You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If Bitcoin was worth $1 each in 2011, why are they worth $12,000 each now?

- Thread starter Brendan Burgess

- Start date

It's already possible to go long bitcoin at leverage without using the Bank of Brendan.

But you could get a better deal off Brendan

TheBigShort

Registered User

- Messages

- 2,789

But you could get a better deal off Brendan

Wait a second, Brendan hasnt even made the offer! You have, on his behalf!!

Wait a second, Brendan hasnt even made the offer! You have, on his behalf!!

you "could" get a better deal off Brendan , if he thinks truly it will be worthless by the start of Jan 19 and some others think it will be worth more , just do a deal and cut out the middle man! I'm sure Brendan in his mind could buy you back 5x the amount you hold now if they are only $100 each , of course if they go up in value he might need to sell everything and you could end up owning askaboutmoney

TheBigShort

Registered User

- Messages

- 2,789

you "could" get a better deal off Brendan , if he thinks truly it will be worthless by the start of Jan 19 and some others think it will be worth more , just do a deal and cut out the middle man! I'm sure Brendan in his mind could buy you back 5x the amount you hold now if they are only $100 each , of course if they go up in value he might need to sell everything and you could end up owning askaboutmoney

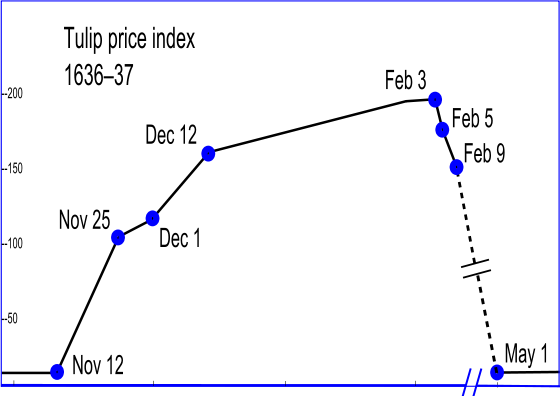

Im looking into the history of the tulip mania at the moment. Ive always been aware of it, but always took it for granted that it was all true. But apparently, there are conflicting accounts as to what actually happened.It appears clear that there was a mania, centred around tulips, but given the lack of financial data, it is not wholly clear in what manner it manifested itself.

I did however come across a chart that was somewhat ominous for us bitcoiners (cant locate it at the mo), as it somewhat mirrors the price rise of tulips with the current price of bitcoin - only for everything to crash, by next Feb!

Here is that tulip chart*

But then again, charts - farts

Last edited:

But then again, charts - farts

Numbers and technical analysis of charts are like people - if you torture them enough they'll tell you what you want to hear.

As a counter to the usual bubble chart that gets trotted out, bitcoin's bubbles might just be growth spurts on the common S curve: https://fs.bitcoinmagazine.com/img/images/Screen_Shot_2017-12-08_at_9.57.15_AM.original.png

Brendan Burgess

Founder

- Messages

- 55,428

if you torture them enough they'll tell you what you want to hear.

And you have done just that...

Those charges appear to show adoption rates. In other words, by 1945, almost 100% of citizens in the US had a phone.

It has nothing to do with the price curve for Bitcoin.

Bitcoin has a close to zero adoption rate. Its usefulness and adoption rate might increase when it falls back to being worth $1 or less. While it is at $16,000 it is useless.

Brendan

Brendan Burgess

Founder

- Messages

- 55,428

Hi f

Have you linked to the wrong chart by any chance? Check your link? It has nothing to do with the price rise of Bitcoin.

Brendan

Have you linked to the wrong chart by any chance? Check your link? It has nothing to do with the price rise of Bitcoin.

Brendan

B

BreadKettle

Guest

And you have done just that...

Those charges appear to show adoption rates. In other words, by 1945, almost 100% of citizens in the US had a phone.

It has nothing to do with the price curve for Bitcoin.

Bitcoin has a close to zero adoption rate. Its usefulness and adoption rate might increase when it falls back to being worth $1 or less. While it is at $16,000 it is useless.

Brendan

Brendan you are embarrassing yourself.

Again, can you explain to me how the price per bitcoin would have any effect whatsoever on any use case?

Clue: I can send or receive $1 worth of bitcoin now, or if one bitcoin is $1,000,000, or if it's 10c. Makes no difference to it's 'usefulness'.

With such a glaring lack of any basic grasp of the subject matter, how can you possibly feel qualified to make your constant sweeping assessments of it?

Im guessing there is a segment of society that doesn't want the status quo disrupted....that it would be an inconvenience.

To the naysayers - I will go so far as to say that there is a volatility issue with bitcoin currently (which is being looked at) and that it's hard to determine what the price of bitcoin should be (what with the ever devaluing FIAT currencies) but like it or loathe it (and whether those of us hodling bitcoin right now lose our shirts, cryptocurrency is going to eat the lunch of the bankers and those in allied/associated professions. It's just a question of when.

Does bitcoin have technological and practical issues to overcome? Yes, it does - but nobody has ever claimed that it is the finished article. Quite the opposite. It's work in progress - and the development of those improvements in many cases is transparent or at least known.

To the naysayers - I will go so far as to say that there is a volatility issue with bitcoin currently (which is being looked at) and that it's hard to determine what the price of bitcoin should be (what with the ever devaluing FIAT currencies) but like it or loathe it (and whether those of us hodling bitcoin right now lose our shirts, cryptocurrency is going to eat the lunch of the bankers and those in allied/associated professions. It's just a question of when.

Does bitcoin have technological and practical issues to overcome? Yes, it does - but nobody has ever claimed that it is the finished article. Quite the opposite. It's work in progress - and the development of those improvements in many cases is transparent or at least known.

Brendan Burgess

Founder

- Messages

- 55,428

You claimed

You showed a chart for one thing and claimed it was comparable to something else. It's not.

I am guessing that the price of everything in the other chart went down, as adoption went up.

It's likely that the adoption of Bitcoin will be hindered by its high price and manic rise.

Brendan

As a counter to the usual bubble chart that gets trotted out, bitcoin's bubbles might just be growth spurts on the common S curve:

You showed a chart for one thing and claimed it was comparable to something else. It's not.

but anyway do you not agree that the long term price of bitcoin is related to demand, which is related to adoption?

I am guessing that the price of everything in the other chart went down, as adoption went up.

It's likely that the adoption of Bitcoin will be hindered by its high price and manic rise.

Brendan

D

Dan Murray

Guest

There's a dot.com company that I've a financial interest in. (As a by the by, its share price rose like a fire-cracker - dropped like a stone - and is now more or less back to all time highs.) I've always seen it as a "disruptive" company. In many respects, its motto reminds me of BTC's battle:

First they ignore you,

then they laugh at you,

then they fight you,

then you win....

First they ignore you,

then they laugh at you,

then they fight you,

then you win....

Brendan Burgess

Founder

- Messages

- 55,428

can you explain to me how the price per bitcoin would have any effect whatsoever on any use case?

Hi BK

I gather that in the past Bitcoin was used for buying coffee and pizzas.

I understand that the transaction costs now mean that this is no longer feasible.

If I am happy paying €1 for something, I would be very reluctant to pay €0.0000555 for it a few years' later.

Of if I pay €3 for a cup of coffee in January, I would be reluctant to pay whatever 3 divided by 18,000 is a few months' later.

Brendan

Brendan Burgess

Founder

- Messages

- 55,428

First they ignore you,

then they laugh at you,

then they fight you,

then you win....

Dan - don't cod yourself by making false comparisons.

In Tulipmania, most people just laughed at the guys.

In the .com boom most people just laughed - there was no fighting.

The majority are just laughing at you.

You can win big now, by selling at this ridiculous price. Go for it.

Brendan

To say that a chart showing the adoption of mobile phones was comparable to the price of mobile phones individually would indeed be misleading, but there's a huge difference between that and bitcoin:You claimed

You showed a chart for one thing and claimed it was comparable to something else. It's not.

I am guessing that the price of everything in the other chart went down, as adoption went up.

If adoption and demand for something that can be manufactured in greater number to meet demand goes up, more of that item is generally mass-manufactured and due to economies of scale the price goes down.

If adoption and demand for something with hard scarcity goes up, price must go up. If everyone for whatever reason decided they wanted an ounce of gold tomorrow, the price would go up.

Obviously lots of people are buying now due to FOMO, many (maybe most) of the them will walk away when the hype cycle ends, some of them will 'get it' and stay. History has shown that bitcoin typically finishes each of these hype cycles with more users than it started with though, that's why I don't think we go below $1000 again unless the whole thing has failed or been surpassed.It's likely that the adoption of Bitcoin will be hindered by its high price and manic rise.

Brendan Burgess

Founder

- Messages

- 55,428

There's nothing to directly compare it to.

There was nothing like Semper Augustus before it came along. It is a direct comparison. It was worth nothing, or almost nothing. But it was hyped up to something extraordinarily valuable. And then it crashed back to nothing.

It is a direct comparison.

The dot.com bubble is pretty comparable. An irrational bubble. The faithful claimed that the rest of us "didn't get it".

It's comparable really to any other bubble.

Brendan