Rates are frequently updated. Information last changed: 1 April 2024.

Highest Instant Access Rate:

€1 to €50,000 - Trading212 - 4.20%

Selected Instant Access Variable Rate Accounts

Trading212

4.20% on €1+

Trade Republic

4.00% on €0.01 to €50,000

N26: Savings Account

2.80% - 4.00% less fees on €0.01+

Advanzia Bank

3.97% on €5,000+ for first 3 months

1.61% on €5,000+ after the first 3 months.

Plum

3.62% with no fees OR 3.82% with 4.99 GBP+ per month of fees on €1+

Lightyear

3.25% on €1+

Morrow via Raisin Bank

3.03% on €1+

Britline (Credit Agricole): Livret A

3.00% on €10-€22,950 less fees*

Interactive Brokers: IBKR Pro

0% on first €10,000

Up to X%* on €10,000 to €100,000 (rate gradually increases depending on the balance*)

Rate varies frequently according to complex methods, rate seems to be currently normally in the following range of 2.90% to 3.40%* on €100,000+

Bux

2.75% less €2.99 per month on €100 - €100,000

Bunq: Easy Savings

2.46% on €1 to €100,000

Wise.com

2.28% on €68+

TFBank via Raisin Bank

1.76% on €5,000+

Bank of Ireland: 365 31-Day Notice Account

1.00% on €5,000 to €100,000

Bank of Ireland: 31 Day Set Notice Account

1.00% on €5,000 to €100,000

PTSB: 40 Day Notice Account

1.00% on €0.01 +

AIB: Online Notice Deposit 7

0.75% on €0.01 to €1,000,000

NTMA: State Savings: Deposit Account

0.75% on €1+

Permanent TSB: Online Instant Access Account

0.01% on €0.01+

N26: Spaces

0.00% on €0.01+

Notes:

Further Information:

Highest Instant Access Rate:

€1 to €50,000 - Trading212 - 4.20%

Selected Instant Access Variable Rate Accounts

Trading212

4.20% on €1+

- Access: Instant access.

- Interest paid: Daily.

- This rate requires opt-in inside the app.

- Tax: No taxes are deducted at source. A portion of your money is re-deposited in deposits with other banks. Another portion of you money may be invested in a Qualifying Money Market Fund (QMMF) but you will not have a personal stake in the money market fund. Discussion on the applicable tax rate here.

- Fees: There are no fees.

- Protection: (1) €20,000 via Investor Protection (this provides protection against T212 going into liquidation but does not provide capital protection). (2) In addition, the portion of your deposit that is re-invested in deposits with other banks has deposit insurance protection but the portion that is re-deposited and the portion that is in a QMMF is not transparent. (3) In addition, T212 provide 1 million GBP of investor protection insurance via Lloyds but this also does not provide capital protection.

Trade Republic

4.00% on €0.01 to €50,000

- Access: Instant access.

- Interest paid: Monthly.

- This rate requires opt-in inside the app.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- There are no fees.

- Deposit Protection: All funds in the cash account are legally protected up to €100,000 per investor. They are held in an escrow account at one of Trade Republics partner banks. These currently are Solaris SE, J.P. Morgan SE, Citibank Europe plc and Deutsche Bank.

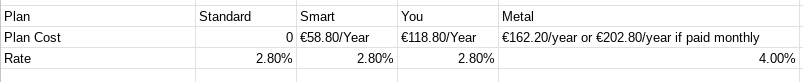

N26: Savings Account

2.80% - 4.00% less fees on €0.01+

- Access: Instant access.

- Interest paid: Monthly.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- Deposit Protection: €100,000 via German Deposit Guarantee.

Advanzia Bank

3.97% on €5,000+ for first 3 months

1.61% on €5,000+ after the first 3 months.

- Access: Instant access.

- Interest paid: Monthly.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- There are no fees.

- Rate applies for new customers only who open an account before the offer expires.

- Deposit Protection: €100,000 via Lux Deposit Guarantee.

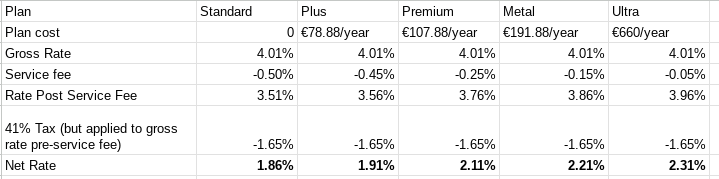

Plum

3.62% with no fees OR 3.82% with 4.99 GBP+ per month of fees on €1+

- Access: Instant access.

- Interest paid: Daily.

- This is classified as an investment product. Money is largely re-invested into a Qualifying Money Market Fund.

- No taxes are not deducted at source.

- As your money is largely re-invested in a Qualifying Money Market Fund an 'exit tax' rate of 41% might apply.

- Fees: None on the basic product. 4.99 GBP per month on the Ultra product which offers the higher rate.

- Deposit/Capital Protection: None. Capital at risk.

Lightyear

3.25% on €1+

- Access: Instant access.

- Interest paid: Monthly.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- There are no fees.

- Deposit Protection: €20,000 via Estonian Investor Protection Scheme.

Morrow via Raisin Bank

3.03% on €1+

- New customers also get €50 if they sign up via a referral.

