canicemcavoy

Registered User

- Messages

- 601

From politics.ie ([broken link removed]):

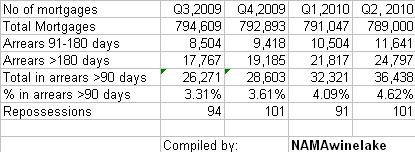

The Central Bank and Financial Regulator has published figures that show that 387 residential properties were repossessed in the 12 months to the end of June 2010. 36,438 residential mortgages have been in arrears for more than 90 days.

According to the central bank, there are over 789,000 private residential mortgages held in Ireland to the value of €118 billion.