Gordon Gekko

Registered User

- Messages

- 7,936

What is the Standard Fund Threshold? In summary, it's the €2m cap placed on the public or private sector pension benefits that an individual can accumulate in Ireland over his or her lifetime.

If the individual breaches the SFT, at the point the offending pension benefits are retired, he or she is subject to a penalty tax (Chargeable Excess Tax) on the surplus amount.

The issue I'd like to focus on is how individuals should plan their investments in the context of the SFT.

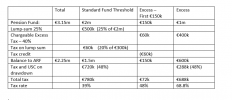

Breaching the SFT isn't a particularly attractive proposition (or is it; we'll come to that later). Say your benefits are worth €3m; the State rides in and grabs 40% of your €1m excess (€400k). You then get your lump sum (€500k, net €440k), with the balance (€2.1m) moving into your ARF/AMRF.

(I've restricted the discussion to DC schemes and ignored the annuity route.)

The €1m excess is therefore taxed once at 40% and then taxed again as it is withdrawn from the ARF. People often talk about an effective rate of 70%, although I have reservations about the logic of that.

It therefore creates a conundrum for a person who cannot access his/her benefits and who will breach €2m/€2.15m (a quirk effectively makes the cap €2.15m but for the purposes of the discussion, let's call it €2m).

So what should that person do?

- Aim to breach €2m in the hope that the SFT rises?

- Aim to get to €2m and then switch to cash because the risk/reward is so unattractive?

- Aim to breach €2m, convert €2m to cash and take high risk/high payoff bets with any excess?

- Grow their pension without a care in the world, because (using the €1m example) a €400k penalty is fair value for having €600k invested in a tax-free environment for circa 30 years.

It's an interesting topic in my view.

If the individual breaches the SFT, at the point the offending pension benefits are retired, he or she is subject to a penalty tax (Chargeable Excess Tax) on the surplus amount.

The issue I'd like to focus on is how individuals should plan their investments in the context of the SFT.

Breaching the SFT isn't a particularly attractive proposition (or is it; we'll come to that later). Say your benefits are worth €3m; the State rides in and grabs 40% of your €1m excess (€400k). You then get your lump sum (€500k, net €440k), with the balance (€2.1m) moving into your ARF/AMRF.

(I've restricted the discussion to DC schemes and ignored the annuity route.)

The €1m excess is therefore taxed once at 40% and then taxed again as it is withdrawn from the ARF. People often talk about an effective rate of 70%, although I have reservations about the logic of that.

It therefore creates a conundrum for a person who cannot access his/her benefits and who will breach €2m/€2.15m (a quirk effectively makes the cap €2.15m but for the purposes of the discussion, let's call it €2m).

So what should that person do?

- Aim to breach €2m in the hope that the SFT rises?

- Aim to get to €2m and then switch to cash because the risk/reward is so unattractive?

- Aim to breach €2m, convert €2m to cash and take high risk/high payoff bets with any excess?

- Grow their pension without a care in the world, because (using the €1m example) a €400k penalty is fair value for having €600k invested in a tax-free environment for circa 30 years.

It's an interesting topic in my view.