tommyryan55

Registered User

- Messages

- 64

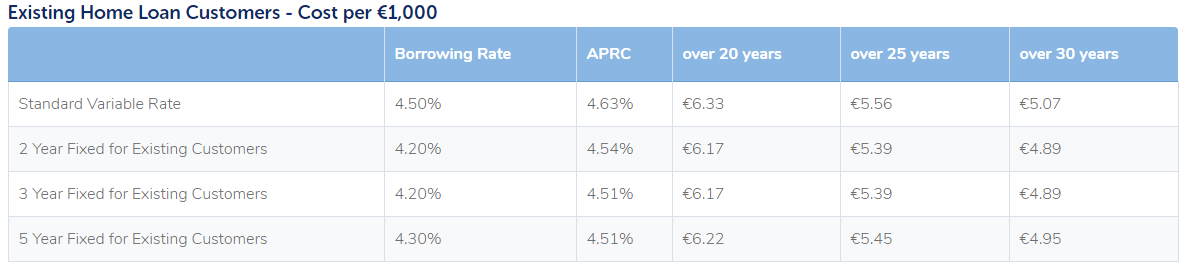

PTSB have are now offering fixed rates to existing customer's, LTV not accounted for, at certain points there is a 1% difference between the fixed rates been offered to new customers versus existing customers.

I sometimes get very cross about it, but will keep pushing to get a change.

Nothing will change at Prison TSB. I can change my own circumstances but not PTSB. They made their bed a long time ago, and they can't get out of it now. I feel that I, and many others like me, are being trapped by other institutions who are mercifully-maintaining the life-support of PTSB customers who got mortgages at the height of the madness, but not attempting to pick over the carcass of this once-friendly society. We worked hard and sacrificed to keep our homes, faithfully paid, but are now trapped with a rate of penury....Hi Joe

It will be one of the issues I will raise at the AGM later this morning. It's a pity that a few customers don't come along and express their rage.

Brendan

Not immediately. CPC is that they must inform you at least once a year.Also isnt the bank meant to inform you when they have new rates or of better rate.

Is this a break fee for exiting your current fixed rate?PTSB looking for €100 to move to the new fixed rate, is this the norm?

Is this a break fee for exiting your current fixed rate?

Then they've no basis to charge you for fixing. Unless they need a new valuation? How did they explain it?Not all all, currently on their SVR of 4.5%

Then they've no basis to charge you for fixing. Unless they need a new valuation? How did they explain it?