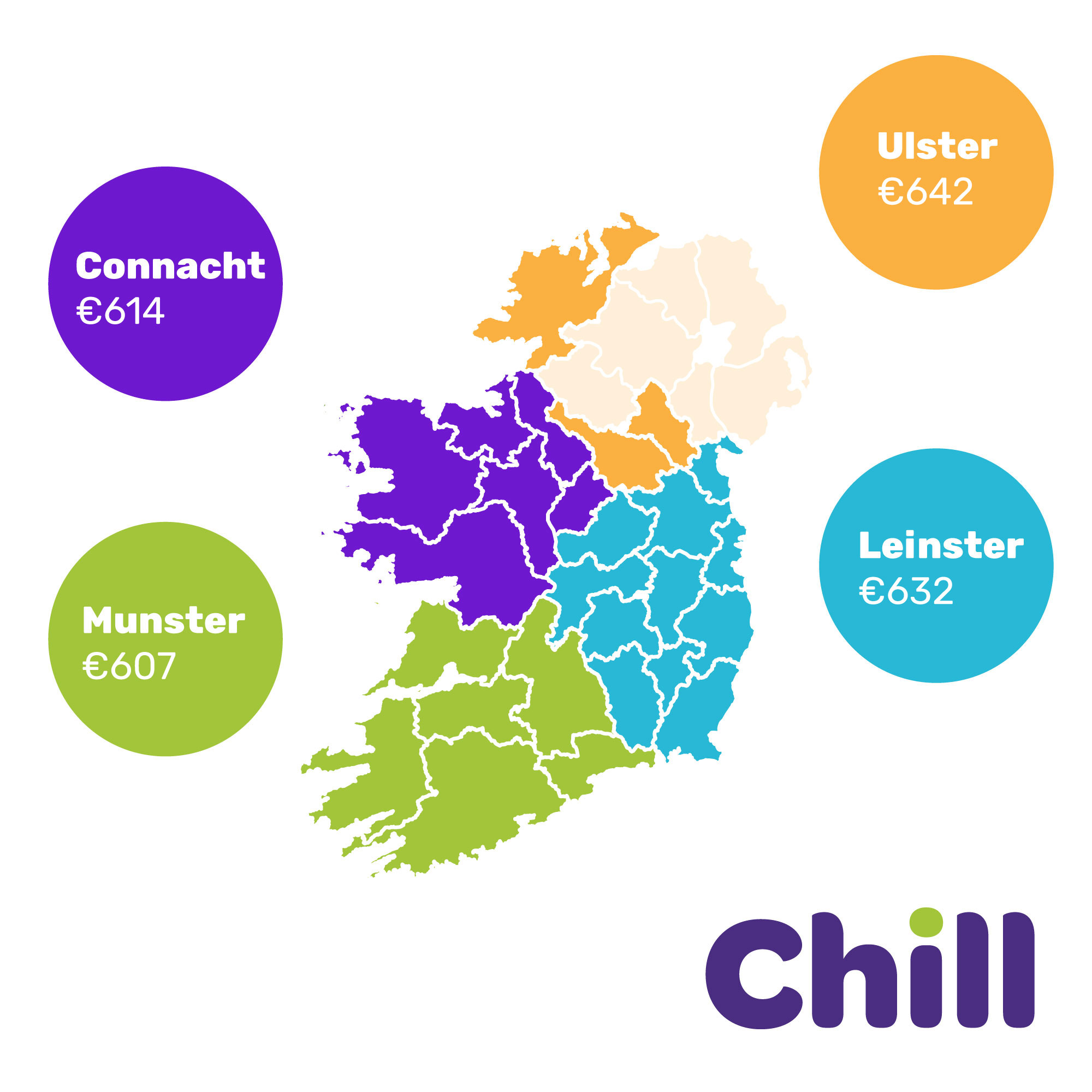

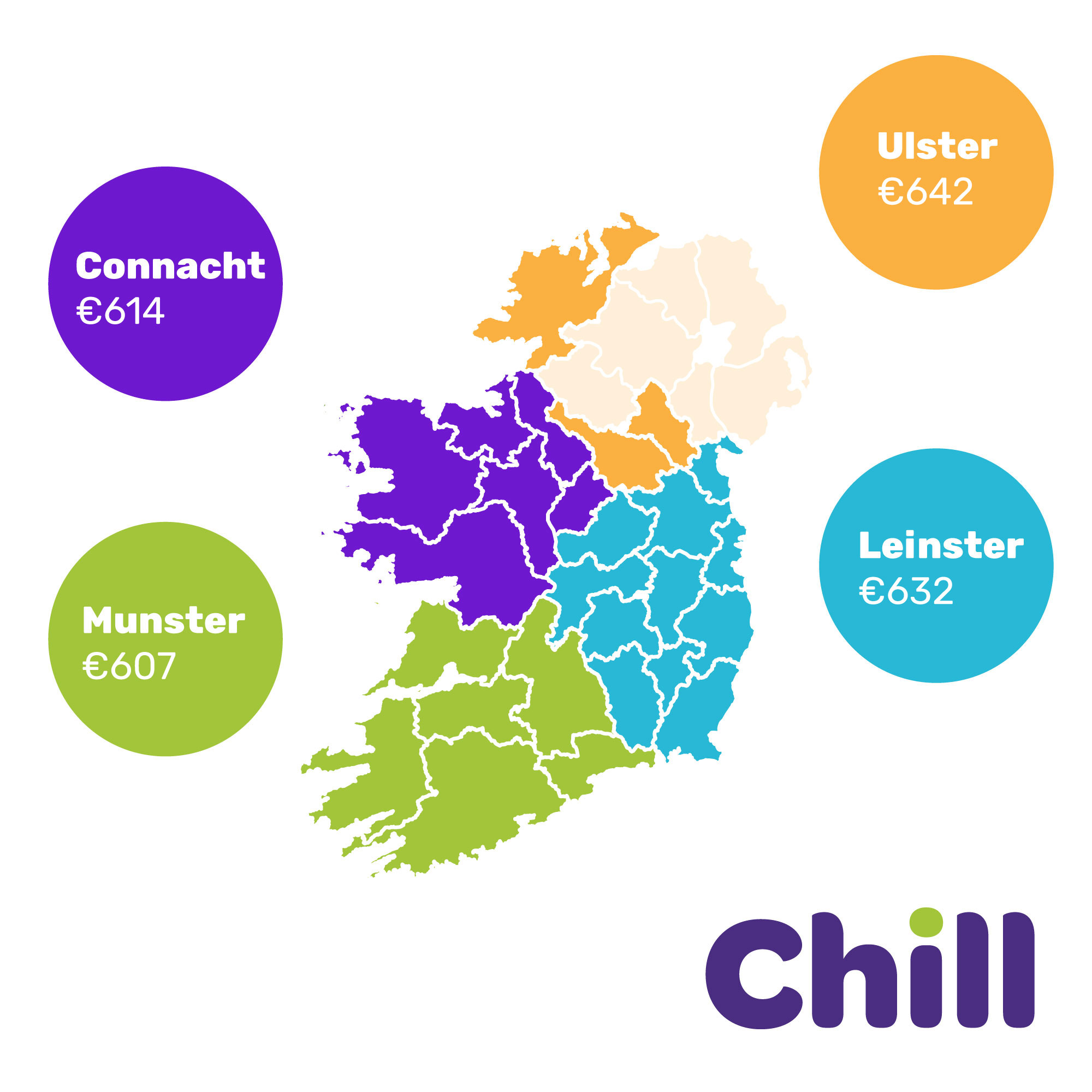

I was reading this over the weekend from Chill and I thought it was fascinating. Why, for example, is insurance for a medical secretary 2% more expensive the for an ordinary secretary?. What on earth are they doing in Longford to make insurance so expensive there?

www.chill.ie

www.chill.ie

Car Insurance Pricing Index | Chill

Looking to insure your car? Chill has done the research to get you the cheapest premium.