Analysis of the Single Public Service Pension Scheme

This post puts together some information that might be helpful for public servants on the Single Public Service Pension Scheme (SPSPS). All new entrants to the public service since 2013 will generally be members of the scheme. A handbook containing information about the Single Scheme can be found here: https://singlepensionscheme.gov.ie/for-members/scheme-information/scheme-booklet/

There’s very little information online about the SPSPS. Most members probably aren’t thinking about retirement yet. The general consensus is that Single Scheme members will get a raw deal on retirement compared to public servants on Pre-2013 pensions. This is likely but will not always be the case depending on an individual’s entry grade and the promotions they receive during their career. There’s a few quirks about how the SPSPS works and the tax treatment of individuals on the SPSPS that can, in some cases, lead to them being financially better off vs. post-1995 public servants, particularly at higher salaries and with a bit of luck / savvy investing. I’m deliberately excluding pre-1995 boomers from this post because I’m not quite sure what their situation is re: PRSI and the state pension.

Below are some basic facts about how the single scheme works and the key differences between it and Post-1995 schemes:

This post puts together some information that might be helpful for public servants on the Single Public Service Pension Scheme (SPSPS). All new entrants to the public service since 2013 will generally be members of the scheme. A handbook containing information about the Single Scheme can be found here: https://singlepensionscheme.gov.ie/for-members/scheme-information/scheme-booklet/

There’s very little information online about the SPSPS. Most members probably aren’t thinking about retirement yet. The general consensus is that Single Scheme members will get a raw deal on retirement compared to public servants on Pre-2013 pensions. This is likely but will not always be the case depending on an individual’s entry grade and the promotions they receive during their career. There’s a few quirks about how the SPSPS works and the tax treatment of individuals on the SPSPS that can, in some cases, lead to them being financially better off vs. post-1995 public servants, particularly at higher salaries and with a bit of luck / savvy investing. I’m deliberately excluding pre-1995 boomers from this post because I’m not quite sure what their situation is re: PRSI and the state pension.

Below are some basic facts about how the single scheme works and the key differences between it and Post-1995 schemes:

- You earn pension benefits in the single scheme on a career average basis. The amount you contribute to the scheme and the benefits you accrue are determined by your salary at the time your contributions are made. Each contribution you make creates a “block” of pension benefits that you bank. The rate you pay as a contribution is a % of your salary. You’ll earn more pension benefits if you have a larger salary when your contributions are made.

- Pre-2013 public servants’ pension benefits are determined by their period of service and their final salary. This is very different to the Single Scheme and means members of pre-2013 schemes can increase their pension benefits massively by getting promotions later on in their career.

- All public servants pay “Additional Superannuation Contribution” (ASC). Members of the Single Scheme pay a lower rate of ASC than Pre-2013 public servants. The rates of ASC are as follows:

- For SPSPS Members, you pay no ASC on the first 34,500 euros you make, 3.33% on the next 25550 euros, and then 3.5% on all salary after that.

- Pre 2013 public servants pay no ASC on the first 34,500 euros they make, 10% on the next 25550 euros, and then 10.5% on all salary after that.

- ASC qualifies for income tax relief at your marginal rate. This will be either 20% or 40%, depending on your salary.

- All things being equal (length of service, salary), a member of the SPSPS will receive the same pension benefits on retirement as a post 1995+ entrant. After forty years this is 50% of final salary less the value of the state pension + 150% of salary as a lump sum.

- However, due to the way pay in the public service works via salary scale increments and promotions, all things will generally not be equal between single scheme members and pre-2013 entrants. Someone who gets an ASEC job in the last five years of their career on a pre-2013 pension will be able to increase the value of their pension by hundreds of thousand of euros overnight. This is no longer possible on the Single Scheme. Similarly, someone on the Single Scheme who spends a longer amount of their career on lower grades (CO / EO) will have a lot of catching up to do via AVCs if they get promoted to HEO or AP later on in their career and they want to maximise their pension benefits. The same person on a pre-2013 pension won’t have this issue.

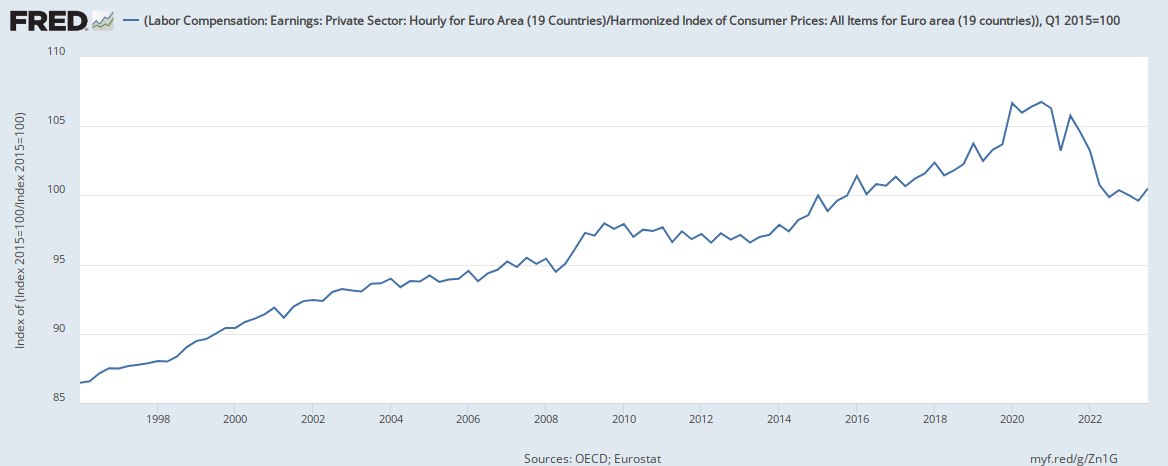

- Pension benefits banked under the single scheme are uprated and indexed in line with inflation. They are not reduced if there is deflation.

- The normal retirement age (NRA) for members of the Single Scheme is equivalent to the State Pension Age. Currently this is 66 and will probably rise in the future.

- If you want to retire earlier than this you can apply for cost-neutral early retirement. This is possible from age 55. If you do this the pension benefits you’ve banked will be reduced. Tables that set out how much your pension benefits will be reduced can be found here: https://singlepensionscheme.gov.ie/circular-18-of-2017/

- All things being equal, prior to retirement, a member of the SPSPS with a salary greater than €34,500 will always be financially better off than a post-1995 entrant. This is a natural consequence of the reduced rate of ASC paid by single scheme members. Effectively, the ASC reduction means members of the Single Scheme that earn above €34,500 are paid a greater net salary than post 1995+ entrants.

- This effect becomes more pronounced the higher the Single Scheme member’s salary becomes because:

- They pay less ASC overall vs. equivalent pre-2013 high earners

- The difference in ASC between the two can be invested in AVCs and/or an AVC-PRSA with tax relief by the Single Scheme member.

- For example:

- If a public servant on the Single Scheme and a public servant on a pre-2013 scheme were both paid €80,000 for thirty years, their resulting pension benefits on retirement, excluding lump sum, would be €20250 PA. This is not factoring in any actuarial reductions which might be applicable for early retirement. However, the Single Scheme member would have paid €55953 less ASC net after tax relief over the course of their career compared to the pre-2013 public servant.

- If the Single Scheme member invested the difference in ASC they pay through an AVC, availing of tax relief at their marginal rate, and with assumed growth rates of 7% pa and a 0.5% increase to contributions pa, they could have an AVC pot of circa. €330,000 on retirement (in addition to equivalent benefits under the main scheme to someone that’s pre-2013).

- If both were paid €100,000 for thirty years, the single scheme member could have a €500,000 AVC pot by investing the ASC difference (€81150 Net)

- If both were paid €50,000 for thirty years, the AVC pot would be much smaller (Approx €110,000) because there’d only be a €18650 ASC difference.

- Benefits can be purchased directly (the purchase facility) or by transfer from revenue approved pension products such as AVCs, PRSAs (the transfer facility).

- Benefits purchased through the purchase or transfer facility rank on par with benefits ordinarily earned in the scheme, and are inclusive of dependant’s benefits.

- To be eligible for the purchase facility, you must be a member of the Single Scheme and have:

- Completed the two year vesting period

- Have the potential to complete a period of 9 FTE years as a member of the Single Scheme by the time you reach normal retirement age;

- Normal pension or lump sum can be purchased. Purchase agreements are made on a twelve month basis. Normal pension can be purchased by way of one lump sum payment only.

- If you cease to be a Scheme Member before nine years have passed, the full cost of all ordinary pension amounts purchased under the purchase facility must be refunded. Money refunded reflects the cost of payment at the time of purchase. Interest is not payable on these refunds (!!!!!!). This doesn't appear to apply for money that has been transferred from another pension product.

- A calculator to work out how much it would cost to purchase benefits is available here: https://singlepensionscheme.gov.ie/...me-member-purchase-transfer-calculation-tool/

- In most cases, after playing around on the calculator, it seems the purchase facility allows you to purchase annuities at roughly a 25:1 ratio, meaning you get €1 of pension in retirement for every €25 you spend.

- If you take cost-neutral early retirement, the benefits you’ve purchased through the purchase facility will be actuarially reduced.

- If you purchase benefits by way of transfer (e.g. from an AVC, PRSA), you’ll lose any money that brings you over the revenue maximum pension benefit limits.

- In most cases, pre-2013 public servants will likely do better than Single Scheme members. This is particularly likely to be the case the longer a Single Scheme members spends their career at grades / salary levels before ASC really kicks in.

- Single Scheme members that enter the public service at higher grades (HEO / AP / PO) and work their way up the ladder quickly might not be much worse off at the end of their career than people in pre-2013 schemes. With good investment choices and favourable market conditions, they might even do better than their colleagues by investing the difference in ASC they pay in a PRSA / AVC and then investing in an ARF or purchasing retirement benefits through the Single Scheme purchase facility.

- Purchasing benefits through the Single Scheme purchase facility should probably only be considered towards the end of your career, and definitely not earlier than nine years after you’ve been a scheme member. It might not make sense at all, depending on the rate you have to pay. It probably makes more sense for you to invest your money in an AVC, earn interest on the amount you invest (with tax relief) and then consider whether you want to purchase by way of transfer later on in your career.

- The career average nature of the Single Scheme probably means that you want to start making AVCs very early. Over the course of your career you'll likely receive promotions that drastically increase your maximum pension benefits, but your actual pension benefits will be much lower than the revenue max. If you're an optimist, by investing in AVCs you could essentially "pre-fund" for raises in maximum revenue pension benefits by future promotions. The gap created by the state pension in your benefits likely makes this possible.

Last edited: