Brendan Burgess

Founder

- Messages

- 52,144

Good article by Karl Deeter

Evidence from the courts fails to support popular 'facts' behind repossessions

Evidence from the courts fails to support popular 'facts' behind repossessions

I agree that Karl Deeter's writing style can be a bit difficult to follow sometimes.

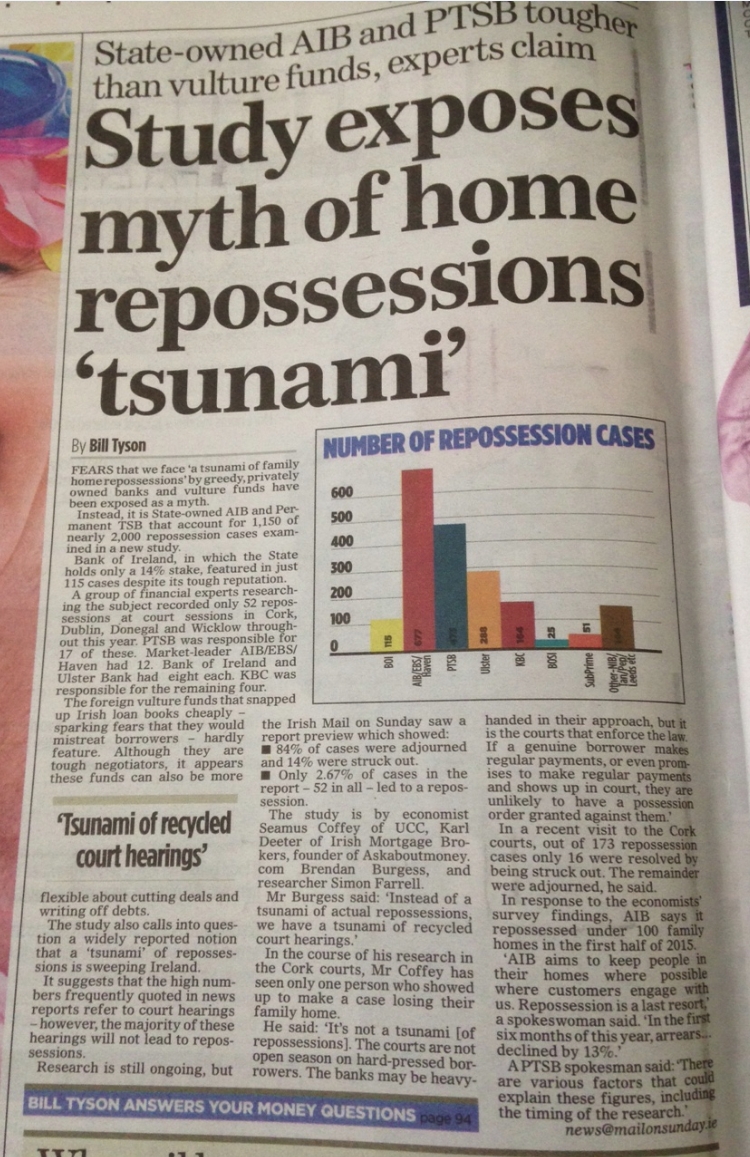

Here's an article on the same data from the Mail on Sunday (I liked Brendan's line that instead of a tsunami of actual repossessions, we have a tsunami of recycled court hearings).

And I agree with your about Burgeess's line of

a tsunami of actual repossessions, we have a tsunami of recycled court hearings

being superb. It could have been a headline all on it's own.

Solicitors got to earn a living too!

And who is paying the failed bank solicitors, the taxpayer.

I liked Brendan's line that instead of a tsunami of actual repossessions, we have a tsunami of recycled court hearings

Actually I don't think it was a good article as it was difficult to follow.

Hi Sarenco. When I read that line in the paper, I roared laughing. I rang Bill and told him that I loved the quote, but that I don't think I had said it and maybe someone else to whom he had spoken for the article, had said it. But he said that I had said it. So I will take the credit.

Brendan

Have a look at today's indo. Two cases where the judge has forced the lender to start again.

Or alternatively a large number of people who are not making any effort to meet their mortgages being retained in their homes. There has to be a downside for those who fail to contribute reasonably towards their mortgages. Also as Sarenco mentioned earlier it is not the banks who ultimately are meeting the costs of retaining these non-payers in their properties it is predominately SVR customers who continue to diligently meet their mortgage payments.Just as well we don't have a speedy repossession process or you're likely to have many families unnecessarily thrown out of their homes !

Hi Sarenco. When I read that line in the paper, I roared laughing. I rang Bill and told him that I loved the quote, but that I don't think I had said it and maybe someone else to whom he had spoken for the article, had said it. But he said that I had said it. So I will take the credit.

Brendan

Or alternatively a large number of people who are not making any effort to meet their mortgages being retained in their homes. There has to be a downside for those who fail to contribute reasonably towards their mortgages.