I was reading this post from @Okokokoknic from last month where they said:

And up to about two days ago, Ulster Bank's website said:

Screenshots:

Now that question and answer has gone from Ulster Bank's website, and some UB mortgage holders are saying that they did not get the two months' notice that they were promised. As a result, some of them have missed the chance to fix/re-fix on a good UB fixed rate and can now only fix on PTSB's higher rates.

For example:

The last email I have from UB relating to my mortgage is from Dec 2021:

It is likely that your mortgage will transfer to Permanent TSB in the future and as part of the Consumer Protection Code obligations we will write to you a minimum of 60 days in advance of any transfer. Please be assured that this announcement does not affect your legal and regulatory protections.

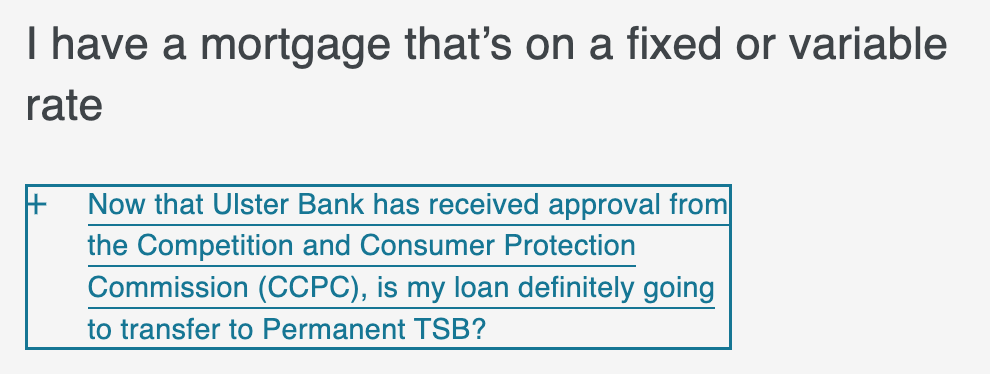

And up to about two days ago, Ulster Bank's website said:

Now that Ulster Bank has received approval from the Competition and Consumer Protection Commission (CCPC), is my loan definitely going to transfer to Permanent TSB?

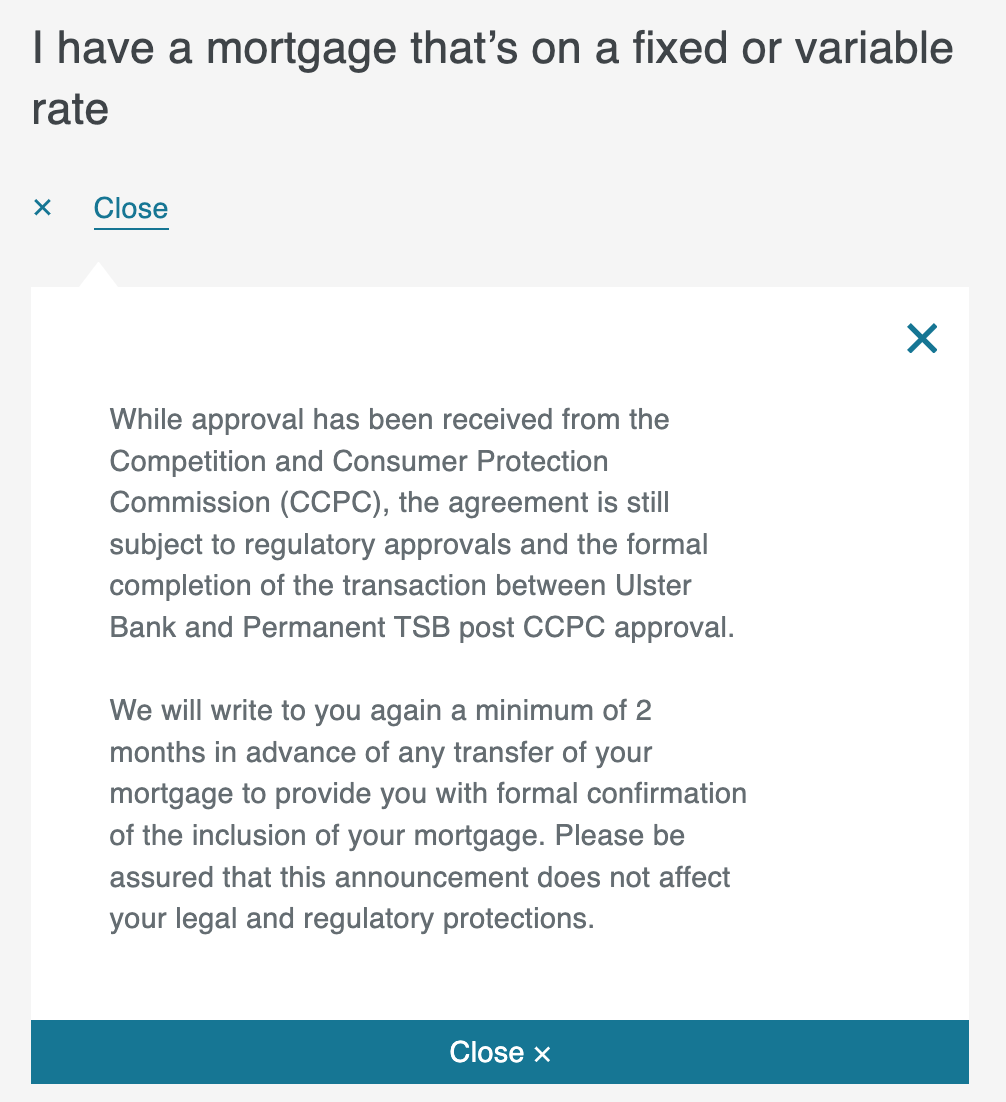

While approval has been received from the Competition and Consumer Protection Commission (CCPC), the agreement is still subject to regulatory approvals and the formal completion of the transaction between Ulster Bank and Permanent TSB post CCPC approval.

We will write to you again a minimum of 2 months in advance of any transfer of your mortgage to provide you with formal confirmation of the inclusion of your mortgage. Please be assured that this announcement does not affect your legal and regulatory protections.

Screenshots:

Now that question and answer has gone from Ulster Bank's website, and some UB mortgage holders are saying that they did not get the two months' notice that they were promised. As a result, some of them have missed the chance to fix/re-fix on a good UB fixed rate and can now only fix on PTSB's higher rates.

For example:

- 5-year fixed rate, loan-to-value (LTV) less than 80%:

- Permanent TSB: 3.0%

- Ulster Bank: 2.45% (or 2.2% of your mortgage balance is over €250k!)

- 10-year fixed rate, loan-to-value (LTV) less than 60%:

- Permanent TSB: not available

- Ulster Bank: 2.8%

Last edited: