Hi Folks, I current pay into a pension via my day job PAYE employment. I pay 5% of my salary matched by 5% from my employer, its with Irish life.... I was a bit of a late starter to the pension game and the current value of both is €32k (im 44 years of age). I understand the projections are to be taken with a pinch of salt but would it be ill advised to increase the risk rating on one pensio to high for a number of years as it appears ill have very little to loose?

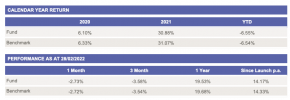

Hey Bonzos, I would echo Protocol above, given that you have 20+ years to retirement and a relatively modest starting position you should consider 100% equities. I would recommend Irish Life Indexed World Equity fund. You should also seriously consider upping your contribution from 5%. At 44 you can contribute up to 25% of you salary, and you should get as close to that as you can afford to.