I took out a car loan and I am paying it off very early (after 4 months) but I'm shocked about how much the interest is front loaded on this. When asking the lender about it they have said it is because interest is being calculated by the rule of 78.

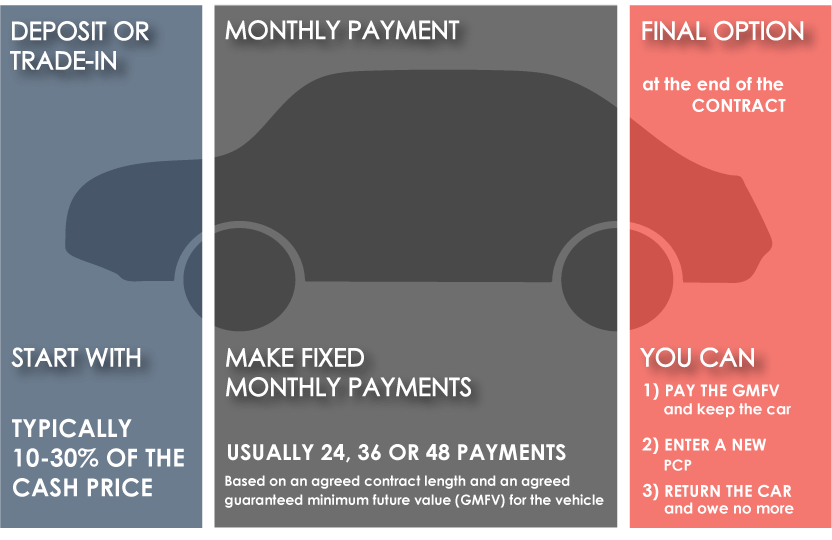

I took out a 4 year PCP loan at 4.9%, the total of the loan was €79,390.63 and the GMFV after 4 years was €31,014.84.

I've paid 4 months at €1244.10 each month so a total of €4976.40.

Now if I pay the loan off this month I will owe €76,947.68, so I've managed to pay €2442.95 of the loan and paid €2533.45 in interest.

Using this calculator here it is calculating that I would owe €75,710.82, which is a difference of €1236.86.

When asking BMW about this, they are saying that there are calculating the interest payments using the rule of 78 which seems to penalise early repayment compared to how it is calculated above.

Looking through the contract it doesn't mention how interest is calculated, and no mention of how early repayments are calculated. How does one get some transparency here?

I took out a 4 year PCP loan at 4.9%, the total of the loan was €79,390.63 and the GMFV after 4 years was €31,014.84.

I've paid 4 months at €1244.10 each month so a total of €4976.40.

Now if I pay the loan off this month I will owe €76,947.68, so I've managed to pay €2442.95 of the loan and paid €2533.45 in interest.

Using this calculator here it is calculating that I would owe €75,710.82, which is a difference of €1236.86.

When asking BMW about this, they are saying that there are calculating the interest payments using the rule of 78 which seems to penalise early repayment compared to how it is calculated above.

Looking through the contract it doesn't mention how interest is calculated, and no mention of how early repayments are calculated. How does one get some transparency here?