|

CHAPTER 4 WHY YOU SHOULD INVEST IN THE STOCKMARKET

1. The stockmarket is a lot less risky than a deposit account

2. The stockmarket dramatically outperforms deposit accounts

3. You don't need any expertise to invest in the stockmarket

|

Market

update 1 September 2002

European and American stockmarkets hit a high in early 2000 and since then have fallen by up to 50%. Someone who invested in the Eurostoxx 50 at the peak and sold out at the low point, lost 50% of their investment. Many are saying that these stockmarkets were obviously overvalued back then. They add that it may take 10 years to reach their former highs. But the only really relevant question is whether or not it is right to invest in the stockmarket now! If stocks have fallen by 50%, they are better value now than they were when they were when they were twice the price. In the past, investors who bought in at the very top of the market, still outperformed depositors, although it may have taken 10 or 20 years to do so. People who invested at the low point in the stockmarket have outperformed depositors from the very start. But it is psychologically very difficult to invest after such heavy falls. These falls underline that the stockmarket can and does fall very sharply at times. So does the advice in this book hold good? Yes, I think it does. Over the medium to longer term, the stockmarket should outperform all other forms of investment. |

|

THE

STOCKMARKET IS A LOT LESS RISKY THAN A DEPOSIT ACCOUNT

|

Over The Medium To Longer Term, There Is Very Little Risk In The Stockmarket

When people think of the stockmarket, they think of the Wall Street Crash, eircom and dot.com disasters. But a well diversified investment in the stockmarket has negligible risk and certainly is less risky than a deposit account.

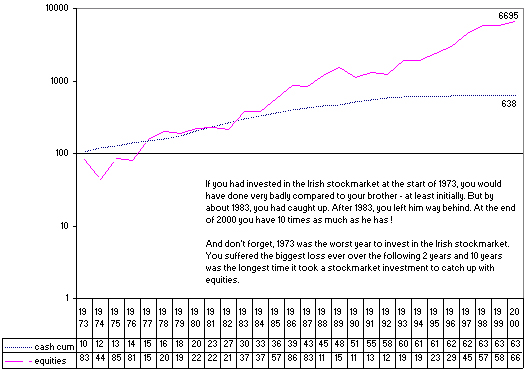

To illustrate this, have a look at Chart 4. The period beginning in 1973 was the worst period for the Irish stockmarket. Say that your father gave your brother and you £100 each at the beginning of 1973 and you both decided to put it away for your children. You chose the stockmarket while he chose a "safe" deposit account.

In 1973 you would have lost 17% of your money. Your brother got 8% interest on his deposit account, so he had 25% more than you by the end of 1973. But things got worse the following year. Your investment went down a further 47%, while his rose by a further 11%. Your brother now had £120 in his bank account while you had only £44 worth of shares. Disaster? Only if you cashed your shares at that stage. But if you left them, you would have been slightly ahead by the end of 1977. The high deposit rates of 1981 and 1982 gave him back the lead, but only temporarily. Since 1983, you haven't looked back. Ten years later, you had 3 times his amount and by the year 2000, you had £6,695 in trust for your child, while he had a miserly £638.

1990 was the second worst year to invest in the Irish Stockmarket. If you had put half your money in a deposit account and half in shares, your stockmarket investment would be worth 3 times as much as your deposit account at the end of 2000 i.e. only 11 years later.

The

worst starting year for the Irish Stockmarket

REGULAR INVESTORS IN THE STOCKMARKET FACE EVEN LOWER RISK.

Someone who invested a lump sum in the stockmarket in 1973 would have had to wait 10 years to catch up on a deposit account. A lump sum investor in 1990 would have had to wait 5 years.

But most of us invest in smaller amounts over time. This means that we are never going to make all our investments at the worst times. We are likely to pick some bad times, some good times, but mostly average times. And such a regular investor will get even better returns than those received by the 1973 investor.

THE HIGHS AND LOWS OF THE IRISH STOCKMARKET

| Worst years since 1966 | Best years since 1966 | ||||||||||||||||||||||||||||||||||||

|

|

You can see from this table that there weren't too many bad years in the Irish stockmarket. There were 10 years when the returns exceeded 40% and only one year when the loss exceeded 40%. This is a risk worth taking.

HOW RISKY HAS IT BEEN INVESTING IN THE STOCKMARKET IN OTHER COUNTRIES?

The Irish data is reliable back as far as 1966. That is only 35 years. So let's look at the experience in other countries.

The best known crash was the Wall Street crash of 1929. But by 1937, the stockmarket was back to its 1929 level. It went down below that level for the next few years, but by 1945 it reached the 1929 peak and remained above it since. So that was a 16 year wait.

More recently, the stockmarket reached a peak in 1968 and did not return to that value until 1980.

It is estimated that equities outperformed cash in 94% of 20 year periods and in all 30 year periods since 1871.

Since 1869, the UK stockmarket has declined in real value in only 10% of 10 year periods. Deposit accounts have declined in value in 30% of ten year periods. In other words, you are three times more likely to lose money in a deposit account than in the stockmarket.

We saw in the last chapter than German depositors were wiped out in 1922 and Japanese depositors were wiped out after the second World War. Despite two world wars, the stockmarkets in both countries recovered eventually. The depositors never recovered.

The Japanese stockmarket hit a peak in 1992 and is still 65% below that peak 10 years later. This is a disaster for Japanese stockmarket investors, but not nearly as bad as the disastrous 99% loss by Japanese depositors in 1942.

But isn't now a bad time to invest?

The stockmarket is very volatile. It is rarely valued correctly. Sometimes it is overvalued and sometimes it is undervalued. With foresight, you would have sold out at the peaks and bought in at the troughs. But, it is very difficult, if not impossible, to identify an overvalued market. If you do correctly identify an overvalued market and sell your shares in time, you will have to buy back in again at the right time. But the stockmarket has a habit of suddenly jumping in value when you expect it least.

I don't know

if the stockmarket is overvalued at the moment. And I don't know of anyone

who has a good long term record of predicting the turns in the market.

Just to be on the safe side, what about putting 50% of my money in shares and the balance in cash?

Look again at Chart 4. An investor who split his money in two, just to be on the safe side, back in 1990 has about £570 now for a £200 investment. An investor who put all his money into the stockmarket, now has £870.

You are better off investing 100% in the stockmarket. But this assumes that you will not panic when the stockmarket crashes. If keeping a part of your savings in cash, minimizes the chances of you panicking , then it is probably an acceptable strategy. It will cost you money in the long term, but you might sleep more easily at night.

| A Counterview

by Contrarian

The Stockmarket is not necessarily the best place to invest and you should not invest 100% of your money in the stockmarket. It

is agreed that the stockmarket has outperformed all other assets

in the past. When Brendan wrote his book, the valuation of the stockmarket assumed a continuation of the wonderful economic times of recent years and no disasters such as a war or an oil price increase. The attacks on the Twin Towers and the Pentagon showed how overvalued the markets actually were. Anyway Brendan's objective in maximizing the returns on your investment is not the right objective. You should be aiming to get a good return on your investments under all conditions - good and bad. You should be prepared to sacrifice some return for greater stability in returns. Brendan suggests investing 100% in the stockmarket. I suggest always keeping at least 30% in cash or gilts. The stockmarket is still overvalued and the outlook is very unclear, but it is not as overvalued as it was. The Irish stockmarket, in particular, looks like good value at the moment. |

|

THE

STOCKMARKET DRAMATICALLY OUTPERFORMS DEPOSITS

|

Look again at Figure 4. Over the 27 year period, £100 in the Irish stockmarket grew to £6,695 while £100 in a deposit account grew to only £638. And we have to keep reminding you that this was the worst period for the Irish stockmarket. Table 4 goes back to 1966 and is a more typical period.

| Table 4 | Average returns since 1966 | Value at the end of 2000 of £100 invested in 1966 |

| Irish stockmarket | 16% | £18,400 |

| Irish deposit account | 6½% | £930 |

| Irish inflation | 7½% | £1,280 |

These returns will be reduced by charges and taxation

From Table 4, it can be seen that the Irish stockmarket returned about 8% a year more than inflation. So if you have a lump sum of £100,000 to invest, you could have spent about £8000 a year while still maintaining the real value of your investment.

It will be lowered by income tax and Capital Gains Tax.

If you invest through a unit-linked fund instead of directly in shares, the real return will be further reduced by between 1½% and 2% annually due to the impact of charges.

By comparison, if you had left your money in a deposit account and accumulated the interest, the real value of your investment would have declined slowly over the period.

The same is found in other countries

This great performance of the stockmarket is experienced in all other countries as well. Stocks have outperformed deposits by about 6% or more in America, Britain and Europe over the long term.

|

YOU

DON'T NEED ANY EXPERTISE TO INVEST IN THE STOCKMARKET

|

| Investing in the stockmarket is really simple. Spread your money equally among the top ten Irish companies and do nothing else. (There are three banking stocks in the top 10, so you might want to select just two of them, so as not to have 30% of your portfolio in banking). You don't need to monitor your investments. You don't need to keep buying and selling. You don't need to read annual reports or stockbrokers' reports. You can if you want to, but there is no benefit in doing so. |

If you decide to invest in property, you will need a certain amount of expertise. You will have to know which areas are likely to do well. You will need to know how to deal with auctioneers, solicitors and tenants. You will need to comply with various local authority requirements. You will probably need to be good at DIY and decorating.

If you invest in the art market, you will also need a lot of expertise. Which artists are likely to do well and what is a fair price for a particular painting. It is easy for the novice to get ripped off by the professionals.

But the stockmarket is much simpler. The price of shares is determined in an open market. And this market is fairly efficient. There are lots of analysts studying the companies and their combined knowledge is reflected in the price of the shares. Shares are overvalued and undervalued from time to time, but not for very long. The market makes mistakes but corrects them quickly.

You buy shares in the top companies at the same price as everyone else.

So all you have to do is to split your money in 10 equal parts in the top 10 companies on the Irish Stock Exchange. You will be investing mostly in household names such as AIB, Smurfits, CRH and Irish Life and Permanent.

And once you have bought them, hold on to them for the longer term.

And don't try to second guess the market. If you are arrogant enough to think that AIB is better value than Bank of Ireland, don't sell your Bank of Ireland shares to buy more AIB. You are just as likely to be right as you are to be wrong. And all that will happen is that you will end up reducing your overall returns by incurring more stockbroking commissions and stamp duty.

The secret to making money, and it's a widely known secret, is to buy and hold your shares.

And if you find buying shares directly too much hassle, then you can buy a unit-linked fund and get a professional manager to buy the shares for you. We don't recommend this as the costs are very high, but you might feel more comfortable doing so.

Why are you recommending 10 Irish shares ? Should I not diversify overseas ? Is 10 shares enough ?

Ten shares is certainly enough to get adequate diversification. There is a misconception that you need hundreds of shares to be fully diversified, but this is incorrect. Having bought 10 shares, the 11th and each subsequent share reduce the risk by negligible amounts.

The answer

to diversifying overseas is less clear cut. For most people diversifying

overseas is not really an option. Buying shares in overseas companies,

apart from the UK, is expensive and is a major administrative headache.

There probably is some useful risk reduction gained by investing in European

shares, but I doubt if it is significant enough to warrant the extra hassle

involved. Irish shares are very well diversified overseas with at least

50% of the top 10 companies' profits coming from outside Ireland. But

if you do want to invest overseas, unless you are investing very large

sums, you should probably buy one of the low cost index trackers available

from Quinn Life.

|

PITFALLS

TO AVOID

|

|

If

you buy and hold a diversified portfolio of shares you will be taking

very little risk and you will earn a good return from the stockmarket

in the longer term. Any other strategy is risky. |

Don't

panic at the first wave of pessimism.

The secret to stockmarket success is patience. If you sell all your shares

at the first stockmarket crash, you will probably lose money. You must

realize that investment is a long term process and shares will eventually

recover. Look again at Figure 4. If you had invested at the start of 1973

and panicked at the end of 1974, you would have lost over 50% of your

money. If you had stayed in the market, you would have recovered your

losses within 2 years!

Don't

panic when one of your shares does badly.

If you have a portfolio of 10 shares, you are bound to have winners and

losers. It will be depressing watching one of your shares doing badly.

But don't worry about it. Your portfolio will be up as a whole and some

of the big winners will compensate for the occasional losers.

Don't

try to beat the market

Be satisfied with the average returns from the stockmarket. 7% a year

after inflation should be enough for anyone. The top companies are analysed

in detail by professional analysts. It is highly unlikely that you will

be able to consistently second guess them and identify undervalued shares.

It seems easy to do, but in reality, it is almost impossible. Strangely

enough, even if you work in a particular industry, it is still very unlikely

that you will be able to identify companies in that industry which are

undervalued.

Don't

be tempted by stockmarket tips

Stockmarket tips are not worth anything. And it doesn't matter how reliable

your source is. It might surprise you to learn that company directors

often buy or sell their shares at the worst time.

Don't

invest in just one or two shares.

No matter how good a company is, don't put more than about 10% of your

portfolio in it. Eircom was regarded by most people as a dead cert. It

was a good investment at the time, but times have changed. If eircom was

your only investment you have lost money. If it was only one of a portfolio

of shares, gains on the other shares will compensate you for your losses

in eircom.

Don't

invest everything in one or two sectors.

No matter how attractive a sector might appear, it should only form part

of your portfolio. It was very difficult for long term, sensible investors

to listen to foolish investors talking about the huge gains they were

making in the dot.com sector. But the dot.com investors lost almost everything

while the steady, boring investors continue to grow at a steady pace.

Don't

buy and sell frequently.

If you read the paper, they will tell you AIB is overpriced and Bank of

Ireland is underpriced. So you sell AIB and buy Bank of Ireland. This

messing about only serves to enrich the stockbrokers. It reduces your

profits by the huge amounts which go on stockbrokers' fees and stamp duty.

Simply hold your original shares through thick and thin.

Don't

follow any stockmarket mantra

"No

one ever lost money taking a profit"

"Run you profits and cut your losses"

"buy more of a losing share to benefit from pound cost averaging"

These simplistic and often contradictory statements have a peculiar appeal. But they increase the amount of trading and so increase your costs. Avoid them

Don't waste your time and money studying technical analysis or astrology or any other system

Despite all the evidence to the contrary, some people will continue in an unshakeable belief that they can see patterns in stock price movements. Humans do try to force patterns on our experiences and so it is tempting to see patterns in the movement of stock prices. Again, this mistaken belief will be reinforced occasionally by its apparent success.

Don't

borrow to invest in the stockmarket.

Borrowing can dramatically increase your profits. If you borrow at 6%

and make a return of 10%, you will become rich over time. But borrowing

dramatically increases your risk. If the stockmarket plunges, you will

get nervous and be tempted to sell to cut your losses. Even if you keep

your nerve, your bank manager might get nervous.

Remember that if you have a significant amount outstanding on your mortgage while you are investing in the stockmarket, you are effectively borrowing to invest in the stockmarket. If your mortgage is at a comfortable level (i.e. less than one years salary), then this is a reasonable approach. However, if you have a high mortgage, you would be better off making additional payments against your mortgage to pay it off earlier.