Scenario:

Couple aged 75-80 now, both retired, combined income is 48k gross

Zurich (Eagle Star) Matrix investment bond, managed funds, started in 2007

100k initial amount, with 101% allocation, and 3.5% commission added into fund = 104.5k

AMC = 1%

Spread evenly across eight funds, 12.5k into each, as follows:

At the eighth year, 2015, the fund was worth 150k approx., and approx. 20k tax was paid. Next deemed disposal due this year 2023.

I am reviewing fund choice, and the policy overall.

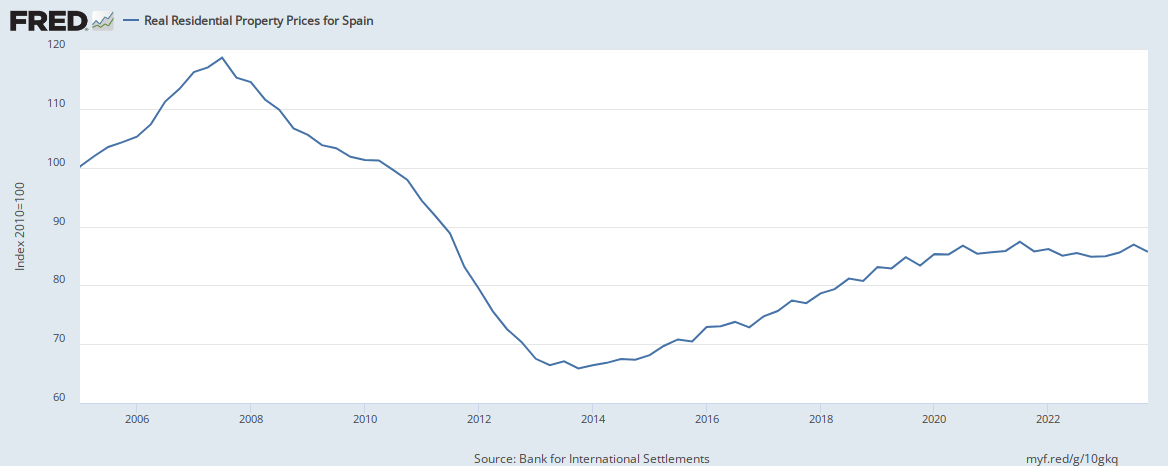

Q1. if property prices and rents have risen so much in many European countries, how come the Eurozone Property fund has done the worst? It's peak was 13,600, now at 12,400? This is the worst preforming fund by a long way.

Q2. Unless there is some sort of disaster, these funds will never be encashed. If cash is required for long-term care, there are deposits available. Given that, should we do a fund switch? Get out of Eurozone Property, Eurozone Equity, Dividend Growth?

Q3. I realise there is overlap between these funds. The three mixed funds probably hold the same shares, but just in different weights with bonds. The three mixed funds hold eurozone equities, and bonds. Is there an argument to simply hold one mixed fund?

Q4. We considered switching broker to move to a lower AMC, but this discussion has dissuaded me

Thanks for any comments.

Couple aged 75-80 now, both retired, combined income is 48k gross

Zurich (Eagle Star) Matrix investment bond, managed funds, started in 2007

100k initial amount, with 101% allocation, and 3.5% commission added into fund = 104.5k

AMC = 1%

Spread evenly across eight funds, 12.5k into each, as follows:

- Active Fixed Income, risk = 3/7

- Long Bond, risk = 4/7

- Balanced, holds 50-75% equities, risk = 5/7

- Performance, holds 65-90% equities, risk = 5/7

- Dynamic, holds 75-100% equities, risk = 6/7

- Eurozone Equity, risk = 6/7

- Dividend Growth, risk = 6/7

- Eurozone Property, risk = 6/7

At the eighth year, 2015, the fund was worth 150k approx., and approx. 20k tax was paid. Next deemed disposal due this year 2023.

I am reviewing fund choice, and the policy overall.

Q1. if property prices and rents have risen so much in many European countries, how come the Eurozone Property fund has done the worst? It's peak was 13,600, now at 12,400? This is the worst preforming fund by a long way.

Q2. Unless there is some sort of disaster, these funds will never be encashed. If cash is required for long-term care, there are deposits available. Given that, should we do a fund switch? Get out of Eurozone Property, Eurozone Equity, Dividend Growth?

Q3. I realise there is overlap between these funds. The three mixed funds probably hold the same shares, but just in different weights with bonds. The three mixed funds hold eurozone equities, and bonds. Is there an argument to simply hold one mixed fund?

Q4. We considered switching broker to move to a lower AMC, but this discussion has dissuaded me

Key Post - Strategy around the 8 year deemed disposal

Thanks @GSheehy - so, if I'm cashing in a unit linked fund to invest the proceeds in shares subject to CGT then I presume that the timing is irrelevant?

www.askaboutmoney.com

Thanks for any comments.