I recently had a chat with a BOI wealth advisor who proposed a 100% Capital Protected bond. Its main attributes are:

Assuming the deposit is less than €100k, the investment is similarly protected. The 3.6% AER is nearly as high as the 3.86% BOI product best-case scenario, and it doesn't require a long-term commitment.

Am I overlooking something here?

Thanks

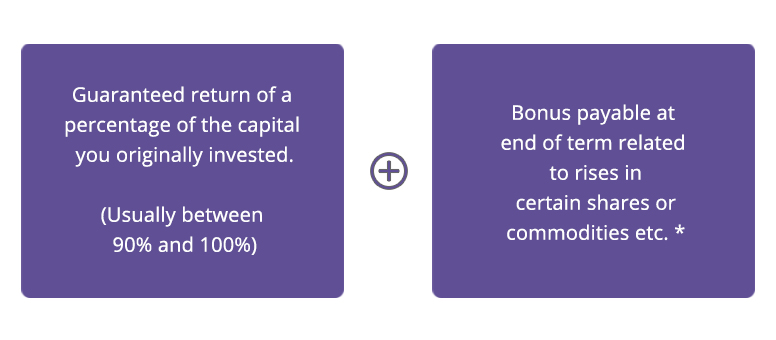

- It follows the performance of the EURO STOXX 50® Index.

- It has a duration of 5 years and 11 months.

- The Return on Investment ranges from 0% to 25%. In other words, your initial investment is secure, and you cannot lose your capital. However, if the return exceeds 25%, it is capped.

- No management fees

Assuming the deposit is less than €100k, the investment is similarly protected. The 3.6% AER is nearly as high as the 3.86% BOI product best-case scenario, and it doesn't require a long-term commitment.

Am I overlooking something here?

Thanks

Last edited: