Brendan Burgess

Founder

- Messages

- 52,045

The discussion of Irish tax policy is not very often based on hard facts.

There is a perception that high earners pay very little tax and that the so-called "squeezed middle" pay very high taxes.

Yes, a single person does start paying the the top rate of tax at €33,800 but what is the effective rate of tax for someone earning that amount?

Some argue that Ireland is a very low tax country and others argue that it is a high tax country. It's easy to argue either viewpoint by excluding prsi from the argument or by measuring taxes as a percentage of GNP, or GDP if you want them lower.

There is a tendency to select statistics to support one's own argument.

Many of the reports are deliberately misleading e.g. confusing households with individuals.

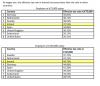

So I thought it would be useful to compile a list of hard data and reports on who pays what taxes in Ireland.

There is a perception that high earners pay very little tax and that the so-called "squeezed middle" pay very high taxes.

Yes, a single person does start paying the the top rate of tax at €33,800 but what is the effective rate of tax for someone earning that amount?

Some argue that Ireland is a very low tax country and others argue that it is a high tax country. It's easy to argue either viewpoint by excluding prsi from the argument or by measuring taxes as a percentage of GNP, or GDP if you want them lower.

There is a tendency to select statistics to support one's own argument.

Many of the reports are deliberately misleading e.g. confusing households with individuals.

So I thought it would be useful to compile a list of hard data and reports on who pays what taxes in Ireland.

Attachments

Last edited: