

RaisinBankIE

New Member

- Messages

- 1

Hi All,

We would like to comment on a few of the points raised in this forum and hopefully provide a bit of clarification.

If you have any further queries please get in touch by emailing us at service@raisin.ie

Thank you,

Raisin Bank Ireland team

We would like to comment on a few of the points raised in this forum and hopefully provide a bit of clarification.

- Two-factor authentication: Raisin bank offers Two-Factor Authentication (2FA) linked to your mobile phone for all transactions. Please see more information by visiting the FAQ section of the Raisin Bank Ireland website (Raisin.ie > Help > FAQs > Online Banking > What is an mTan?)

- Country Ratings: The ratings listed on our product offerings page are taken from S&P’s analysis of the countries where our partner banks are domiciled. They are not bank specific ratings. The analysis considers institutional and governance effectiveness, economic structure, growth prospects, external finances, and fiscal and monetary policy of the country.

- Withholding tax: To avoid double taxation between Ireland and the European country where you deposit your funds, it will generally be necessary to send Raisin a Letter of Residence confirming your tax residency in Ireland. Please read more information about how to avoid double taxation by visiting the FAQ section of our website (Raisin.ie > Help > FAQs > Taxation > Double taxation). For further information on taxation of the products you order via Raisin Bank, please refer to the information page about taxes on our website (Raisin.ie > Information > Tax Guide) or by visiting Revenue's online service.

- Deposit Guarantee Scheme: We would like to make it abundantly clear that all Partner Banks offering savings accounts via Raisin Bank, are members of their respective Deposit Guarantee Scheme, therefore your deposits are secured up to €100,000 per customer, per bank. It is for this reason that we allow a maximum deposit amount of €100,000 for any deposit account a customer opens with our Partner Banks via Raisin Bank. For further information about the Deposit Guarantee Schemes in the European Union, please visit our information page on the Deposit Guarantee Scheme (Raisin.ie > Information > Deposit protection) and our FAQ section on this topic on the Raisin Bank Ireland website (Raisin.ie > Help > FAQs > Deposit Guarantee Schemes).

If you have any further queries please get in touch by emailing us at service@raisin.ie

Thank you,

Raisin Bank Ireland team

Very good, if the FGDR clear up the ambiguity thats on their website it would stop all the second guessing. An email from them is a good start. They were the only ones who could clarify the situation. Thanks for contacting them -or rather congratulations on getting a response. I filled in an online form but never heard anything back.Inquiry:

Response from: contact@garantiedesdepots.fr

Can we eventually put this to bed?

YouNited is unquestionably covered by the fDGS in line with European directives, and your deposits are covered up to 100 large, and subject to all assurances in line with the European harmonized DGS?

@Freelance @skrooge ........thoughts?

YOUNITED offer very good rates but if they were not covered by the same safeguards as other deposit providers the marginally better rate would have to be looked at in a different light.

I use both Lightyear & TR. Very impressed with both. Lightyear reminds me of revolut.

TR after the first deposit to keep it no fees you need to do a SEPA trasfer but LY is no fee & instant via the likes revolut.

The referral option is excellent which gives both parties free €10 stock option.

TR after the first deposit to keep it no fees you need to do a SEPA trasfer but LY is no fee & instant via the likes revolut.

The referral option is excellent which gives both parties free €10 stock option.

BrokeBroker

Registered User

- Messages

- 254

Do you have a deposit with Raisin/YouNited at the moment?YOUNITED offer very good rates but if they were not covered by the same safeguards as other deposit providers the marginally better rate would have to be looked at in a different light.

Just curious whether you've plunge, basically.

BrokeBroker

Registered User

- Messages

- 254

Looking at the T&C's for YouNited:

This probably isn't a major issue for many, but still.

Say you were on vacation, not routinely checking your account or the state of French credit institutions and missed your 7 day window?

(4) ReimbursementThe responsible Deposit Guarantee Scheme is Fonds de garantie des dépôts et de résolution (FGDR), 65 rue de la Victoire, 75009Paris, France, Tel: +33 0158 18 38 08, E-Mail: contact@garantiedesdepots.fr. It will repay your deposits (up to EUR 100 000) within 7working days. If you have not been repaid within these deadlines, you should contact the Deposit Guarantee Scheme since the time to claimreimbursement may be barred after a certain time limit. Further information can be obtained under https://www.garantiedesdepots.fr/en.

This probably isn't a major issue for many, but still.

Say you were on vacation, not routinely checking your account or the state of French credit institutions and missed your 7 day window?

Its not a 7 day window ti dispute, it's 2 months in France.Say you were on vacation, not routinely checking your account or the state of French credit institutions and missed your 7 day window?

7 days is the maximum time within which compensation should be automatically paid out.

You seem to be misreading this as the time limit for claims to be made (as opposed to being paid) being 7 days.Say you were on vacation, not routinely checking your account or the state of French credit institutions and missed your 7 day window?

To be honest, since you seem to have so many concerns about many of these online offerings and don't seem reassured by the info/clarifications that others are posting, maybe you should stick to Irish bricks and mortar banks? After all, every investment needs to pass each individual's "sleep test" even if it involves an opportunity cost in terms of potential returns foregone...

https://www.nasdaq.com/articles/does-your-financial-plan-pass-sleep-test-2015-11-03

Just so long as it doesn't involve cheques...maybe you should stick to Irish bricks and mortar banks?

BrokeBroker

Registered User

- Messages

- 254

I don't really like this one either:

In other words, if you get hacked or there's some kind of electronic faux-pas, not their problem?

9.2 The Bank shall not be responsible for damages or lost profits due to inaccuracies, errors ordelays in the transfer of information and/or documents due to force majeure, technical,communication or other causes beyond the control of the Bank, as well as in cases where theBank has acted to fulfill a legal obligation under the existing Irish law or European Union law. TheClient has been informed in advance and accepts the risks associated with the transmission ofdata in the internet environment, with the possibility of unauthorized access or technical failures inthe transmission of data and information over the internet.

In other words, if you get hacked or there's some kind of electronic faux-pas, not their problem?

Last edited:

BrokeBroker

Registered User

- Messages

- 254

You seem to be misreading this as the time limit for claims to be made (as opposed to being paid) being 7 days.

To be honest, since you seem to have so many concerns about many of these online offerings and don't seem reassured by the info/clarifications that others are posting, maybe you should stick to Irish bricks and mortar banks? After all, every investment needs to pass each individual's "sleep test" even if it involves an opportunity cost in terms of potential returns foregone...

https://www.nasdaq.com/articles/does-your-financial-plan-pass-sleep-test-2015-11-03

Don't think I haven't thought about it.

OR - now check this out - I could just cover every possibility in relation to (potentially slightly more risk bearing) foreign deposit opportunities, and proceed with unequivocal confidence as to what I'm getting into;

Thereby, reaping the benefits of "potential returns".

Besides which, "not reassured by the info/clarification of others"?

What clarification was that?

If you're referring to the unequivocal assurance that institutions like YouNited are covered under the fDGS, well, that assurance came from the fDGS themselves...... not another contributor on this site.

And it's assurances like that I consider more "iron clad", and iron-clad is what I need when it comes to my life savings and the future that's dependent on them.