To keep the maths simple I’m going to assume a 100% equity allocation and a €1m pension fund.

back in 2008 global equities dropped 40% and in March last year almost the same

so that’s a €400k downside from a higher risk strategy

what’s the upside

lets assume a 10% pa return

so you are adding at a rate of €100kpa but losing at a rate of potentially 4 times that.

if the market drops like it did in 2008 you could easily be down to €600k. Now your 10%pa return is only worth €60k pa to you and it will take a long time to recover back to your €1m and that’s especially true if you NEED to keep your income the same as before (See later post on volatility drag)

In principle you could have achieved a €60kpa return from a less risky portfolio say a 60%equity 40%bond mix. That would have also served you better in a bad year. A well-constructed balanced portfolio was down around 20% in 2008 whereas the market was down 40%.

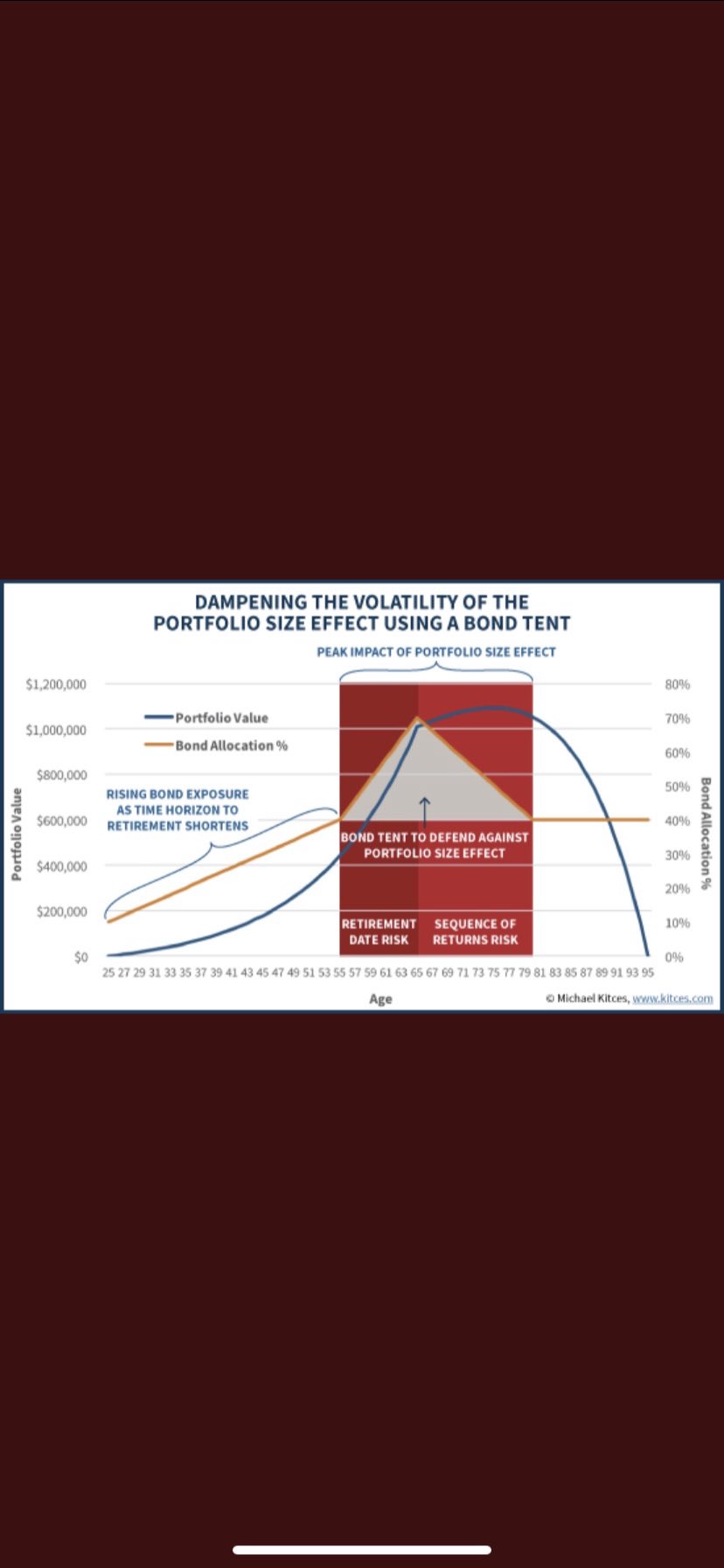

as you get closer to retirement the drops hurt more than the gains so de risking makes sense

to a point. Note I’m not suggesting selling everything and going to cash here.

