Again with the bias with your 'promo' jibe. As outlined to you previously, you don't like the conclusion that he arrived at - so you kick up with this prejudicial nonsense.So I have read Mr Boyapati's promo of bitcoin.

So let me get this straight. You are surprised when market participants determine the value of something? What of it?I don't think I could have put it better myself. "each market participant values the good based on their appraisal of whether and how much other participants will value it" exactly as Mr Fax Machine and the vast majority of mainstream economists have argued. It is pure speculation as to what the other speculators will speculate - a game.

Ok, so we're 11 years in - how long more will this realisation take and people reach your higher level of thinking? Will the Euro have managed to weather its next crisis by then? I can more than accept bitcoin going to zero as a possibility (albeit a very unlikely one). To exactly the same point, do you accept that the Euro could come to an end over the next couple of years (just like it almost did in the aftermath of the last financial crisis)? Do let us all know your thoughts on that.As soon as the satoshi drops that it is a BOHA it goes to zero, a risk that even the enthusiasts admit exists.

What are you talking about? You're saying it's not considered yet you're quoting from the guys own analysis. Pure brilliance."Bitcoins are not backed by any physical commodity, nor are they guaranteed by any government or company, which raises the obvious question for a new bitcoin investor: why do they have any value at all? " Indeed. And it is the question that I ask. But the question doesn't even appear on the exam paper!

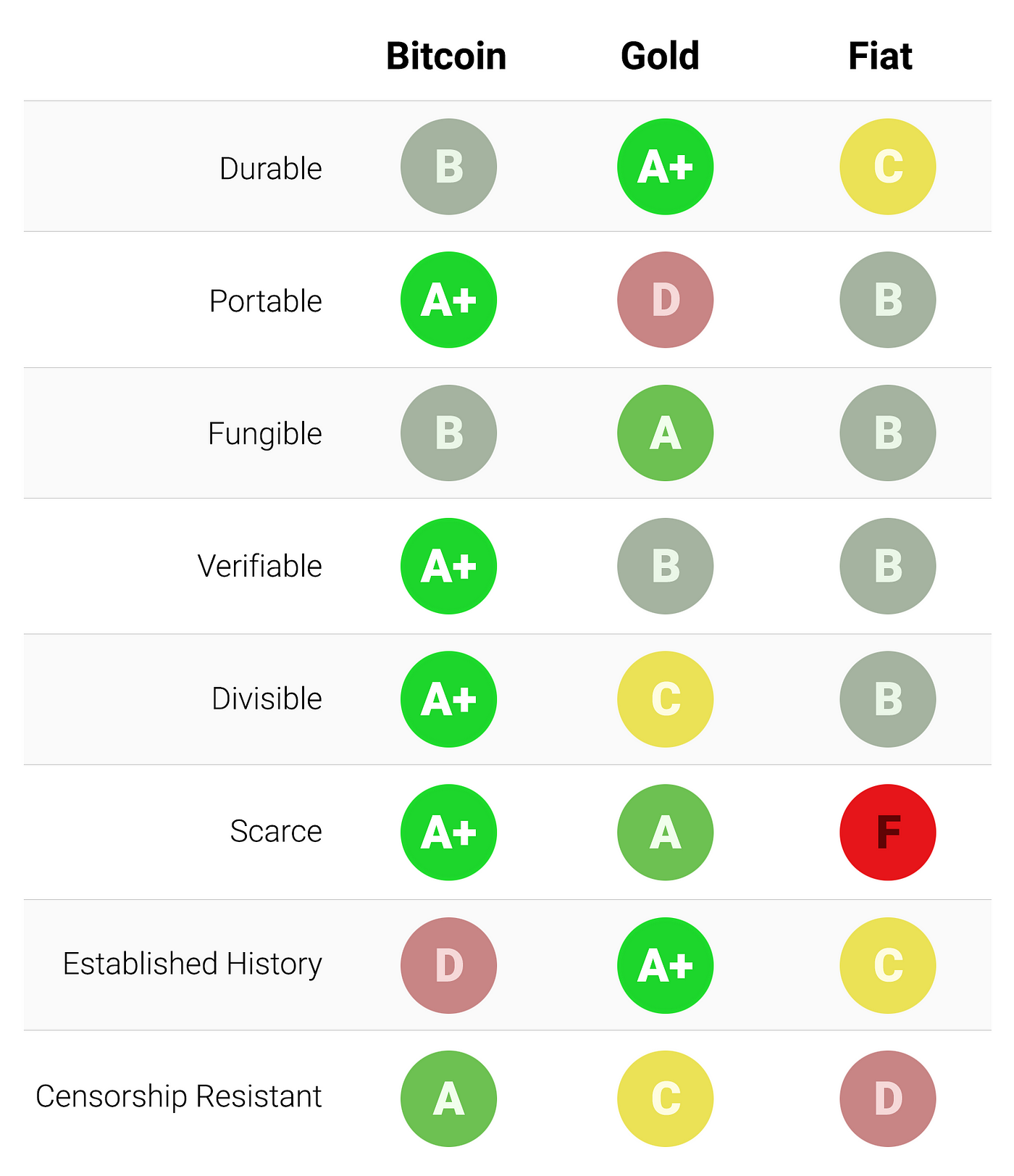

Firstly, the graphic deals with the properties of a store of value as opposed to a means of exchange/transactional currency. There is a distinction. And before you claim otherwise, he still discusses all three functions of money (Means of Exchange, Unit of Account and Store of Value) in the complete analysis - and all facets implicated by those functions.In fact there are two key questions here, intrinsic value and government backing. Bitcoin would of course have scored an F on both and maybe for bitcoin enthusiasts those would be good scores on these questions.

Having looked at the exam paper again I think I would probably agree with the allotted scores but as I have repeatedly said I agree with the mainstream view that since it is tethered to nothing that is a fatal flaw.

His analysis is tainted it seems (because he had the misfortune to arrive at a conclusion that you are diametrically opposed to). outlining their six characteristics of money (as opposed to a store of value) as Divisibility, Portability, Acceptability, Durability, Scarcity and Stability. Where's the mention of intrinsic value and government backing?

And other than that, are you a hypocrite much - or only on this subject? You're walking around with FIAT money in your pocket that has NO intrinsic value. On government backing, what comfort is that to the holders of every FIAT currency that has ever failed? (and they all fail eventually - given that the average lifespan of a FIAT currency is 27 years). We've had 2 of them fail in the last 10 days alone!

Should the euro be dissolved within the next couple of years (which is a real possibility) and your euros are converted into Punt Nua's, the value of your wealth is going to take a major haircut. What does your government backing stand for in this situation? I'll tell you - nothing! There was considerable discussion here on AAM ten years ago on that very subject. People were scrambling to open bank accounts in Germany/Holland/Belgium. No-one mentioned anything about government backing.

And by the way, we had this yesterday =>

Even the Federal Reserve agrees that scarcity is a fundamental characteristic of store of value and money.Brendan Burgess said:Scarcity is not a reason for buying BTC

And this betrays a total lack of understanding. I invited him to examine his proposed money or store of value against the other essential characteristics. Scarcity is fundamental - but not without holding its head above water with regard to the other essential characteristics of money/store of value.The Boss' poetry is scarce. That is not trying to be smart alicky but it is my riposte to your Mr Fax Machine riff.

And the point I made about Krugman and his fax machine is equally valid for yourself and Brendan. There's no doubt that he's a scholar of one particular school of economics (Keynesian). I'm sure that serves him well in the Keynesian economics gravy-train. However, the fax machine incident betrays a total lack of understanding of technological impact. That's significant in this discussion - not just because you decided to underpin your argument with his opinion. It's significant because blockchain/crypto/bitcoin is new found innovation which is in the foundational stages of disrupting all manner of aspects of finance. Everything doesn't just stay the same. FIAT may have served us reasonably well but that doesn't mean that it isn't fundamentally flawed and that we shouldn't look to improve and consider alternatives (or provide those that manage FIAT with motivation not to screw up!).

Many people have a difficult time appreciating the value of a digital currency given that you can't see it, you can't touch it. The irony is that you can do those things with a euro note but all it is - is a bacteria-riddled promissory note made of cotton. Bitcoin may not be backed by a physical good but its integrity is locked in by its code as it's programmable, decentralised money. It can't be tampered with - whereas you can print off FIAT money to your hearts content.

Digital money is only one of the technological changes we're seeing. There are other facets of technology that are already in the process of having a fundamental effect on the FIAT monetary system. Given his fax machine howler, I certainly wouldn't trust Krugman in his consideration of how new forms of technology and innovation impinge on finance and monetary systems.

China is a totalitarian regime. So they're much more likely to go with a full court press against bitcoin than other governments. But no matter - there are all sorts of twists and turns in the road over the next few years where crypto and regulation is concerned. I still liken it to the war on drugs. A government can go in with both feet and they will surpress it in the short term. However, whatever chance they have at controlling it out in the open, in the longer game, they won't ever be able to stop it. More so than the actions of governments, I think its far more important that innovators in the space manage to find a way to make it easier to use - that's a bigger issue (if it's to be used on a mass market basis).I think there's a risk that the pandemic is accelerating the move away from cash to contactless payments and centralised digital currencies like China are rolling out. Such moves may make it more difficult to cash out of cryptos, as you still can't really use them to buy stuff, any significant increase in restrictions on cashing out could lead to a collapse.

I've recognised that FIAT has (and continues) to serve society - but I've also recognised its flaws (or rather the flaws of the people implicated in managing it). On the flip side, you can't manage to be objective about it (and the same re. bitcoin).tecate you are wont to roll out Lebanon, Venezuela, Zimbabwe etc. in your demonisation of FIAT.

The political stuff I'm not getting in to as for the purposes of this discussion, it's pointless (and in your case, it's clouding your ability to be objective when it comes to consideration of bitcoin). However, to your point on a 'well functioning FIAT currency', see my comments on FiAT above. FIAT isn't the issue in principal. People are always the variable. The expectation is that we should trust someone when it comes to FIAT money. Sooner or later, that will fall apart. It's for precisely that reason that the average lifespan of a FIAT currency is 27 years. It's for that reason we have inflationary systems as a stealth tax against ordinary people (as they don't understand it and its implications). It's for that reason we have QE that has proven to be totally inequitable - favouring the pigs with their snouts closer to the trough.tecate you are wont to roll out Lebanon, Venezuela, Zimbabwe etc. in your demonisation of FIAT. Let me pose a similar question. Do you think an official police force is good for society? Of course, you may say no - there are those in the bitcoin community who appear to be of an anarchist persuasion. In which case ignore the rest of this post.

So if you have reached thus far I take it that you do think an official police force is a good, nay necessary, thing in a modern society. But it is very clearly open to abuse. Indeed one can cite many instances where it has been grossly abused; interestingly the Venn intersection of these instances with your own FIAT rogues' gallery is far from the empty set.

By analogy I put it to you that a well functioning FIAT currency can be very beneficial, nay necessary, for society and the fact that it is open to abuse and has indeed been abused should not mean that we should abandon it.

On the flipside, Satoshi recognised this problem and in designing bitcoin, he/she assumed the principal of trustlessness from the outset. Don't trust - verify. Decentralised programmable money can't be screwed with in the way that FIAT money is being tampered with. Government backing is the last thing it needs in achieving that.

Last edited: