The crypto crash (and preceding bubble) shows that cryptocurrencies are objects of speculation rather than stores of value. That also makes them unusable as units of account.

It shows that they have been subject to hype cycles, yes. It doesn't mean that this will always be the case (or at the very least, not to the same extent). Crypto is far from having reached a point of maturity. In a world where the euro has lost 20% of its international buying power in a short space of time, I don't believe that Bitcoin will have the same level of volatility once mature.

“The prevalence of stablecoins, which attempt to peg their value to the US dollar or other conventional currencies, indicates the pervasive need in the crypto sector to piggyback on the credibility provided by the unit of account issued by the central bank. In this sense, stablecoins are the manifestation of crypto’s search for a nominal anchor.”

Stablecoins have found their own use case in their own right. They certainly complement fully fledged crypto - and help create a world in which there is no need to off-ramp from the tokenised world at all. It's certainly useful to have them in the interim as cryptocurrencies move on to maturity.

There are now about 10,000 cryptocurrencies. There could just as well be 1 billion.

Complete nonsense - that has long since been outed. That there are so many projects is good in terms of innovation. This space is experimental - and out of that experimentation real solutions and use cases will emerge. Aside from the other reality which is that of those projects, only a handful pursue a purely 'money' use case/function. We've had this claim pop up here multiple times (including the past week) - In the same way as you can't just copy and paste a Facebook or a Google, you can't copy and paste Bitcoin - not without the challenger being 10x better (because it will have to be 10x better in order to overcome its existing network effect).

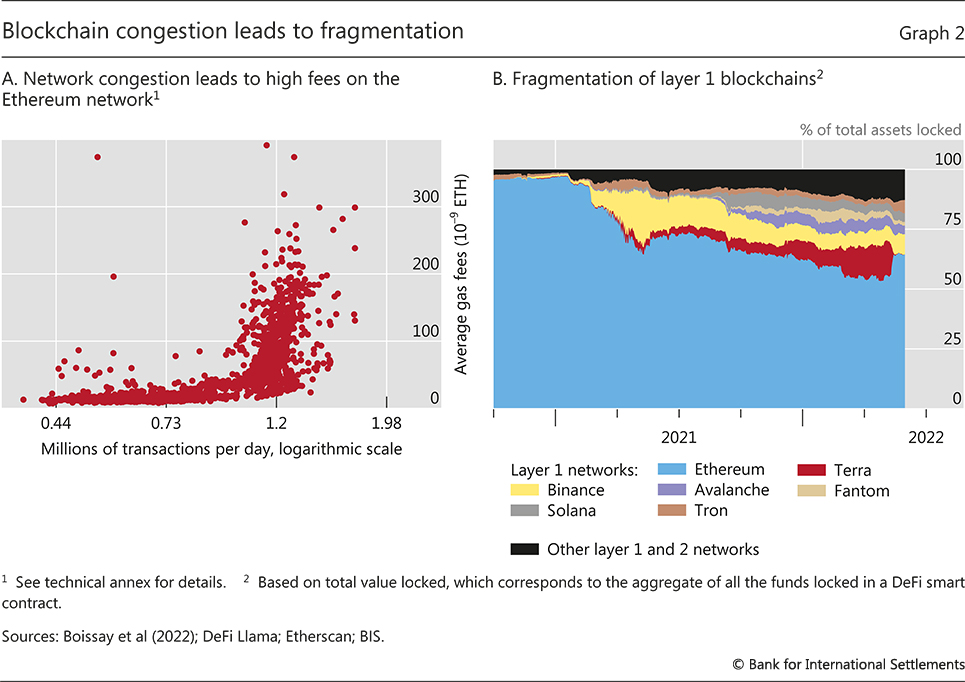

In a good monetary system, the greater the number of users, the lower the costs of transactions and so the greater its utility. But as more people use a cryptocurrency, the greater the congestion and the more costly the transactions.

The issue of scalability has already been outed above i.e. it has either been dealt with (for the most part in the case of Bitcoin/Lightning Network) or is in the process of being dealt with on the smart contracting platforms (There are layer 2 scaling solutions for Ethereum, Ethereum itself as a L1 blockchain is in transition with a view to addressing this directly OR there are other blockchains that have solved this issue).

One cannot have all three of security, decentralisation and scalability. In practice, cryptocurrencies sacrifice the last. The crypto system gets around this handicap with “bridges” across blockchains. But these are vulnerable to hacks.

Bridges have been notorious as regards hacks - that's for sure. However, in those cases, we're seeing experimentation to resolve these problems. It's fair enough to draw attention to it - but they should qualify that by acknowledging that as this experimentation goes on, there are likely to be appropriate solutions found. Bridging is relevant to the smart contract chains for the most part. Bitcoin already has a L2 scaling solution that doesn't implicate bridging.

Part of the answer is to insist that crypto meets the standards expected of any significant part of the financial system. Among other things, exchanges must “know their customers”.

Applying regulation that was designed for the legacy system is not in any way appropriate for crypto.

Here's a former regulator ( Chris Giancarlo - former CFTC Chairman ) who understands exactly how this should work.

Today’s system falls short, especially on cross-border payments.

No kidding - and there would be no admission of an issue to be solved here if it hadn't been for the emergence of crypto.

The fundamental point is that the crypto universe does not provide a desirable alternative monetary system.

There are all manner of technological solutions required within crypto still - in tandem with education and much more work to be done on the user experience. I think it's far too early to say how it performs over the longer stretch. At the very least, I would be very surprised if it is not a value add - as an additional option and choice for people.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/4GKPOH734PUDYULB2UVQPQPYCU.jpg)