This discussion paper from the UCD Geary Institute titled “

Varieties of home ownership: Ireland’s transition from a socialised to a marketised policy regime” traces home ownership since Ireland ceded from the UK.

“Introduction

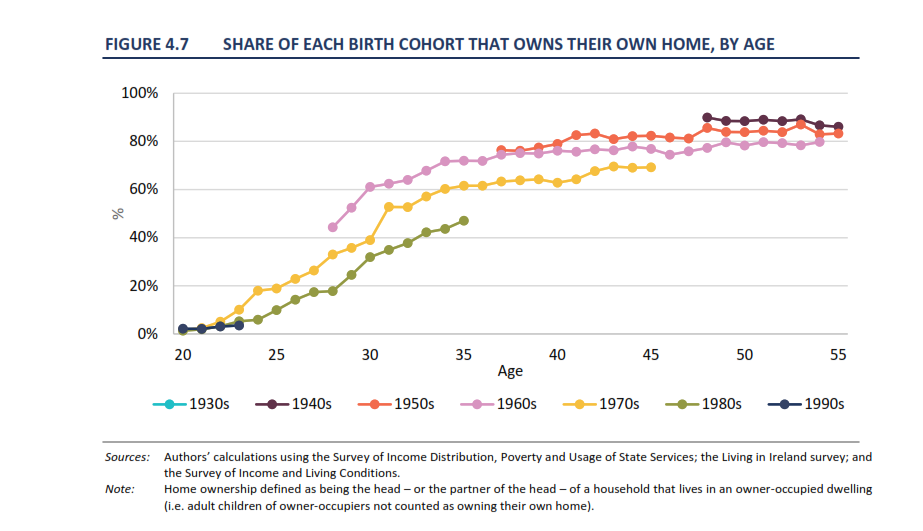

For most of the 20th Century home ownership rates in the Republic of Ireland rose steadily and were among the highest in the developed world. In 1971, 70.8 per cent of Irish households were home owners, compared to 50 and 35 per cent of their counterparts in the United Kingdom and Sweden respectively (Kemeny, 1981; Central Statistics Office, various years a). By 1991 Irish home ownership rates had risen to 80 per cent, compared to 65 in the UK and 39 per cent in Sweden (Bokovert, 2006; Central Statistics Office, various years)”

It is an interesting read. If you don’t want to read it all, the paper concluded:

“As the Irish case demonstrates when government supports are rolled back, home ownership declines, particularly among low income earners and average levels of associated debt increase.

Thus properly ‘neo liberal’, in the sense of entirely marketised housing systems are not characterised by very high (80 per cent plus) levels of home ownership but by home ownership among a small majority of the population accompanied by higher than average levels of (unsubsidised and unregulated) private renting

1, and small, highly targeted social housing sectors.”

1: the paper was written in 2013 and so does not take account of legislative change in the private rental sector since then. However, the rest of the content is still relevant.