Brendan Burgess

Founder

- Messages

- 55,348

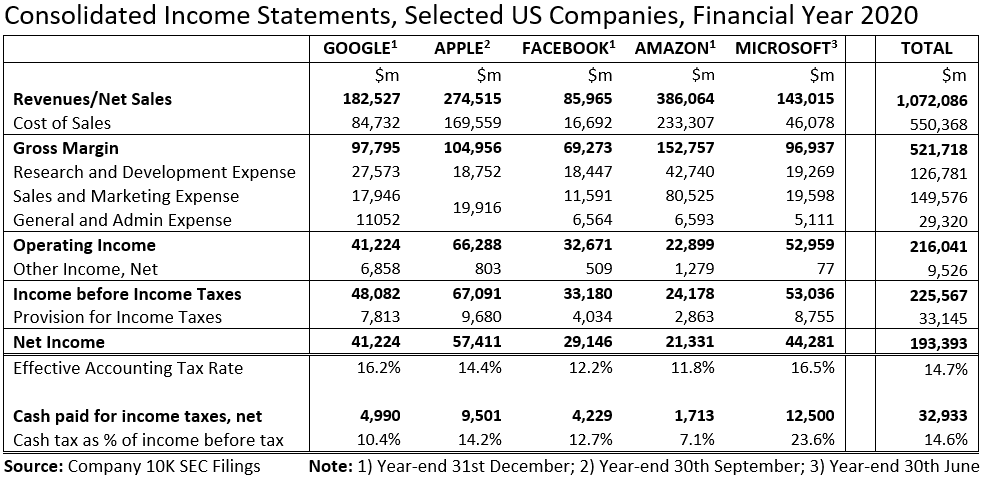

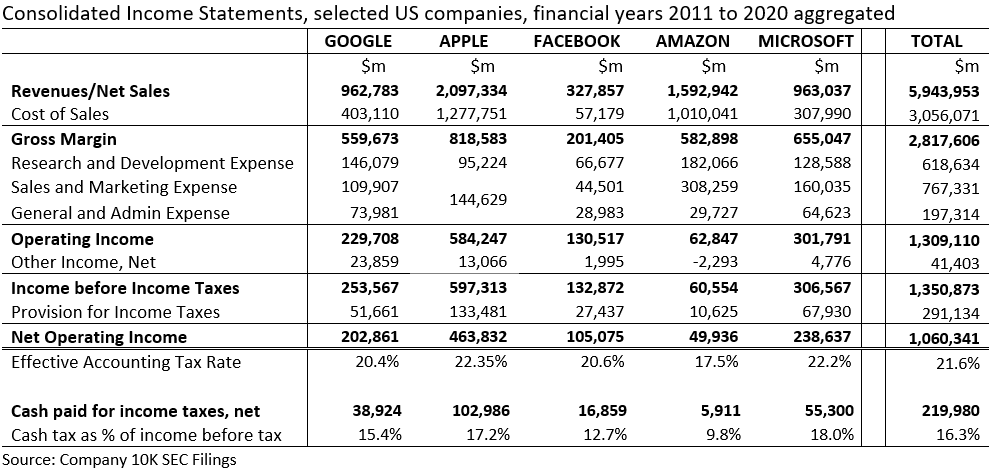

First of all, from a global perspective, it seems right to say to the likes of Google and Amazon that they should pay at least 15% of their profits in Corporation Tax somewhere in the World.

It would be good for the citizens of the World if that came to pass.

If so, then Ireland should not stand in the way of implementing that.

Imagine if you had different income tax rates in the different counties in Ireland. And Kerry brought in a maximum income tax rate of 10% as long as you owned a house there. We would all shift our income to Kerry.

Brendan

It would be good for the citizens of the World if that came to pass.

If so, then Ireland should not stand in the way of implementing that.

Imagine if you had different income tax rates in the different counties in Ireland. And Kerry brought in a maximum income tax rate of 10% as long as you owned a house there. We would all shift our income to Kerry.

Brendan