Okay, so it grossly understates the levels of wealth because it excludes wealth that cannot be made liquid. Strange since it is absolutely real wealth and easy to put a value on.I googled the 60 page credit suisse report. Copy paste of a section below. Private pension assets are included. State entitlement are not. It's Not explicit on db pensions but the implication is they are not included, and that an annuity would not be included either.

Notes on concepts and methods

Net worth, or “wealth,” is defined as the value

of financial assets plus real assets (principally

housing) owned by households, minus their

debts. This corresponds to the balance sheet

that a household might draw up, listing the items

which are owned, and their net value if sold.

Private pension fund assets are included, but not

entitlements to state pensions. Human capital is

excluded altogether, along with assets and debts

owned by the state (which cannot easily be

assigned to individuals).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Irish Wealth / net worth distribution

- Thread starter SPC100

- Start date

Allpartied

Registered User

- Messages

- 512

That would be down to the other word in the discussion.If we are the 17th wealthiest country in the world and wealthier than even UK and Germany, why are left wing parties like sinn fein so popular here?

Wealth is one thing, fair distribution is another.

https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html for anyone who wants to dig deeper. They state that their methodology generally reports more millionaries than other reports.

They are trying to report across every country, so they might be somewhat limited by data sources that they can easily get for each country.

It seems like public & db pensions are the elephant in the room for the results, that would likely bring a lot (10 percent ?) of adults in Ireland into the 1 million bracket.

But state pensions would also effect the distribution in a lot of other countries, they highlight that nordic countries wealth (as measured here) is lower, as they have very generious state pensions, so people don't accumulate as much wealth. I think multiple other countries have state pensions related to your earnings.

They are trying to report across every country, so they might be somewhat limited by data sources that they can easily get for each country.

It seems like public & db pensions are the elephant in the room for the results, that would likely bring a lot (10 percent ?) of adults in Ireland into the 1 million bracket.

But state pensions would also effect the distribution in a lot of other countries, they highlight that nordic countries wealth (as measured here) is lower, as they have very generious state pensions, so people don't accumulate as much wealth. I think multiple other countries have state pensions related to your earnings.

Because there's more to life than one metric (money / wealth).If we are the 17th wealthiest country in the world and wealthier than even UK and Germany, why are left wing parties like sinn fein so popular here?

Sophrosyne

Registered User

- Messages

- 1,588

Correct - data with varying degrees of reliability.They are trying to report across every country, so they might be somewhat limited by data sources that they can easily get for each country.

Much of the data required to compile a country's wealth is not in the public domain.

Therefore, where does Ireland stand in the wealth rankings?

Who knows?

Last edited:

And the definition of "fair" is yet another.That would be down to the other word in the discussion.

Wealth is one thing, fair distribution is another.

What can be said is that we redistribute a greater share of earned income that any other country in the EU.

Left wing parties are strongly against wealth redistribution, as can be seen in their opposition to our existing wealth tax.

We have a strongly left wing populist media, spearheaded by our Public Sector Broadcaster, RTE. That is a big part of the reason that the national discussion on this topic is so one-eyed and ridiculously ill-informed.

We also have a strong left-wing lean in third level institutions. My son did a college project on "Capitalism and Hunger" and had to ignore most of the data so that he didn't upset his Lecturer.

Surely "socialism and hunger" would be more correct, stalinist socialism along maoist socialism in China caused more starvation than anything else in the twentieth century. Oh and how can we forget Cambodia , the kmher rouge and its year zero ideology trying to obtain the most pure form of socialism.We also have a strong left-wing lean in third level institutions. My son did a college project on "Capitalism and Hunger" and had to ignore most of the data so that he didn't upset his Lecturer.

Even in eastern Europe in the best food producing countries in the world there were food shortages during communism in the 80s. Now we have putin trying to resurrect the Soviet Union causing global food shortage again

That's the stuff he had to ignore.Surely "socialism and hunger" would be more correct, stalinist socialism along maoist socialism in China caused more starvation than anything else in the twentieth century. Oh and how can we forget Cambodia , the kmher rouge and its year zero ideology trying to obtain the most pure form of socialism.

Even in eastern Europe in the best food producing countries in the world there were food shortages during communism in the 80s. Now we have putin trying to resurrect the Soviet Union causing global food shortage again

He also has to ignore socialism and climate change; that's all the fault of Capitalism too, the facts and evidence be damned.

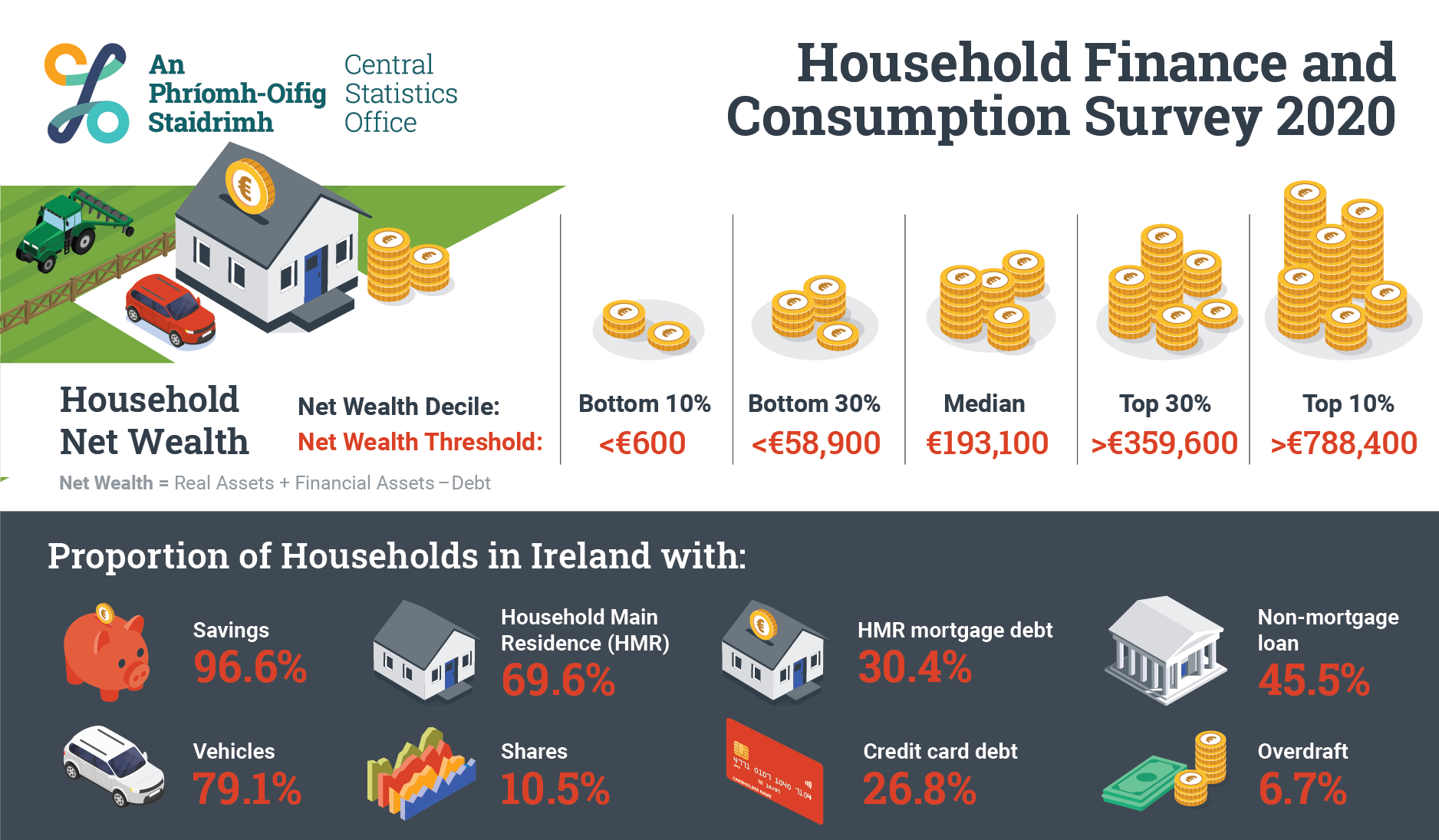

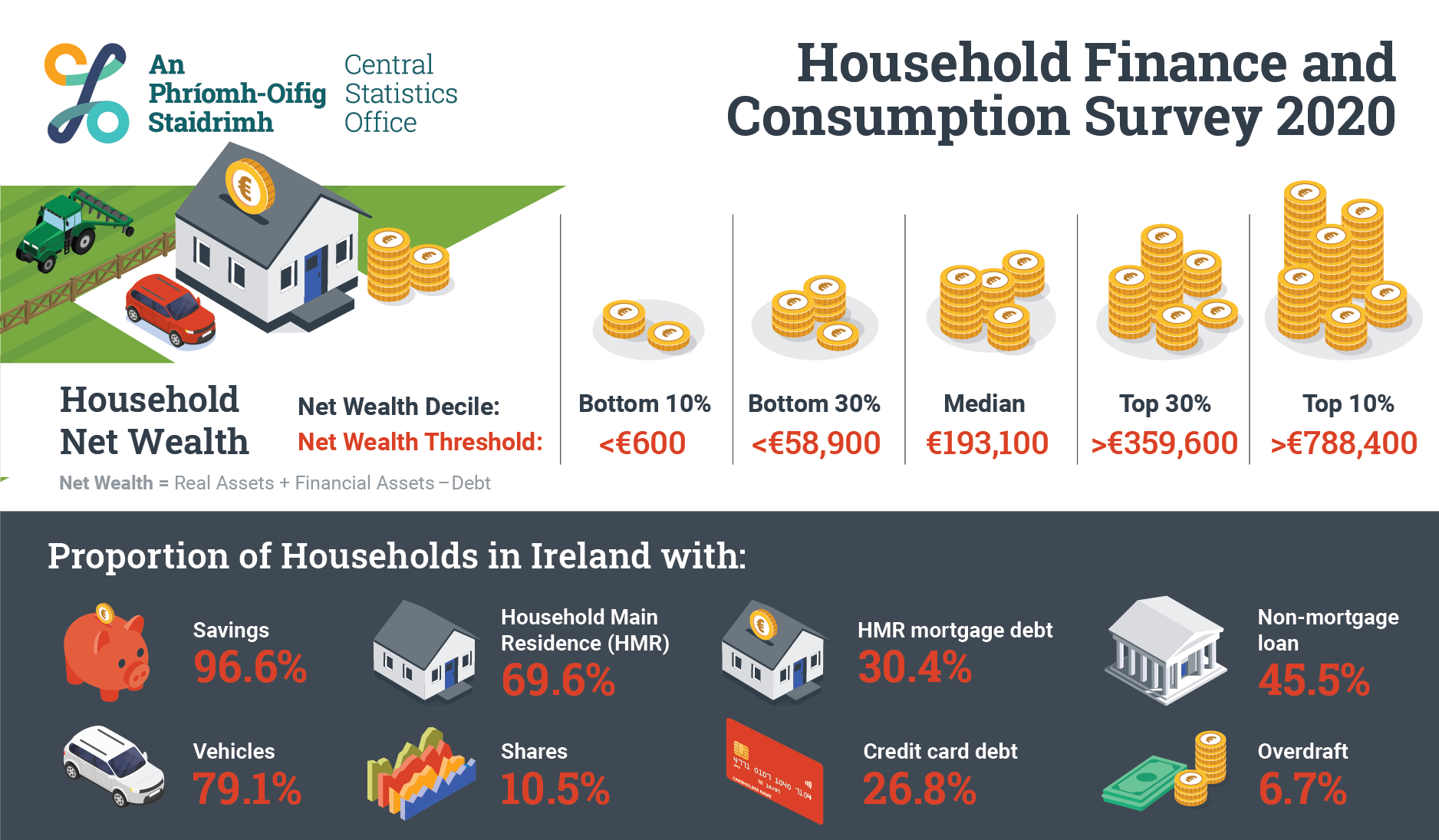

This is CSO data on wealth:

