Or to put it another way, can index tracking become so prevalent, that it will fail?

I think I first read about passive investing and using index trackers about 15 or 20 years ago. They were not very popular then. But they have been growing in popularity.

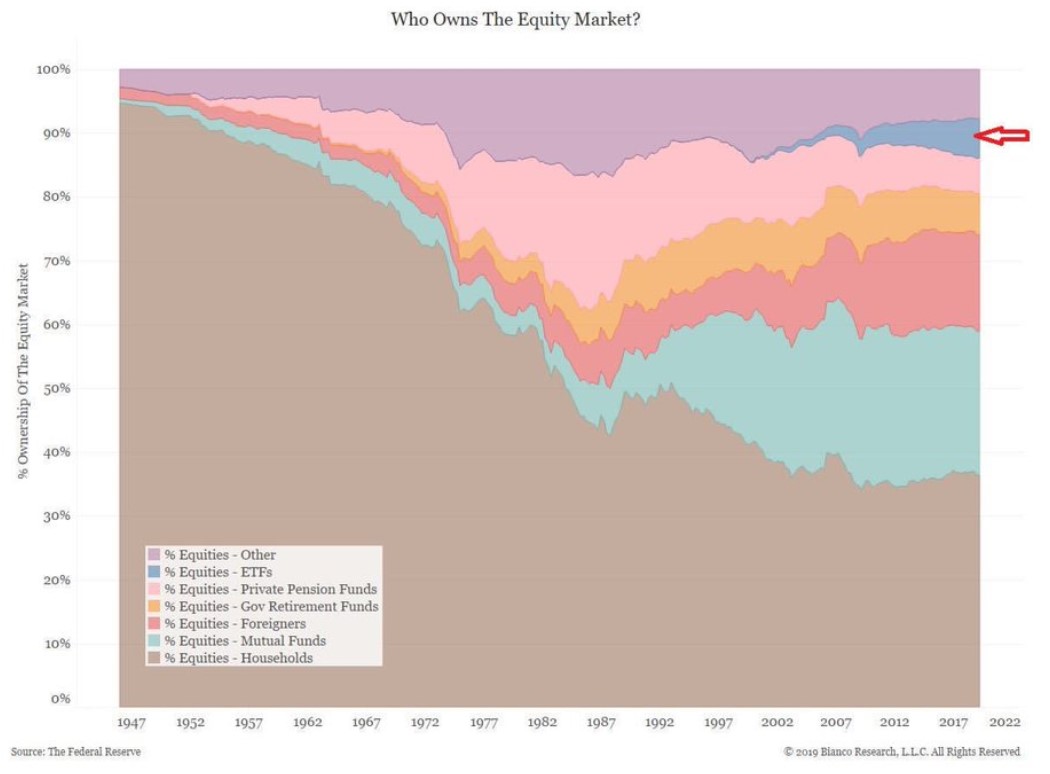

Today a very significant amount of new money invested in the market is money that is 'blindly' invested in shares via index trackers.

Is there a tipping point after which this will fail as a strategy for reliably getting top percentile returns?

We effectively rely on a wisdom of the crowd effect to price shares correctly and to reflect all known information. But if there is no crowd exercising their wisdom....e.g. if most actions of the crowd is just buying and selling based on being in an accumulation or distribution stage of their life, or because a company is added or removed from an index, or due to an emotional response to the world/market, how we ensure individual stocks are fairly priced?

If 100% of all new money invested in the stock market was blindly following index trackers, I would expect this to result in running up the price/valuation of companies that were listed in the major trackers, and result in companies that are not listed on the major index tackers being better value.

Wouldn't this depress future returns for index trackers?

For the record, I have been index tracking, and plan to continue to do so, but this question weighs more heavily in my mind, partially due to the shoeshine boy concern, as more and more people I talk to already know that you should just buy and hold a passive tracker.

I think I first read about passive investing and using index trackers about 15 or 20 years ago. They were not very popular then. But they have been growing in popularity.

Today a very significant amount of new money invested in the market is money that is 'blindly' invested in shares via index trackers.

Is there a tipping point after which this will fail as a strategy for reliably getting top percentile returns?

We effectively rely on a wisdom of the crowd effect to price shares correctly and to reflect all known information. But if there is no crowd exercising their wisdom....e.g. if most actions of the crowd is just buying and selling based on being in an accumulation or distribution stage of their life, or because a company is added or removed from an index, or due to an emotional response to the world/market, how we ensure individual stocks are fairly priced?

If 100% of all new money invested in the stock market was blindly following index trackers, I would expect this to result in running up the price/valuation of companies that were listed in the major trackers, and result in companies that are not listed on the major index tackers being better value.

Wouldn't this depress future returns for index trackers?

For the record, I have been index tracking, and plan to continue to do so, but this question weighs more heavily in my mind, partially due to the shoeshine boy concern, as more and more people I talk to already know that you should just buy and hold a passive tracker.

Last edited: