For anyone who has been implementing a simple index strategy via a Davy self-directed PRSA by purchasing Vanguard Global Stock Index Fund (ISIN IE00B03HD19) and either euro-hedged Vanguard Global Bond Index Fund or Vanguard Euro Government Bond Index Fund shares and rebalancing periodically, transferring their PRSA to Standard Life as a direct client would seem (to me anyway) to make sense now given the impending fee increase, regardless of whether their balance is under or over €50,000.

The life assurance companies are frustratingly opaque regarding costs etc., but Standard Life are better than the other providers. It took me some time, but I did a little digging, and from what I can tell, their headline AMC (annual management charge) of 0.90% on the Vanguard Global Stock Index Fund appears to be a pretty accurate representation of the total costs that a retail investor would incur. (Hopefully, the same is true of the other Vanguard funds that they offer, which I did not have time to investigate as carefully.)

The underlying fund that the Standard Life Vanguard Global Stock Index mirrors is the Vanguard Global Stock Index Fund (ISIN: IE00B03HD19) which is the same as the fund available from Davy. It tracks the MSCI World Index of large and mid-cap companies across 23 developed markets, so unfortunately you don’t get small-cap or emerging market exposure, but the difference between the MSCI World Index and the more comprehensive MSCI ACWI IMI Index (which tracks large, mid, and small-caps across developed and emerging markets) is not enormous. (The MSCI World Index has done slightly better over the past ten years owing to recent US outperformance and emerging market and small cap underperformance, but that could change of course.) The underlying fund’s OFC (ongoing charges figure) is 0.18%.

According to the Standard Life Fund Centre, their Vanguard Global Stock Index Fund was launched on 14 February 2018:

https://investorhub.financialexpress.net/brokerzone?defaultcategorycode=SyPRSA

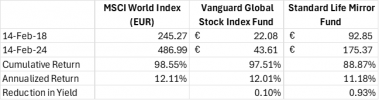

Standard Life also makes historical prices available online via their Fund Centre, so I checked the prices on the inception date and 6 years later on 14 February 2024 against the corresponding historical closing prices in euro of the MSCI index, which I got from Investing.com:

https://www.investing.com/indices/msci-world-net-eur-historical-data

…and of the underlying Vanguard fund, which I got from the

Financial Times:

https://markets.ft.com/data/funds/tearsheet/historical?s=IE00B03HD191:EUR

Here are the results, which I tabulated in Excel:

As you can see, the annualized return on the underlying Vanguard fund over the past 6 years is only 10 basis points lower than the return on the index, which is less than the ongoing charges figure of 18 basis points, reflecting Vanguard’s skill in index fund construction and management. And the reduction in yield on Standard Life’s mirror fund is only 3 basis points higher than their advertised AMC of 90 basis points.

I double-checked my numbers, so I think they’re correct, although I can’t guarantee it, but the results confirm the helpful total cost assessment of 0.92% by

@LDFerguson upthread and constitute good reason to think there are no further hidden expenses. In any case, the original data can be accessed via the links above. And, as LDFerguson also pointed out, there is a 25 basis point rebate available from Standard Life for balances over €100,000. I hope this analysis is of use to anyone considering their options in light of the Davy fee hike.