Shame to hear you're having issues Freelance. Just for balance, I've had none with Bunq, either during sign up, or usage. I've no affiliation with them, just a happy customer, someone who is really pleased to see this type of competition in the market place.I am experiencing the exact same issue with BUNQ. Started the "5 minute" sign up process on Wednesday of last week. A week after I am still waiting for a verification code or a means to jump to the next step. Customer Support worse than useless - try this, try that (remove/reinstall, reboot, delete, yada yada, all of which were irrelevant and resolved nothing). Finally called them out on it being a known bug with their systems, which they eventually acknowledged. It's now been "passed to developers to investigate with their SMS messaging partner blah blah. Having had a few less than positive experiences while dealing with banks via online platforms (Northern Rock, Ulster Bank, KBC) this is not really inspiring much confidence.

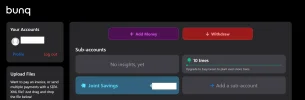

To me Bunq remains one of the most compelling offerings for an instant access savings account. No intermediaries, full EU/Dutch deposit guarantee, good app, interest paid monthly, and the latest thing I spotted, they even tell you the interest accrued/earned during the month before its paid. My only criticism is that they haven't passed on the recent ECB rate increases, but when you have the likes of BOI launching their new savings product at 1.5%, Bunq are already ahead of the game.