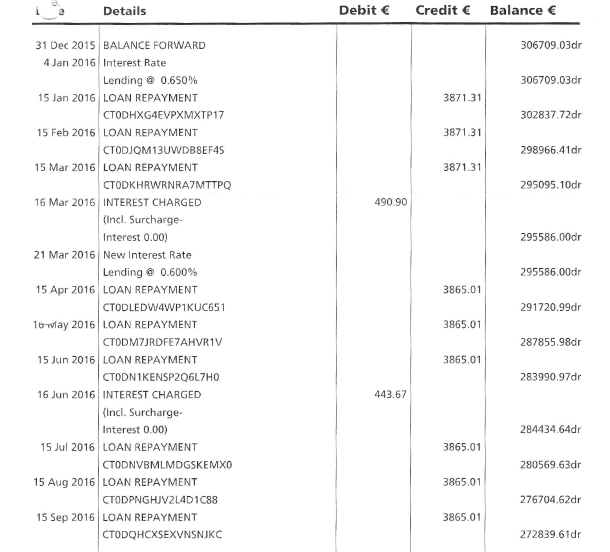

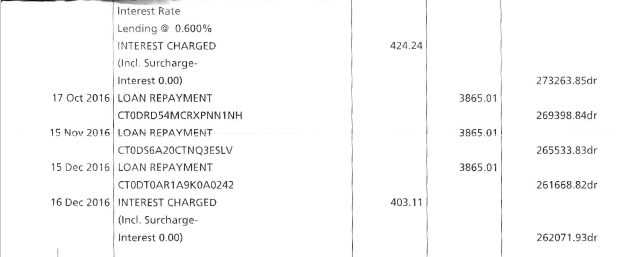

Now let's look at a mortgage in arrears.

This lender provides two separate statements - The Loan Statement and the Arrears Statement.

The Loan Statement is the same as the example above.

They charge interest every month.

This borrower pays €120 each week.

The balance goes down whenever a repayment is made and goes up again when interest is added.

The Mortgage Arrears Statement for the same period is as follows:

This is telling the borrower what repayments they should have made and what they actually made, therefore how much they are behind.

At the end of August this account was in arrears of €21,050.47

On 1 Sept a repayment was

due, so the arrears balance went up by this amount to €21,740.52.

When he made a payment of €120 on 5th Sept, the arrears balance went down.