| Table 2.1 Summary of results | ||

| Households with asset/debt | Median value 1 | |

| % | € | |

| Real assets | ||

| Household Main Residence (HMR) | 69.6 | 260,000 |

| Land | 8.9 | 300,000 |

| Other Real Estate Property | 12.5 | 236,600 |

| Self Employment Business Wealth | 15.2 | 19,700 |

| Vehicles | 79.1 | 10,000 |

| Valuables | 78.3 | 4,100 |

| Any Real Asset | 95.3 | 253,100 |

| Financial assets | ||

| Savings | 96.6 | 8,700 |

| Bond or Mutual funds | 13.6 | 5,000 |

| Shares | 10.5 | 5,800 |

| Voluntary Pension | 16.3 | 37,600 |

| Other Financial Asset | 7.2 | 10,000 |

| Any Financial Asset | 97.1 | 13,300 |

| Debt | ||

| Mortgage on HMR | 30.4 | 124,400 |

| Mortgage on Other Property | 7.2 | 104,800 |

| Non-mortgage loan | 45.5 | 7,300 |

| Overdraft | 6.7 | 600 |

| Credit Card debt | 26.8 | 700 |

| Any Debt | 68.1 | 25,000 |

| 1 Conditional on participation. |

NoRegretsCoyote

Registered User

- Messages

- 5,766

I'm always a bit sceptical about these "Irish billionaire" lists. Very few of them actually live in Ireland and I suspect very little of their wealth or income is taxed here.

Here is the list.

Does the wealth originate in Ireland? No. Do they live in Ireland? No. Does they pay much tax in Ireland? Very little.

Does the wealth originate in Ireland? No. Does he live in Ireland? Wikipedia says he lives in London. Does he pay much tax in Ireland? Likely not very much.

Does the wealth originate in Ireland? Mainly, yes. Does he live in Ireland? He is tax resident in Malta. Does he pay much tax in Ireland? Presumably less than if he was still tax resident here.

Does the wealth originate in Ireland? No. Does he live in Ireland? No. Does he pay much tax in Ireland? No.

Does the wealth originate in Ireland? Largely, yes. Does he live in Ireland? Yes. Does he pay much tax in Ireland? Yes.

Does the wealth originate in Ireland? No. Does he live in Ireland? No. Does he pay much tax in Ireland? No.

Does the wealth originate in Ireland? Largely, yes. Does he live in Ireland? He is tax resident in Switzerland. Does he pay much tax in Ireland? Presumably less than if he was still tax resident here.

So, of the nine, only five were raised in Ireland. Four of the five them have left. The other four seem to have acquired Irish citizenship through naturalisation and otherwise don't live here or have much connection. Eugene Murtagh of Kingspan is the only one of nine "Irish billionaires" who was raised in Ireland, made his money from an Irish-controlled business, and has stayed.

I can only conclude that Ireland is not a friendly place to be a billionnaire!

Here is the list.

Does the wealth originate in Ireland? No. Does he live in Ireland? Not clear, but likely no. Does he pay much tax in Ireland? Likely very little.The Republic’s richest person remains construction magnate Pallonji Mistry (92). The Indian-born Irish citizen controls engineering business, Shapoorji Pallonji Group, and holds a stake in Tata Sons, one of India’s biggest businesses.

Patrick Collison (33) and John Collison (31), whose wealth shot up to $9.5 billion each after a fundraising round that saw the valuation of Stripe almost triple in less than a year.

Does the wealth originate in Ireland? No. Do they live in Ireland? No. Does they pay much tax in Ireland? Very little.

John Grayken (65), founder of Dallas, Texas-based private equity business Lone Star Funds, an active investor in the Republic, is in 386th place with an estimated fortune of $6.5 billion, down from $7.6 billion a year earlier.

Does the wealth originate in Ireland? No. Does he live in Ireland? Wikipedia says he lives in London. Does he pay much tax in Ireland? Likely not very much.

Digicel founder and owner Denis O’Brien (63) is at 778th in the list with wealth of $3.8 billion, down from $4.6 billion and 622nd place a year ago.

Does the wealth originate in Ireland? Mainly, yes. Does he live in Ireland? He is tax resident in Malta. Does he pay much tax in Ireland? Presumably less than if he was still tax resident here.

John Armitage (62), the British-born founder and investment manager of who became an Irish citizen four years ago,

Does the wealth originate in Ireland? No. Does he live in Ireland? No. Does he pay much tax in Ireland? No.

https://www.irishtimes.com/topics/topics-7.1213540?article=true&tag_company=Kingspan (Kingspan) founder Eugene Murtagh (79) was close behind with $2.8 billion, Forbes said, up $500 million on a year ago, putting him in 1,096th place.

Does the wealth originate in Ireland? Largely, yes. Does he live in Ireland? Yes. Does he pay much tax in Ireland? Yes.

John Dorrance (78), an heir to the Campbell’s Soup fortune, is at 1,163rd with $2.7 billion, up $100 million.

Does the wealth originate in Ireland? No. Does he live in Ireland? No. Does he pay much tax in Ireland? No.

Finally, Dermot Desmond (71) appears on the list in 1,445th place with a $2.1 billion estimated fortune, down from $2.2 billion.

Does the wealth originate in Ireland? Largely, yes. Does he live in Ireland? He is tax resident in Switzerland. Does he pay much tax in Ireland? Presumably less than if he was still tax resident here.

So, of the nine, only five were raised in Ireland. Four of the five them have left. The other four seem to have acquired Irish citizenship through naturalisation and otherwise don't live here or have much connection. Eugene Murtagh of Kingspan is the only one of nine "Irish billionaires" who was raised in Ireland, made his money from an Irish-controlled business, and has stayed.

I can only conclude that Ireland is not a friendly place to be a billionnaire!

So DB pensions are not included. That greatly skews the data and misrepresents the facts. It’s hard to believe that a bunch of people with DB pensions in the CSO would ignore them when calculating household wealth. Go figure…

Table 2.1 Summary of results Households with asset/debt Median value 1 % € Real assets Household Main Residence (HMR) 69.6 260,000 Land 8.9 300,000 Other Real Estate Property 12.5 236,600 Self Employment Business Wealth 15.2 19,700 Vehicles 79.1 10,000 Valuables 78.3 4,100 Any Real Asset 95.3 253,100 Financial assets Savings 96.6 8,700 Bond or Mutual funds 13.6 5,000 Shares 10.5 5,800 Voluntary Pension 16.3 37,600 Other Financial Asset 7.2 10,000 Any Financial Asset 97.1 13,300 Debt Mortgage on HMR 30.4 124,400 Mortgage on Other Property 7.2 104,800 Non-mortgage loan 45.5 7,300 Overdraft 6.7 600 Credit Card debt 26.8 700 Any Debt 68.1 25,000 1 Conditional on participation.

Gordon Gekko

Registered User

- Messages

- 7,919

Why would a DB pension be included?

The capital value of a DB pension is notional.

If I’ve a million quid and I go off to Irish Life and buy an annuity that pays me €30,000 a year, I no longer have a million quid.

The capital value of a DB pension is notional.

If I’ve a million quid and I go off to Irish Life and buy an annuity that pays me €30,000 a year, I no longer have a million quid.

The CSO survey follows these definitions:

Publicly Traded Shares

Publicly traded shares are shares that are listed on a stock exchange or other form of secondary market, i.e. they can be bought and sold there.

Valuables

This includes items such as jewellery, works of art, antiques etc.

Self-employed Business

These are businesses in which somebody in the household is either self-employed in or has an active part in running the business. Examples would include a self-employed plumber, partner in an accounting firm or the director and part-owner of a haulage company.

Savings

This includes items such as all types of deposit and savings accounts as well as positive balance on current accounts

Mutual Funds

Money market funds (MMF) are defined as those collective investment undertakings the shares/units of which are, in terms of liquidity, close substitutes for deposits. They are funds primarily invested in money market instruments, MMF shares/units and in other transferable debt instruments with a residual maturity of up to and including one year.

Bonds

These are bearer instruments, are usually negotiable but do not grant the holder any ownership rights to the institutional unit issuing them. They provide the holder with the unconditional right to a fixed or contractually determined variable money income in the form of coupon payments (interest) and/or a stated fixed sum on a specified date or dates or starting from a date fixed at the time of issue. The issuer owes the holders a debt and is obliged to repay the principal and interest (the coupon) at a later date, termed maturity. A bond is generally transferrable from one person to another. For the purposes of HFCS, Post Office savings bonds and prize bonds are classified as ‘Bonds’.

Voluntary Pensions and Life Assurance

These are personal (voluntary) plans, access to which is not linked to an employment relationship. Individuals independently purchase and select material aspects of the arrangements without intervention of their employers. Some personal plans may have restricted membership (i.e.to the self-employed, to members of a particular craft or trade association, to individuals who do not already belong to an occupational plan, etc).

Holders of life insurance policies, both with profit and without profit, make regular payments to an insurer (there may be just a single payment), in return for which the insurer guarantees to pay the policy holder an agreed minimum sum or an annuity, at a given date or at the death of the policy holder, if this occurs earlier. Term life insurance, where benefits are provided in the case of death but in no other circumstances, is excluded here

Gross Wealth

This is defined as the sum of real and financial assets.

Only certain assets and liabilities are included. In particular, the present value of all future, expected defined benefit pensions is excluded, which can be a sizable portion of the wealth of many households. The present value of future, voluntary, expected defined contribution pensions is included.

Net Wealth

This is defined as gross wealth less total debt.

Publicly Traded Shares

Publicly traded shares are shares that are listed on a stock exchange or other form of secondary market, i.e. they can be bought and sold there.

Valuables

This includes items such as jewellery, works of art, antiques etc.

Self-employed Business

These are businesses in which somebody in the household is either self-employed in or has an active part in running the business. Examples would include a self-employed plumber, partner in an accounting firm or the director and part-owner of a haulage company.

Savings

This includes items such as all types of deposit and savings accounts as well as positive balance on current accounts

Mutual Funds

Money market funds (MMF) are defined as those collective investment undertakings the shares/units of which are, in terms of liquidity, close substitutes for deposits. They are funds primarily invested in money market instruments, MMF shares/units and in other transferable debt instruments with a residual maturity of up to and including one year.

Bonds

These are bearer instruments, are usually negotiable but do not grant the holder any ownership rights to the institutional unit issuing them. They provide the holder with the unconditional right to a fixed or contractually determined variable money income in the form of coupon payments (interest) and/or a stated fixed sum on a specified date or dates or starting from a date fixed at the time of issue. The issuer owes the holders a debt and is obliged to repay the principal and interest (the coupon) at a later date, termed maturity. A bond is generally transferrable from one person to another. For the purposes of HFCS, Post Office savings bonds and prize bonds are classified as ‘Bonds’.

Voluntary Pensions and Life Assurance

These are personal (voluntary) plans, access to which is not linked to an employment relationship. Individuals independently purchase and select material aspects of the arrangements without intervention of their employers. Some personal plans may have restricted membership (i.e.to the self-employed, to members of a particular craft or trade association, to individuals who do not already belong to an occupational plan, etc).

Holders of life insurance policies, both with profit and without profit, make regular payments to an insurer (there may be just a single payment), in return for which the insurer guarantees to pay the policy holder an agreed minimum sum or an annuity, at a given date or at the death of the policy holder, if this occurs earlier. Term life insurance, where benefits are provided in the case of death but in no other circumstances, is excluded here

Gross Wealth

This is defined as the sum of real and financial assets.

Only certain assets and liabilities are included. In particular, the present value of all future, expected defined benefit pensions is excluded, which can be a sizable portion of the wealth of many households. The present value of future, voluntary, expected defined contribution pensions is included.

Net Wealth

This is defined as gross wealth less total debt.

Sophrosyne

Registered User

- Messages

- 1,588

The capital value of a DB pension - is that an asset? Can it be traded? Can it be turned into cash and spent?

Does it meet the criteria for an asset to be included in wealth?

Only certain assets and liabilities are included. In particular, the present value of all future, expected defined benefit pensions is excluded, which can be a sizable portion of the wealth of many households. The present value of future, voluntary, expected defined contribution pensions is included.

Is it not a question of fund ownership?

Ownership entails control over an asset.

Defined benefit schemes are managed by the employer. The employee has no control of the fund.

By contrast, defined contributions plans are owned and controlled by the employee.

Last edited:

Gordon Gekko

Registered User

- Messages

- 7,919

They’re held in trust for the employee as I understand it (i.e. DC pensions).

But a DB is just a promise.

It’s 100% correct to exclude DB pensions. The discussion seems more about public sector bashing TBH.

But a DB is just a promise.

It’s 100% correct to exclude DB pensions. The discussion seems more about public sector bashing TBH.