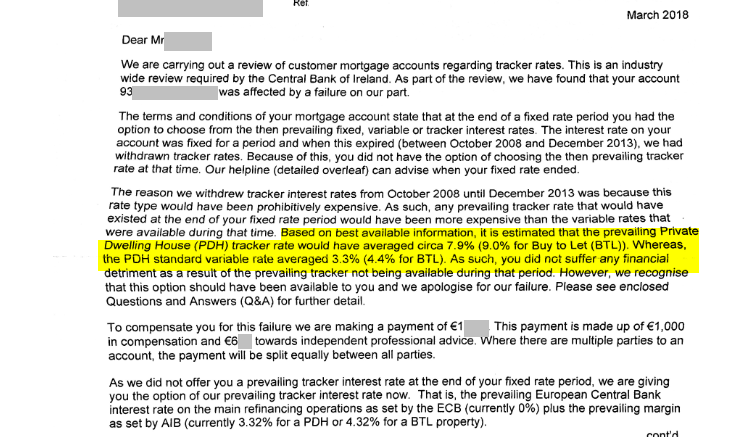

@Brendan Burgess do you know if the 7.9% is the total rate or the mark-up over ECB rate? In post 2, you apply it is the mark-up over ECB which seems absolutely crazy? I would have read the line as the tracker rate (ECB + mark-up) would have been 7.9%.

Do you have any idea what the cost of funds was for AIB during this time? Is it possible there is a correlation between them?

I think the only fair way that anyone can retrospectively apply a rate, given the circumstance is to perform the following calculation

In 2006/2007 (when tracker rates were still available) the cost of funds was x - ECB was y and the margin was z. The calculation for margin over ECB was a%

In 2008, the cost of funds was x - ECB was y and the margin was z. The calculation for margin over ECB was a%

In 2009, the cost of funds was x - ECB was y and the margin was z. The calculation for margin over ECB was a%

In 2010, the cost of funds was x - ECB was y and the margin was z. The calculation for margin over ECB was a%

So in effect, issue the formula and the associated pattern, and then publish this as to how they came up with the rate. If the rate is still 'off the charts' they should be asked to support the same formula for their fixed and variable rates, and there should be some level of correlation between them.

Otherwise, any rate made up in hindsight is absolute nonsense ..... especially if it has no bearing to the other rates published at the time.