I got our house insurance renewal letter yesterday. I had to call them to make sure it wasn't a mistake!

Our premium for this year is 30% of what it was last year - €276 compared to €920.

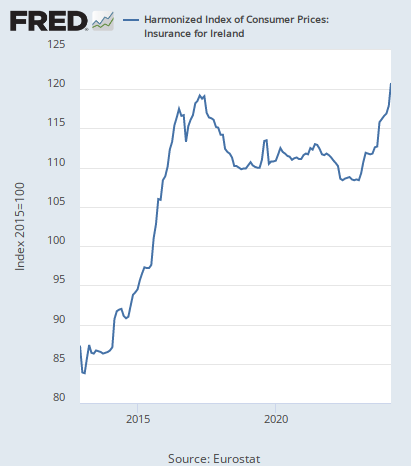

This is on foot of the Central Bank's review of differential pricing in the home and car insurance market.

Hoping to see similar fall in car insurance when I renew that in the summer.

Our premium for this year is 30% of what it was last year - €276 compared to €920.

This is on foot of the Central Bank's review of differential pricing in the home and car insurance market.

Hoping to see similar fall in car insurance when I renew that in the summer.