- Interest paid: Quarterly.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- Tax: Morrow are a non-EU bank. According to Revenue.ie, higher rate tax payers pay 40% tax on non-EU deposit interest. Hence, 40% might perhaps apply as a tax rate for this product if you are a higher rate payer. More discussion on this here.

- There are no fees.

- Deposit Protection: €100,000 via Norwegian Deposit Guarantee.

Britline (Credit Agricole): Livret A

3.00% on €10-€22,950 less fees*

- Access: Instant access.

- *Current account mandatory with this product. One of two current account packages must be chosen, either "Premium" which costs €183.60/year or "Essentiel" which costs €109.80/year.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- Deposit Protection: €100,000 via French Deposit Guarantee.

Interactive Brokers: IBKR Pro

0% on first €10,000

Up to X%* on €10,000 to €100,000 (rate gradually increases depending on the balance*)

Rate varies frequently according to complex methods, rate seems to be currently normally in the following range of 2.90% to 3.40%* on €100,000+

- Access: Instant access.

- Interest paid: Monthly.

- *Firstly, the 'headline rate' needs to be sourced from the Interactive Brokers website. The 'headline rate' varies frequently but is typically currently inside the range of 2.80% to 3.30%. Secondly, a scale applies. For example, if the 'headline rate' is hypothetically 2.622%, a balance of €50,000 earns 1.311% (2.622%/2) because you are half way to €100,000 but the 1.311% only applies to the balance from €10,000-€50,000. Amounts in excess of €100,000 get full 'headline rate' but still have zero applied to the first €10,000.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- There are no fees.

- Deposit Protection: 90% of the first €20,000 via Irish Investor Protection Scheme.

Bux

2.75% less €2.99 per month on €100 - €100,000

- Access: Instant access.

- Interest paid: Quarterly.

- Fees: €2.99 per month service fee.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- Deposit Protection: €100,000 via Dutch Deposit Guarantee.

Bunq: Easy Savings

2.46% on €1 to €100,000

- Access: Instant access. 2 free withdrawals per month.

- Interest paid: Weekly.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- There are no fees on the Easy Savings account.

- Deposit Protection: €100,000 via Dutch deposit guarantee.

- This is a Money Market Fund (MMF) product.

- Access: Instant access.

- Exit Tax is deducted at source.

Wise.com

2.28% on €68+

- Access: Instant access.

- Interest paid: Monthly.

- DIRT is not deducted at source. Deposit interest needs to be declared to the Revenue.

- There are no fees.

- Deposit Protection: €20,000 via Investor Protection.

TFBank via Raisin Bank

1.76% on €5,000+

- New customers also get €50 if they sign up via a referral.

- Minimum: €5,000.

- Tax: DIRT not deducted at source. Deposit interest will need to be declared to the Revenue.

- Deposit Protection: €100,000 via Swedish Deposit Guarantee.

Bank of Ireland: 365 31-Day Notice Account

1.00% on €5,000 to €100,000

- Access: 31 days notice required for withdrawals.

- Online and by phone only.

- Deposit Protection: €100,000 via Irish Deposit Guarantee Scheme.

Bank of Ireland: 31 Day Set Notice Account

1.00% on €5,000 to €100,000

- Access: 31 days notice required for withdrawals.

- Deposit Protection: €100,000 via Irish Deposit Guarantee Scheme.

PTSB: 40 Day Notice Account

1.00% on €0.01 +

- Access: 40 days notice required for withdrawals.

- Deposit Protection: €100,000 via Irish Deposit Guarantee Scheme.

AIB: Online Notice Deposit 7

0.75% on €0.01 to €1,000,000

- Access: 7 days notice required for withdrawals.

- Interest paid: Bi-annually in April and October.

- Online only.

- Customers must already have an AIB account and be registered for phone and internet banking.

- One withdrawal per notice and at most one notice pending at any time.

- Lodgements/withdrawals can only be made from another AIB account. Therefore, customer must keep another AIB account open.

- Deposit Protection: €100,000 via Irish Deposit Guarantee Scheme.

NTMA: State Savings: Deposit Account

0.75% on €1+

- Access: Instant access.

- Interest paid: Annually.

- No online access provided.

- This State Savings account is subject to normal DIRT.

- Deposit Protection: Unlimited via Irish government guarantee.

Permanent TSB: Online Instant Access Account

0.01% on €0.01+

- Access: Instant access.

- Interest paid: Annually on first working day after 20 November.

- Online only.

- Joint accounts not allowed.

- Deposit Protection: €100,000 via Irish Deposit Guarantee Scheme.

N26: Spaces

0.00% on €0.01+

- Access: Instant access.

- Online only.

- Ability to open multiple savings accounts (2-10 depending on the current account product). Each savings account can be labelled with a purpose in mind. For example, holidays etc.

- Deposit Protection: €100,000 via German deposit protection.

Notes:

Further Information:

- Instant access and notice account rates and products change frequently. Ensure you regularly check your rate to ensure you are getting the best return for your money.

- All rates are AER.

- Post updates / suggestions in the deposits and savings forum.

- If you want to save on a regular basis, you should also consider regular saver accounts, some of which offer higher rates, than some of the instant access accounts above.

- There are other best buy threads for term deposits, regular saver accounts and current accounts.

- If you want email updates on instant access and notice account rate changes, you can subscribe to this thread.

Last edited: