I will be 60 this year . HSE part time 10.5 hrs per week . I checked out my record and subsequently given option and bought back years I spent early in career in voluntary hospitals. Took 3 years out 1996-98 ( new baby!) . I don’t intend retiring till standard retirement age and due to my part time employment I’m sure my pension won’t be much. I am a bit confused about the A and D stamps. Is there anything I could for next few years to maximise my entitlement ? I don’t know how taking 3 years out of employment for child minding will have effected my end pension. Any advice please? Thanks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Part time HSE . A & D stamps

- Thread starter Xraylady

- Start date

Have you checked if you might be entitled to PRSI credits for this period under the Homemaker's Scheme:Took 3 years out 1996-98 ( new baby!) .

Homemaker’s Scheme

A homemaker, under the scheme, is someone who provides full-time care for a child under 12 or an ill or disabled person over 12. It makes it easier to qualify for a higher State Pension Contributory.

The different PRSI contribution classes are explained here:I am a bit confused about the A and D stamps.

PRSI - Pay Related Social Insurance

At some stage voluntary contributions may become option:Is there anything I could for next few years to maximise my entitlement ?

Voluntary social insurance contributions

Voluntary social insurance contributions can help you qualify for a social insurance payment in the future. Find out more about making voluntary contributions.

You might want to clarify what your entitlements are or are likely to be on those two fronts.

You seem to have a mix of class A, D, K and S contributions. Are the K/S contributions related to some sort of self employment including property rental income?

Do you have any additional private pension cover/savings such as a PRSA?

Last edited:

NoRegretsCoyote

Registered User

- Messages

- 5,766

Almost certainly. Try to get this clarified before you reach retirement age.Have you checked if you might be entitled to PRSI credits for this period under the Homemaker's Scheme:

Homemaker’s Scheme

A homemaker, under the scheme, is someone who provides full-time care for a child under 12 or an ill or disabled person over 12. It makes it easier to qualify for a higher State Pension Contributory.www.gov.ie

The mix of Class A and Class D insurance may qualify you for a mixed pension if that is advantageous to you. The rules for this are beyond me but more knowledgeable posters may be able to provide.

The fact that you've uploaded your PRSI record is really helpful!

Black Sheep

Registered User

- Messages

- 2,372

Looking at your record it appears to me if you continue working for a further 6 years you would come into the yearly average rate of 30-39 contributions which based on present rates would give you a pension of €227.70 per week.

Does that take into account that class D/K contributions don't cover pension benefits?Looking at your record it appears to me if you continue working for a further 6 years you would come into the yearly average rate of 30-39 contributions which based on present rates would give you a pension of €227.70 per week.

State Pension (Contributory)

The State Pension (Contributory), previously called the Old Age (Contributory) Pension, is payable to people aged 66 and over who have worked and paid enough social insurance contributions.

"....due to my part time employment I’m sure my pension won’t be much..."

Whether you were in full time or part time employment is completely irrelevant to the value of the State pension that you'll get!

The only thing that matters is the total number of reckonable contributions (plus credits) that you will have accumulated when the time comes to calculate your Contributory State pension.

Whether you were in full time or part time employment is completely irrelevant to the value of the State pension that you'll get!

The only thing that matters is the total number of reckonable contributions (plus credits) that you will have accumulated when the time comes to calculate your Contributory State pension.

Last edited:

Dave Vanian

Registered User

- Messages

- 1,253

Just to be clear - all of the above replies refer to the State Contributory Pension. Are you also a member of the superannuation scheme in the HSE? If so, that will also give you an additional entitlement to a pension, over and above the State Contributory Pension. You may be able to enhance your benefits in that in a tax-efficient way by looking into possibly buying additional years or making Additional Voluntary Contributions. Whether or not you should is a much bigger question involving looking at your entitlements from the superannuation scheme, your tax position now, your anticipated tax position in retirement, that of your spouse (if applicable) etc.

I did touch on this point in my original reply although I referred to a "public service defined benefit pension" which perhaps isn't strictly correct nomenclature?Just to be clear - all of the above replies refer to the State Contributory Pension. Are you also a member of the superannuation scheme in the HSE?

Last edited:

Mixed pension would not apply as the poster has more than 10 years of reconable paid contributions.The mix of Class A and Class D insurance may qualify you for a mixed pension if that is advantageous to you. The rules for this are beyond me but more knowledgeable posters may be able to provide

Mixed class is applied if the person had more than 5 years and less than 10 years reconable paid contributions.

Baby boomer

Registered User

- Messages

- 735

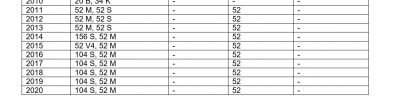

@Xraylady as a matter of idle curiousity, how did you manage to clock up 104 Class S contributions in 2016? I would have thought that was impossible!

I agree with other posters - you will get homemaker credits for the three years you took out. You can apply now to have them recognised - no need to wait until pension age to do so.

I agree with other posters - you will get homemaker credits for the three years you took out. You can apply now to have them recognised - no need to wait until pension age to do so.

NoRegretsCoyote

Registered User

- Messages

- 5,766

This is very confusing to me too. Once you made a Class S payment at all my understanding was that you got 52 contributions.@Xraylady as a matter of idle curiousity, how did you manage to clock up 104 Class S contributions in 2016? I would have thought that was impossible!

In any case the fourth column for reckonable contributions has the logical maximum of 52.

This is very confusing to me too. Once you made a Class S payment at all my understanding was that you got 52 contributions.

In any case the fourth column for reckonable contributions has the logical maximum of 52.

It appears to be a not-uncommon occurrence: both my missus and I have it on our PRSI records!

Last edited:

Black Sheep

Registered User

- Messages

- 2,372

Class S stamps are paid contributions by those who are self employed, so it possible to be employed paying class A contributions and self employed paying class S contributions in the same year.

BTW if your class S contributions are not fully paid up when you apply for pension you will quickly reminded of the amount outstanding and will be required to pay up

BTW if your class S contributions are not fully paid up when you apply for pension you will quickly reminded of the amount outstanding and will be required to pay up

Black Sheep

Registered User

- Messages

- 2,372

Maximum contributions per year is 52 for pension purposes.

You had a major change from paying for 156 S contributions in 2014 to making voluntary contributions in 2015. Have you checked that this is correct.It appears to be a not-uncommon occurrence: both my missus and I have it on our PRSI records!

View attachment 6102

Baby boomer

Registered User

- Messages

- 735

I have rental income and self employed income, and my contribution statement shows 52 S contributions per year.You pay S class on ARF distributions, unearned income and self employment earnings.

It is therefore possible to have 156 contributions per year.

Presumably if you had two or more part time jobs, you'd get 52 contributions not 104?

I my case the extra 52 contributions only showed in my contributions statement for 2020 in December 2021 so you might have 104 if you check again. There are also certain conditions where you get K instead of S contributions for unearned income.

The Prsi system is very complicated, so I would not be surprised if a lot of mistakes are made in the contributions statements.

The Prsi system is very complicated, so I would not be surprised if a lot of mistakes are made in the contributions statements.

Last edited: