Brendan Burgess

Founder

- Messages

- 55,577

https://www.centralbank.ie/statisti...owers-facing-end-of-term-repayment-shortfalls

From the Conclusion at the end: (The rest of the extracts are in order of appearance in the paper.)

The data illustrate that the current levels of, and approach to, long-term restructuring are not sufficient to solve the problems for all these borrowers. In summary, there are accounts with restructuring arrangements that even if successfully adhered too will not result in full repayment.

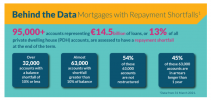

This "Behind the Data" (BTD) estimates the size of the cohort of mortgage borrowers facing repayment shortfalls. It is the first data collection of firms’ assessments on the long-term sustainability of all PDH mortgage accounts, assessed by the borrowers’ ability to repay the full final balance at the end of the term.

, as at March 2021, around 13 per cent of all PDH mortgage accounts are assessed by firms to have a shortfall in repaying the balance at the end of their term. By further segmenting this cohort into different groups, we differentiate according to the level of shortfalls and complexity of circumstances.

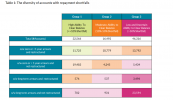

There are four separate categories:

The scale of the shortfall is categorised by firms into four groups which are:

79 per cent of accounts have positive equity (i.e. the outstanding loan is less than value of property) with the remainder in negative equity.

From the Conclusion at the end: (The rest of the extracts are in order of appearance in the paper.)

The data illustrate that the current levels of, and approach to, long-term restructuring are not sufficient to solve the problems for all these borrowers. In summary, there are accounts with restructuring arrangements that even if successfully adhered too will not result in full repayment.

This "Behind the Data" (BTD) estimates the size of the cohort of mortgage borrowers facing repayment shortfalls. It is the first data collection of firms’ assessments on the long-term sustainability of all PDH mortgage accounts, assessed by the borrowers’ ability to repay the full final balance at the end of the term.

, as at March 2021, around 13 per cent of all PDH mortgage accounts are assessed by firms to have a shortfall in repaying the balance at the end of their term. By further segmenting this cohort into different groups, we differentiate according to the level of shortfalls and complexity of circumstances.

There are four separate categories:

- Account is currently in arrears; and/or

- Account has not made full capital and interest monthly payments for the last 12 months under an existing alternative repayment arrangement; and/or

- Repayments under an existing alternative repayment arrangement will not lead to full repayment of the account by the maturity date, and/or

- Account is classified as in default or non-performing under international accounting standards.

The scale of the shortfall is categorised by firms into four groups which are:

- High ability to repay balance: the shortfall is assessed to be 10 per cent or less; or

- Moderate ability to repay balance: the shortfall is greater than 10 per cent but less than 50 per cent; or

- Low ability to repay balance: the shortfall is at least 50 per cent, or

- Uncertain ability to repay: the scale of the shortfall is uncertain because there are not sufficient details or engagement between the firm and the borrower to facilitate the assessment. These borrowers are expected to be primarily in the "low" ability to repay category.Accordingly, the low and uncertain groups are consolidated in the analysis presented in this paper.

79 per cent of accounts have positive equity (i.e. the outstanding loan is less than value of property) with the remainder in negative equity.

Last edited: