Brendan Burgess

Founder

- Messages

- 55,242

:quality(70):focal(1262x640:1272x650)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/NGQ63Q5SDFFCBERRR7G3IWCTNE.jpg)

Ireland has many housing problems. But lack of supply isn’t one of them

Today’s problem is high prices and rents relative to incomes, a legacy of undersupply in the past

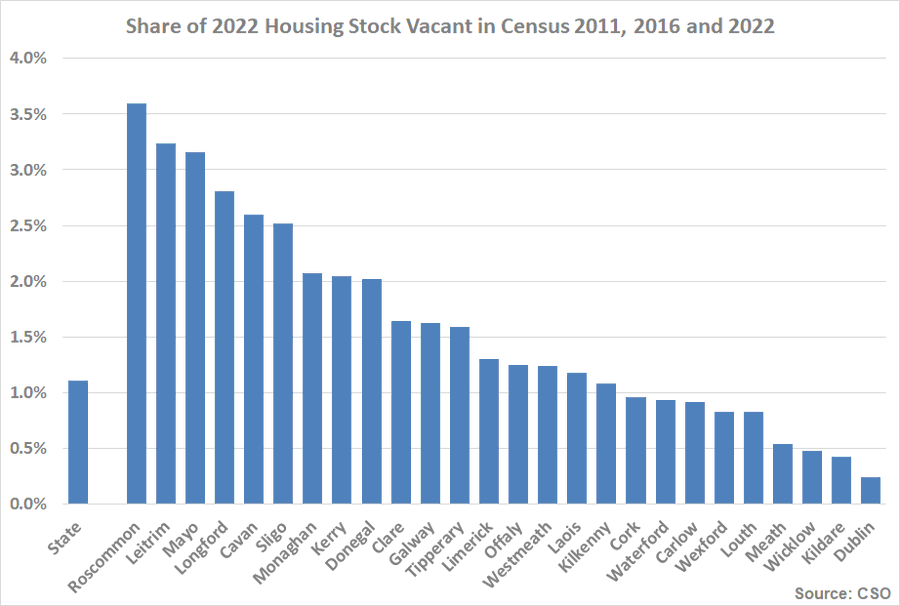

Every market has an optimal vacancy rate that facilitates the fluid movement of occupiers. If vacancy falls below this, the market is undersupplied. Our Government says the vacancy sweet-spot lies between 2.5 and 6 per cent in a properly functioning housing market, and I have previously estimated the optimum for Ireland at about 5.75 per cent. However, the Census recently measured housing vacancy at 7.85 per cent, excluding temporary absences and unoccupied holiday homes. This does not scream undersupply.

...

We can challenge the accuracy of vacancy data, but pricing signals cast further doubt on the idea that our housing market is undersupplied. Real house price inflation in Dublin has averaged just 1 per cent a year since March 2019, and negative inflation has been recorded 23 times in the last 50 months, including in each of the last seven. Real property prices are currently falling by 5.8 per cent a year (3.4 per cent nationally), and a similar pattern is evident in the rental market, where there has been negative real inflation since the second quarter of 2022.

...

Confronted by this evidence, why is there such a widely-held conviction that Ireland’s property market is undersupplied?

The reason is that our national housing debate has been dominated by sectional interests which benefit from the chronic undersupply narrative. From a commercial perspective, undersupply makes development funding easier to obtain. It also provides leverage for industry representatives to lobby for occupier subsidies that draw out supply by supporting higher prices and rents. Examples include Help to Buy, the First Home Scheme, the Local Authority Home Loan and the Rent Tax Credit, all of which have been introduced, extended or enhanced in the last six months, while mortgage restrictions have been relaxed.