Well said tonight Brendan tonight as i felt they would only target relief towards people who are prisoners of the vulture funds paying say 9%. Manna from heaven for people who have trackers, hard as its been for the last year or so but had it great for the previous 10 years or more and whose mortgages are now 15 years old at their youngest. I argued on here about the fate of the SVR holders who suffered in that time who are at least getting something but those who correctly fixed, including those with larger balances miss out. And lastly i never begrudged the tracker holders, good luck to them that they were giving the banks low levels of interest for so long and the banks did all they could to deny trackers to people.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mortgage interest rate measures

- Thread starter Brendan Burgess

- Start date

- Status

- Not open for further replies.

Brendan Burgess

Founder

- Messages

- 55,503

Bingo!

Well done Brendan, you spoke very well.

Thanks and thanks for the great line Sarenco.

What about the person buying that house now?An average 3 bed home owner in mid market Dublin bought in 2006 on a 1% tracker and 25 year mortgage, is paying about €2,400 a month.

Someone buying the same home in 2015 is no where near that type of payment.

Hi everyone... a bit confused about the mortgage interest relief measure. I had a tracker for years, the interest hikes were crippling me so I fixed in May 2023. Am I entitled to claim the relief in relation to interest paid in 2022/part of 2023 or am I completely excluded now that I have a fixed rate? Thanks in advance.

Brendan Burgess

Founder

- Messages

- 55,503

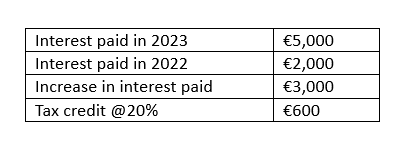

It has been badly explained.

The calculation will be as follows

Obviously, if your mortgage rate was fixed at the same rate for 2023 and 2022, you will not have paid increased interest.

But if you were fixed for part of either year, it won't matter - if you pay more in 2023 than you paid in 2022, then you will get the tax credit.

Brendan

The calculation will be as follows

Obviously, if your mortgage rate was fixed at the same rate for 2023 and 2022, you will not have paid increased interest.

But if you were fixed for part of either year, it won't matter - if you pay more in 2023 than you paid in 2022, then you will get the tax credit.

Brendan

time to plan

Registered User

- Messages

- 910

I got in just before ECB rates went up with a 1.95% 7 year fix. Before that I think I had a 3% 5 year fix. I never benefited from the low Tracker rates. But I'm happy enough with the measures, even if I don't benefit from them. No problem at all with people getting a bit of help with increased payments, even if there is a moral hazard argument against it.

Flybytheseat

Registered User

- Messages

- 486

The funds available should have been more targeted to those in vulture fund mortgages paying ECB + >3%. These are the people that really need help.

It has been badly explained.

The calculation will be as follows

View attachment 8030

Obviously, if your mortgage rate was fixed at the same rate for 2023 and 2022, you will not have paid increased interest.

But if you were fixed for part of either year, it won't matter - if you pay more in 2023 than you paid in 2022, then you will get the tax credit.

Brendan

Given this appears as a tax credit (or that's the impression given) will people be limited to a refund on the amount of tax they have over payed?

RichieRich

Registered User

- Messages

- 52

Hi all,

I'm right in the middle of fixing my tracker and should be fixed in the next few weeks. Can I benefit from this measure given I will have had a tracker for at least 10 months of 2023? Thanks in advance!

I'm right in the middle of fixing my tracker and should be fixed in the next few weeks. Can I benefit from this measure given I will have had a tracker for at least 10 months of 2023? Thanks in advance!

time to plan

Registered User

- Messages

- 910

See Brendan's post above - 10:16 today. Calculate your interest paid in 2023 and your interest paid in 2022.Hi all,

I'm right in the middle of fixing my tracker and should be fixed in the next few weeks. Can I benefit from this measure given I will have had a tracker for at least 10 months of 2023? Thanks in advance!

RichieRich

Registered User

- Messages

- 52

Thanks!See Brendan's post above - 10:16 today. Calculate your interest paid in 2023 and your interest paid in 2022.

Brendan Burgess

Founder

- Messages

- 55,503

Given this appears as a tax credit (or that's the impression given) will people be limited to a refund on the amount of tax they have over payed?

It is a tax credit. So most people with mortgages will be paying tax in excess of €1,250 so they will get this.

However, the Department of Social Protection will pay a welfare payment to any of their clients who have mortgage interest, but who don't have tax to set the credit against.

I don't know what would happen in the few cases where the tax liability is less than the tax credit.

Brendan

Made a decision to stick with our 1% tracker as I think rates will come back down again, so thanks Mr McGrath  Disagree with this measure, though.. BTW EBS wil be sending customers their 2022 statement (again!), so if you can't find it there is no need to call them.

Disagree with this measure, though.. BTW EBS wil be sending customers their 2022 statement (again!), so if you can't find it there is no need to call them.

You could have a substantial amount of people whose tax liability Is less than €1,250. Maybe additional tax credits like the incapacitated child tax credit coupled with high pension contributions or tax relief for nursing home fees/medical expenses. Given the great 10 years tracker holders had it would not be surprising if they were pumping every spare penny into a pension and minimising their PAYE. Quite a lot of earners would pay more in PRSI and USC than PAYE over 12 months.It is a tax credit. So most people with mortgages will be paying tax in excess of €1,250 so they will get this.

However, the Department of Social Protection will pay a welfare payment to any of their clients who have mortgage interest, but who don't have tax to set the credit against.

I don't know what would happen in the few cases where the tax liability is less than the tax credit.

Brendan

I'd imagine in the situation where the tax liability is less that the credit it falls to the DSP to make up the shortfall.

Thanks for clarifying

Thanks Brendan and well done on Primetime last night.It has been badly explained.

The calculation will be as follows

View attachment 8030

Obviously, if your mortgage rate was fixed at the same rate for 2023 and 2022, you will not have paid increased interest.

But if you were fixed for part of either year, it won't matter - if you pay more in 2023 than you paid in 2022, then you will get the tax credit.

Brendan

A few practical questions on the process.

Is it a comparison of interest paid between calendar years ‘22 and ‘23 and if so, do people need to wait until January ‘24 before requesting the relief?

Also, will it be case of having to post hard copy mortgage statements for each year to Revenue?

Thanks again,

R

Brendan Burgess

Founder

- Messages

- 55,503

Yes.Is it a comparison of interest paid between calendar years ‘22 and ‘23

Yes.do people need to wait until January ‘24 before requesting the relief?

will it be case of having to post hard copy mortgage statements for each year to Revenue?

I doubt it though I have seen this mentioned.

I suspect that the banks will issue a statement at the end of 2023 giving the interest paid in the two years. Then you will submit a tax return for 2023.

It would also be possible for the banks to automate this and issue the 20% credit directly to the borrower in non switcher cases.

But that is my idea. I don't think it's being planned.

Brendan

Yes you would need to wait until 2024 to claim as part of your 2023 tax statements.Thanks Brendan and well done on Primetime last night.

A few practical questions on the process.

Is it a comparison of interest paid between calendar years ‘22 and ‘23 and if so, do people need to wait until January ‘24 before requesting the relief?

Also, will it be case of having to post hard copy mortgage statements for each year to Revenue?

Thanks again,

R

You could upload them to the Revenue online system when claiming, if you don't get it as a PDF from your mortgage provider you could take a photo on phone. Similar to what is done for medical / working from home expenses by some people.

I'm in the exact same situation. No help for me on my SVR mortgage and negative equity a few years agoI got in just before ECB rates went up with a 1.95% 7 year fix. Before that I think I had a 3% 5 year fix. I never benefited from the low Tracker rates. But I'm happy enough with the measures, even if I don't benefit from them. No problem at all with people getting a bit of help with increased payments, even if there is a moral hazard argument against it.

Brendan Burgess

Founder

- Messages

- 55,503

I used to get an annual statement of interest charged on my mortgage from AIB in the early part of the year.

Do all banks not do that?

Otherwise, people would have to get every statement.

then add up the interest charged.

Many people can't read a statement.

Some will add up the repayments instead.

Brendan

Do all banks not do that?

Otherwise, people would have to get every statement.

then add up the interest charged.

Many people can't read a statement.

Some will add up the repayments instead.

Brendan

- Status

- Not open for further replies.