Moderator's note, Feb 2023: It looks like all (or almost all) KBC mortgages have now transferred to Bank of Ireland. If that is the case for your mortgage, your options are:

If you want to ask whether you should fix or not (or switch to another lender), please provide the following information:

1) Existing tracker margin. (This is set in your mortgage contract.)

5) Lender

6) Value of your home

7) Might you trade up or overpay your mortgage?

8) Do you face any barriers to switching? E.g., an impaired credit record, a mortgage with a warehoused portion due to a restructuring, reduced income since you took out your mortgage, you are now renting out the property.

9) What rates are you considering fixing at?

10) Does your house have a high BER rating which might qualify it for a lower rate? Check it here or estimate it if necessary.

11) How well could you handle a further 2% rise in the ECB rate?

Brendan,

Advice would be appreciated

1. Tracker ECB + 1.25%

2. N/A

3. Outstanding €165,000 approx

4. term remaining 20 Years. (Borrowed €255,000 for 35 years originally In 2007)

5. Lender KBC

6. Value €185,000. ( House was in negative equity to recently)

7. Have refund from tracker scandal as savings so flexibility to reduce outstanding balance

8. No barriers , dilemma is whether to fix the tracker with KBC or switch to fix ? Will I lose my tracker if I fix? I know it’s gone if I switch.

kBC advised on phoned that if I fix now , BOI will have to offer tracker back after end of fixed rate and quoted the attachment below from website. The agent said this was in the “Public Domain” and on their website. I’ve asked for this in writing. I do not trust anything over phone after last tracker scandal. Must BOI offer tracker at end of fixed rate if this is in my contract with KBC?

Thank you.

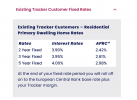

Moderator's note: the above KBC fixed rates for tracker mortgage customers come from this webpage:

- Stay on your tracker rate

- Move to one of Bank of Ireland's fixed rates for existing customers (see this page; choose "Existing" from the dropdown list and pick your loan-to-value (LTV) bracket)

- Switch to another lender

If you want to ask whether you should fix or not (or switch to another lender), please provide the following information:

1) Existing tracker margin. (This is set in your mortgage contract.)

- If your tracker margin is 1%, please state it in the following format to avoid confusion: ECB + 1%

- E.g., "Fixed at 2% with three and a half years of the fixed-rate period remaining."

- If you have both a tracker and a second mortgage on the property, specify the amount outstanding on each

5) Lender

6) Value of your home

7) Might you trade up or overpay your mortgage?

8) Do you face any barriers to switching? E.g., an impaired credit record, a mortgage with a warehoused portion due to a restructuring, reduced income since you took out your mortgage, you are now renting out the property.

9) What rates are you considering fixing at?

10) Does your house have a high BER rating which might qualify it for a lower rate? Check it here or estimate it if necessary.

11) How well could you handle a further 2% rise in the ECB rate?

Brendan,

Advice would be appreciated

1. Tracker ECB + 1.25%

2. N/A

3. Outstanding €165,000 approx

4. term remaining 20 Years. (Borrowed €255,000 for 35 years originally In 2007)

5. Lender KBC

6. Value €185,000. ( House was in negative equity to recently)

7. Have refund from tracker scandal as savings so flexibility to reduce outstanding balance

8. No barriers , dilemma is whether to fix the tracker with KBC or switch to fix ? Will I lose my tracker if I fix? I know it’s gone if I switch.

kBC advised on phoned that if I fix now , BOI will have to offer tracker back after end of fixed rate and quoted the attachment below from website. The agent said this was in the “Public Domain” and on their website. I’ve asked for this in writing. I do not trust anything over phone after last tracker scandal. Must BOI offer tracker at end of fixed rate if this is in my contract with KBC?

Thank you.

Moderator's note: the above KBC fixed rates for tracker mortgage customers come from this webpage:

Last edited by a moderator: