DublinHead54

Registered User

- Messages

- 1,052

All,

There is a huge amount of information and polarizing opinions on Bitcoin and other digital assets spanning all information mediums. Most people via mainstream media will have some awareness of Bitcoin and may have heard about potential financial gains to be made. I find with the vast array of information it is difficult for a new market participants to find the information required to help form an opinion and make an investment decision (should they chose to). I thought it would be useful to provide objective information for those considering an investment, leveraging my own experience and feedback from knowledgable users on this forum. Objectively to highlight the key items for consideration when forming opinions.

This information is intended to be used in the context of the site it is being posted on, an Irish consumer forum. I am not advocating for or against Bitcoin, but simply providing information to help others form an opinion. I will focus first on Bitcoin and then introduce other Digital Assets, platforms and concepts. The aim is to present information that helps an investment decision to be made today based on known tangible information.

I will start by saying as of June 2021 Bitcoin remains a volatile asset, as such any investment can lose value.

Often in the discourse of digital assets future events are used as a supporting narrative. However, whilst it is important to recognize digital assets as an evolving space, future enhancements do not guarantee a return. As such, when considering future developments / enhancements and the impact on Bitcoin or other cryptocurrency they are not guaranteed. For example, in interest rate markets we know with a degree of certainty the Fed will make announcements on their rate policy every quarter and predictions are made. Similarly in Bitcoin we know for certain that the bitcoin reward will reduce in future and as such the impact on price can be theorized. What is harder to predict is the impact on price by the introduction of a new en-hancement or further adoption. As such, I recommend that you form your own opinion on items like this.

I will edit and add to this over the coming days, please comment below for topics you want to be covered.

Taxes

All relevant Irish tax treatment of Cryptocurrencies can be found below.

www.revenue.ie

www.revenue.ie

Bitcoin: What is it?

The following is the first sentence in the Bitcoin Whitepaper:

"A purely peer-to-peer version of electronic cash would allow online

payments to be sent directly from one party to another without going through a

financial institution."

Bitcoin is a peer-to-peer (distributed) payment system, the use of cryptography (hashing / proof-of-work removes the need for a central body or third party to validate transactions. This is different to our current monetary system which requires intermediaries to validate each transaction and is a trust-based system. Bitcoins are created (mined) through the algorithmic validation (Proof of Work) process, with there being a total 21 million supply, and each Bitcoin is divisible to 0.00000001 BTC (1 Satoshi).

As of 2021, an individual's easiest method to gain direct exposure to BTC is by purchase on a 'Crypto Exchange'. There are other methods like buying in a direct peer to peer transaction but those are likely not available to everyone.

Yes that is correct as of 2021 you do have to trust a third party private company to purchase Bitcoin, and that is an evolution from the initial whitepaper. This point is a very important point for prospective investors and their security, and is not at the forefront of the Bitcoin rhetoric. Whilst Bitcoin transactions are immutable and the cryptographic techniques provide security, if you purchase Bitcoin on an exchange it is no different to keeping your savings in a bank account (minus the Deposit protection insurance). That is why it is imperative that you transfer your holdings into your own private wallet that only you have access to (more on that late).

Bitcoin: Is it a currency or a store of value?

A highly controversial topic. Bitcoin has a value so it can be used as a means of payment, there is no doubted that, but it is not currently used as a mainstream currency. In 2020 we say Paypal announce it would accept BTC as a payment means in the US, however this is where friction exists with the current fiat system. Paypal is a regulated entity, the US Government treat the sale of Bitcoin as Capital Gains event, as such if you were to use Bitcoin it would be a tax event. Paypal would accept the BTC and convert it to USD to complete the payment as well. In recent weeks (not yet live), El Salvador made the move to accept BTC as legal tender.

The bigger adoption of BTC is as an asset with a store of value, we have seen a small number of firms (Microstrategy being the largest) start buying and holding BTC on balance sheet as a treasury type asset.

In summary, Bitcoin currently is used mainly as a store of value, but there is adoption of it as a legal tender. I will update this thread as the El Salvador project rolls out.

Bitcoin: What's the Risk?

There is always risk involved with any investment, anybody that advises otherwise should be ignored. The question is how much risk? Can we quantify that risk and does that risk fit into an investors risk appetite? There are two ways I think about this, the first is the risk of the asset itself and the second is the risk in an investors portfolio.

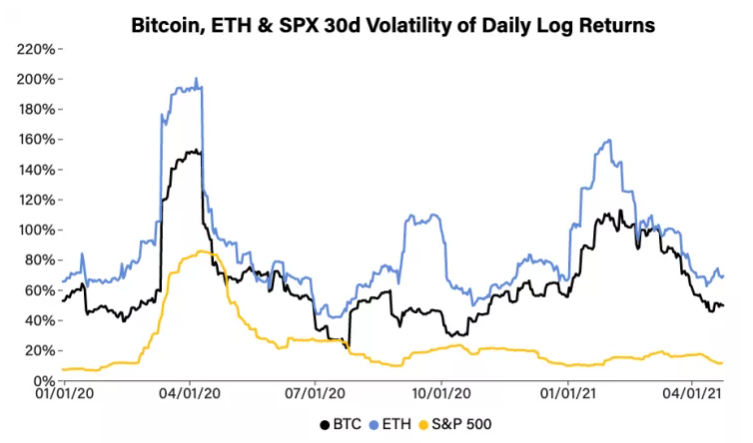

1. The simplest metric to quantify risk is to look at volatility of an asset and thus the returns. The simple view is the more volatile an asset is the riskier it is, or put in another way you should expect a greater return for taking a greater amount of risk. In terms of risk generally it goes from least risky to most; cash --> bonds --> equity. Within each of these markets there are different levels of risk yielding different returns i.e. Greek bonds earn a better yield than US treasuries, but you accept more risk purchasing a Greek bond. There is also the concept of assets that in benefit in a risk off environment, this is often called flight to quality and why you will see the yields on US treasuries decrease, when Equity market decreases as investors seek safety. At this point I have not seen concrete evidence to suggest that Bitcoin or other Cryptocurrencies will operate as safehaven assets. Bitcoin and other cryptocurrencies should currently be considered riskier than Equities. The chart below supports this hypothesis, showing that since 2020, BTC is more volatile than the returns of the S&P500 (broad representation of US equity markets).

2. No financial advisor should advise you to invest all your portfolio in one asset, and Bitcoin /Digita Assets are no different. Out of investable asset classes, crypto is currently the riskiest and thus should only form a small part of any portfolio. Ensuring diversification in your portfolio is key, and would position you to benefit from digital asset as the market matures, whilst also not risking everything.

A very important point is that Bitcoin is often presented as digital currency outside of the control of central banks and governments. However, for the vast majority who are unable to mine BTC or mined BTC in the early days, the main way to access BTC is via third parties that operate in regulated entities. Thus, governments or regulators can control to an extent your interaction and this is another reason why it is key that you do not keep your main holdings in a wallet on an exchange. Going forward we may see traditional investment products available such as ETFs or other custodian services offered by banks that retail investors can access through their current brokers etc.

Decentralized Finance: Yield for Investors

This is an emerging area and whilst it is risky due its novel nature, the returns are less volatile and more stable. Up until recently Stablecoins (digital assets pegged to a fiat currency) have maintained parity with its fiat equivalent by holding the fiat equivalent. These coins are a popular vehicle to convert Bitcoin or other volatile assets into without having to completely convert to fiat. As such an investor will earn nothing by holding Stablecoins directly.

However, as DeFI is emerging there are services in which you can loan these assets to an in reward be paid an interest rate. Think of it like how Banks used to use deposits as leverage to fund their trading businesses. Very simply you can loan your crypto out and earn a return on it. Despite being 'Crypto' the products on offer work similarly to traditional financial markets. However, typically these products are not available to retail investors and are instead used by professional investors.

Investing in these products requires trust, you are trusting that the the crypto you deposited will be returned along with the interest.

News Sources - Cryptocurrency is awash with news articles both in mainstream media and crypto specific news outlets. Articles in mainstream media are often ClickBait related or commonly known as 'FUD' (Fear, Uncertainty and Doubt).

There is a huge amount of information and polarizing opinions on Bitcoin and other digital assets spanning all information mediums. Most people via mainstream media will have some awareness of Bitcoin and may have heard about potential financial gains to be made. I find with the vast array of information it is difficult for a new market participants to find the information required to help form an opinion and make an investment decision (should they chose to). I thought it would be useful to provide objective information for those considering an investment, leveraging my own experience and feedback from knowledgable users on this forum. Objectively to highlight the key items for consideration when forming opinions.

This information is intended to be used in the context of the site it is being posted on, an Irish consumer forum. I am not advocating for or against Bitcoin, but simply providing information to help others form an opinion. I will focus first on Bitcoin and then introduce other Digital Assets, platforms and concepts. The aim is to present information that helps an investment decision to be made today based on known tangible information.

I will start by saying as of June 2021 Bitcoin remains a volatile asset, as such any investment can lose value.

Often in the discourse of digital assets future events are used as a supporting narrative. However, whilst it is important to recognize digital assets as an evolving space, future enhancements do not guarantee a return. As such, when considering future developments / enhancements and the impact on Bitcoin or other cryptocurrency they are not guaranteed. For example, in interest rate markets we know with a degree of certainty the Fed will make announcements on their rate policy every quarter and predictions are made. Similarly in Bitcoin we know for certain that the bitcoin reward will reduce in future and as such the impact on price can be theorized. What is harder to predict is the impact on price by the introduction of a new en-hancement or further adoption. As such, I recommend that you form your own opinion on items like this.

I will edit and add to this over the coming days, please comment below for topics you want to be covered.

Taxes

All relevant Irish tax treatment of Cryptocurrencies can be found below.

Cryptocurrencies and crypto-assets

This page has information on cryptocurrencies and crypto-assets

Bitcoin: What is it?

The following is the first sentence in the Bitcoin Whitepaper:

"A purely peer-to-peer version of electronic cash would allow online

payments to be sent directly from one party to another without going through a

financial institution."

Bitcoin is a peer-to-peer (distributed) payment system, the use of cryptography (hashing / proof-of-work removes the need for a central body or third party to validate transactions. This is different to our current monetary system which requires intermediaries to validate each transaction and is a trust-based system. Bitcoins are created (mined) through the algorithmic validation (Proof of Work) process, with there being a total 21 million supply, and each Bitcoin is divisible to 0.00000001 BTC (1 Satoshi).

As of 2021, an individual's easiest method to gain direct exposure to BTC is by purchase on a 'Crypto Exchange'. There are other methods like buying in a direct peer to peer transaction but those are likely not available to everyone.

Yes that is correct as of 2021 you do have to trust a third party private company to purchase Bitcoin, and that is an evolution from the initial whitepaper. This point is a very important point for prospective investors and their security, and is not at the forefront of the Bitcoin rhetoric. Whilst Bitcoin transactions are immutable and the cryptographic techniques provide security, if you purchase Bitcoin on an exchange it is no different to keeping your savings in a bank account (minus the Deposit protection insurance). That is why it is imperative that you transfer your holdings into your own private wallet that only you have access to (more on that late).

Bitcoin: Is it a currency or a store of value?

A highly controversial topic. Bitcoin has a value so it can be used as a means of payment, there is no doubted that, but it is not currently used as a mainstream currency. In 2020 we say Paypal announce it would accept BTC as a payment means in the US, however this is where friction exists with the current fiat system. Paypal is a regulated entity, the US Government treat the sale of Bitcoin as Capital Gains event, as such if you were to use Bitcoin it would be a tax event. Paypal would accept the BTC and convert it to USD to complete the payment as well. In recent weeks (not yet live), El Salvador made the move to accept BTC as legal tender.

The bigger adoption of BTC is as an asset with a store of value, we have seen a small number of firms (Microstrategy being the largest) start buying and holding BTC on balance sheet as a treasury type asset.

In summary, Bitcoin currently is used mainly as a store of value, but there is adoption of it as a legal tender. I will update this thread as the El Salvador project rolls out.

Bitcoin: What's the Risk?

There is always risk involved with any investment, anybody that advises otherwise should be ignored. The question is how much risk? Can we quantify that risk and does that risk fit into an investors risk appetite? There are two ways I think about this, the first is the risk of the asset itself and the second is the risk in an investors portfolio.

1. The simplest metric to quantify risk is to look at volatility of an asset and thus the returns. The simple view is the more volatile an asset is the riskier it is, or put in another way you should expect a greater return for taking a greater amount of risk. In terms of risk generally it goes from least risky to most; cash --> bonds --> equity. Within each of these markets there are different levels of risk yielding different returns i.e. Greek bonds earn a better yield than US treasuries, but you accept more risk purchasing a Greek bond. There is also the concept of assets that in benefit in a risk off environment, this is often called flight to quality and why you will see the yields on US treasuries decrease, when Equity market decreases as investors seek safety. At this point I have not seen concrete evidence to suggest that Bitcoin or other Cryptocurrencies will operate as safehaven assets. Bitcoin and other cryptocurrencies should currently be considered riskier than Equities. The chart below supports this hypothesis, showing that since 2020, BTC is more volatile than the returns of the S&P500 (broad representation of US equity markets).

2. No financial advisor should advise you to invest all your portfolio in one asset, and Bitcoin /Digita Assets are no different. Out of investable asset classes, crypto is currently the riskiest and thus should only form a small part of any portfolio. Ensuring diversification in your portfolio is key, and would position you to benefit from digital asset as the market matures, whilst also not risking everything.

A very important point is that Bitcoin is often presented as digital currency outside of the control of central banks and governments. However, for the vast majority who are unable to mine BTC or mined BTC in the early days, the main way to access BTC is via third parties that operate in regulated entities. Thus, governments or regulators can control to an extent your interaction and this is another reason why it is key that you do not keep your main holdings in a wallet on an exchange. Going forward we may see traditional investment products available such as ETFs or other custodian services offered by banks that retail investors can access through their current brokers etc.

Decentralized Finance: Yield for Investors

This is an emerging area and whilst it is risky due its novel nature, the returns are less volatile and more stable. Up until recently Stablecoins (digital assets pegged to a fiat currency) have maintained parity with its fiat equivalent by holding the fiat equivalent. These coins are a popular vehicle to convert Bitcoin or other volatile assets into without having to completely convert to fiat. As such an investor will earn nothing by holding Stablecoins directly.

However, as DeFI is emerging there are services in which you can loan these assets to an in reward be paid an interest rate. Think of it like how Banks used to use deposits as leverage to fund their trading businesses. Very simply you can loan your crypto out and earn a return on it. Despite being 'Crypto' the products on offer work similarly to traditional financial markets. However, typically these products are not available to retail investors and are instead used by professional investors.

Investing in these products requires trust, you are trusting that the the crypto you deposited will be returned along with the interest.

News Sources - Cryptocurrency is awash with news articles both in mainstream media and crypto specific news outlets. Articles in mainstream media are often ClickBait related or commonly known as 'FUD' (Fear, Uncertainty and Doubt).

- Coindesk - The largest Crypto source, a bit like the Financial Times in type of reporting

- Decrypt - This reports on more emerging themes like DeFi

- Financial Times - Out of all the mainstream media, I think the FT provides some great articles with high quality reporting and analysis

Last edited: