Brendan Burgess

Founder

- Messages

- 55,509

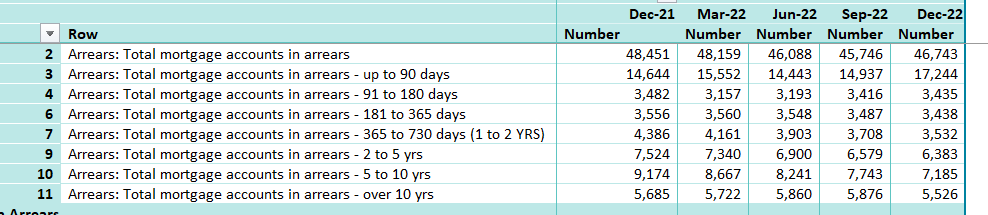

The Central Bank issued their arrears report for December 2022 last week.

I would be very concerned that the arrears up to 90 days has increased quite significantly.

This presumably is due to the increase in interest rates and increases in the cost of living generally.

Brendan

I would be very concerned that the arrears up to 90 days has increased quite significantly.

This presumably is due to the increase in interest rates and increases in the cost of living generally.

Brendan