This is absolutely critical once you start to draw on the fund a big drop hurts even more known as “sequence of return risk” so the strategy we advise is to reduce risk either side of the planned retirement date

as set out in our guide to planning for retirement below

[broken link removed]

You should definitely seek independent advice and not the advice of the company administering the scheme.

a good adviser will pursue an asset location strategy which seeks to maximise the after tax returns from different asset classes.

you need to make sure you have sources of taxable income to make full use of your allowances between now and age 60.

if you don’t then drawing on the pension earlier might make more sense, if you do then deferring might make more sense.

a lot of this turns on your overall financial position which you haven’t disclosed.

because tax is so ridiculous in Ireland this means turning the approach on its head compared to other jurisdictions which is why you can’t use a US or U.K. website to inform your decisions

I set out below a working example of a prudently diversified ARF account going through the fall of March last year with no interruptions in income payments and just as importantly, no break down in investor composure.

And the asset allocation that generated these returns

Remember that the objective for an ARF should be to maintain the income payments to the investor for the whole of the rest of their life however long they might live, preferably in real terms allowing for inflation and generate an income which overall is at least as good as the annuity that they could have purchased at outset.

Why an Annuity matters to an ARF investor How should one approach investing an ARF? As we set out in our [broken link removed] for retirement planning in Ireland, an investor’s risk tolerance is only one of several factors that go into the decision to go into an ARF. A far more appropriate...

www.askaboutmoney.com

For most people, the goal is

NOT to maximise the potential inheritance for the next generation at the expense of one's own financial security.

More people invest in an Approved Retirement Fund (ARF), over the certainty of an annuity. But do you need to review your ARF strategy?

globalwealth.ie

As you can see from that post

we are not against investing in equities in an ARF far from it, many of the accounts we review are excessively conservative and our recommendation is generally to have more than 50% Equities in an ARF.

We are able to limit total equity exposure by over weighting stocks with higher expected returns such as high beta stocks, generally smaller companies, and stocks with high book to market or "value" stocks.

We're advocates of low-cost investing. However, an obsession with the lowest cost option isn't always in investors' best interests.

globalwealth.ie

However, later in this thread is an assertion that a 100% equity strategy might be suitable and/or appropriate and to make matters worse the investments are in fact just 12 companies rather than an index fund which is frankly completely insane and significantly increases the risk far beyond the risk capacity of the vast majority of private investors.

We would consider such an approach to be reckless and therefore all subsequent debate on the matter irrelevant to the average investor in Ireland.

By way of an example using the US Market for the period January 1929 to December 1938

The annualised return of the US Market over this period was -0.89%pa a total return of -8.52%

However, the cumulative return to the end of 1932 was -64.22% that's losing 22.66%pa for 4 years.

That means a million invested at the start of 1929 was worth around 360,000 by the end of 1932!!

You would need a return of 278% just to get back to where you started just 4 years earlier.

To avoid a drop in income you would need to continue to take €40,000pa from the depleted pension fund making the annualised withdrawal now an unsustainable 11%pa.

I set out below several arguments why including an allocation to fixed interest or bonds makes sense for most if not all retirees with an ARF. In some posts this has been corrupted into a position of why would you hold 100% in cash? You wouldn’t of course; and that’s not what I’m arguing at all.

However, as is all too common on here the debate quickly descends into mud slinging.

I am blocking a large number of posters so don’t be surprised if many subsequent posts go unanswered, I’m ignoring them and so should you.

“Ignorance more frequently begets confidence than does knowledge: it is those who know little, and not those who know much, who so positively assert that this or that problem will never be solved by science.” Charles Darwin

Joomag digital interactive publication

joom.ag

[broken link removed]